thetradingfrog

New member

I am trying to pull the option bid price for a strike a given offset from the current underlying asset price.

For example if it is Monday November 14th and SPY is trading at 400 I would like to get the .SPY20221116C415 bid price.

Here is some code I have been trying to get working to display the price for the given option while looking at the SPY chart.

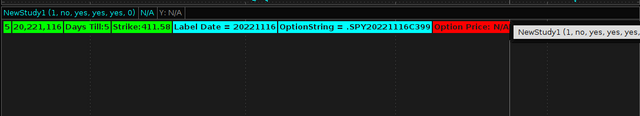

I can't figure out how to get the price to actually work, I have tried several things and it is always N/A

Any help is much appreciated. Thanks!

For example if it is Monday November 14th and SPY is trading at 400 I would like to get the .SPY20221116C415 bid price.

Here is some code I have been trying to get working to display the price for the given option while looking at the SPY chart.

Code:

# Weekly Options Implied Volatility Plotted intraday

# Mobius

# Chat Room Request

# 02.27.2016

#

# 2021-07-01 : Modified by rad14733 for personal needs

input series = 1;

input showBands = no;

input show_itm_labels = yes;

input show_atm_labels = yes;

input show_otm_labels = yes;

input Days_In_Contract = 0;

Assert(series > 0, "'series' must be positive: " + series);

def RTHopen = open(period = AggregationPeriod.Day);

def CurrentYear = GetYear();

def CurrentMonth = GetMonth();

def CurrentDOM = GetDayOfMonth(GetYYYYMMDD());

def Day1DOW1 = GetDayOfWeek(CurrentYear * 10000 + CurrentMonth * 100 + 1); # First DOM is this DOW

def FirstFridayDOM1 = if Day1DOW1 < 6

then 6 - Day1DOW1

else if Day1DOW1 == 6

then 7

else 6;

def SecondFridayDOM = FirstFridayDOM1 + 7;

def ThirdFridayDOM = FirstFridayDOM1 + 14;

def FourthFridayDOM = FirstFridayDOM1 + 21;

def RollDOM = FirstFridayDOM1 + 21; #14; changed to 21 to pick up all Fridays of the current month for weekly options

def ExpMonth1 = if RollDOM > CurrentDOM

then CurrentMonth + series - 1

else CurrentMonth + series;

def ExpMonth2 = if ExpMonth1 > 12

then ExpMonth1 - 12

else ExpMonth1;

def ExpYear = if ExpMonth1 > 12

then CurrentYear + 1

else CurrentYear;

def Day1DOW = GetDayOfWeek(ExpYear * 10000 + ExpMonth2 * 100 + 1);

def FirstFridayDOM = if Day1DOW < 6

then 6 - Day1DOW

else if Day1DOW == 6

then 7

else 6;

def ExpDOM = if currentDOM < FirstFridayDOM -1

then FirstFridayDOM1

else if between(currentDOM, FirstFridayDOM, SecondFridayDOM-1)

then SecondFridayDOM

else if between(currentDOM, SecondFridayDOM, ThirdFridayDOM-1)

then ThirdFridayDOM

else if between(currentDOM, ThirdFridayDOM, FourthFridayDOM-1)

then FourthFridayDOM

else FirstFridayDOM;

def NextFriday = DaysTillDate(ExpYear * 10000 + ExpMonth2 * 100 + ExpDOM);

def ExpirationDate = GetYYYYMMDD() + NextFriday;

def ExpData = (ExpirationDate / 1) + 1;

def yr = Round(GetYear() / 100, 0);

def yr2 = GetYear() - 2000;

def dow2 = GetDayOfWeek(GetYYYYMMDD());

AddLabel(yes, dow2, Color.GREEN);

def adjust = if dow2 < 3 or dow2 > 4 then 2 else 0;

def OptionDateString = ExpYear * 10000 + ExpMonth2 * 100 + ExpDOM - adjust;

def daysTill = DaysTillDate(OptionDateString);

def yyyy = Round(OptionDateString / 10000, 0);

def yy = Round((OptionDateString / 10000 - 2000), 0); # yy = 21

def mmdd = OptionDateString - 10000 * yyyy;

def mm = Round(mmdd / 100, 0);

def dd = mmdd - mm * 100;

AddLabel(yes, OptionDateString, Color.GREEN);

AddLabel(yes, "Days Till:" + daysTill, Color.GREEN);

AddLabel(yes, "Strike:" + (close + 15), Color.GREEN);

AddLabel(1, "Label Date = " +"20"+yy+mm+dd , Color.CYAN);

AddLabel(1, "OptionString = "+ ".SPY"+"20"+yy+mm+dd+"C"+Round(close("SPY") + 2,0), Color.CYAN);

def closeP = close(symbol = ".SPY+"+"20"+yy+mm+dd+"C"+Round(close("SPY")+2,0), priceType = PriceType.BID);

AddLabel(yes, "Option Price: " + closeP);

plot result = closeP;I can't figure out how to get the price to actually work, I have tried several things and it is always N/A

Any help is much appreciated. Thanks!