Montana101x

New member

Hello Everyone,

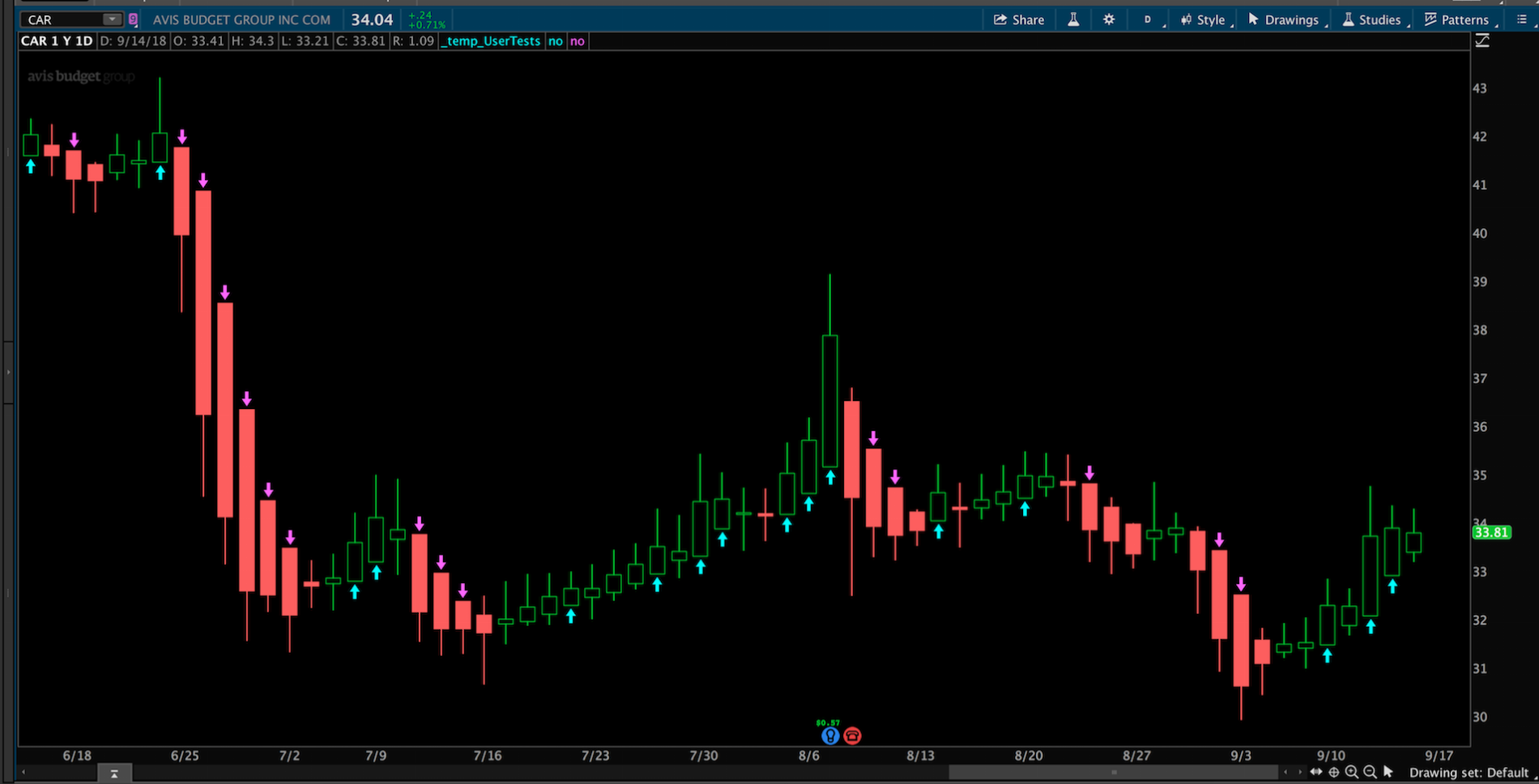

I was looking for Arrow signal on Heiken Ashi chart with no wick to give me confident for holding position to bigger move. I was unable to find it except on haha-tech forum but it was an incomplete code. Since i don't know coding and i can't figure it out but i will share the post link for anyone can crack the code for this strategy into scripting and thank you. https://www.hahn-tech.com/ans/scann...CQ_lcU5HWUFpT2jS60RL3ZQYhok0VNW5PjTkSPvpNHFkI

I was looking for Arrow signal on Heiken Ashi chart with no wick to give me confident for holding position to bigger move. I was unable to find it except on haha-tech forum but it was an incomplete code. Since i don't know coding and i can't figure it out but i will share the post link for anyone can crack the code for this strategy into scripting and thank you. https://www.hahn-tech.com/ans/scann...CQ_lcU5HWUFpT2jS60RL3ZQYhok0VNW5PjTkSPvpNHFkI