Author Message - Upper Study:

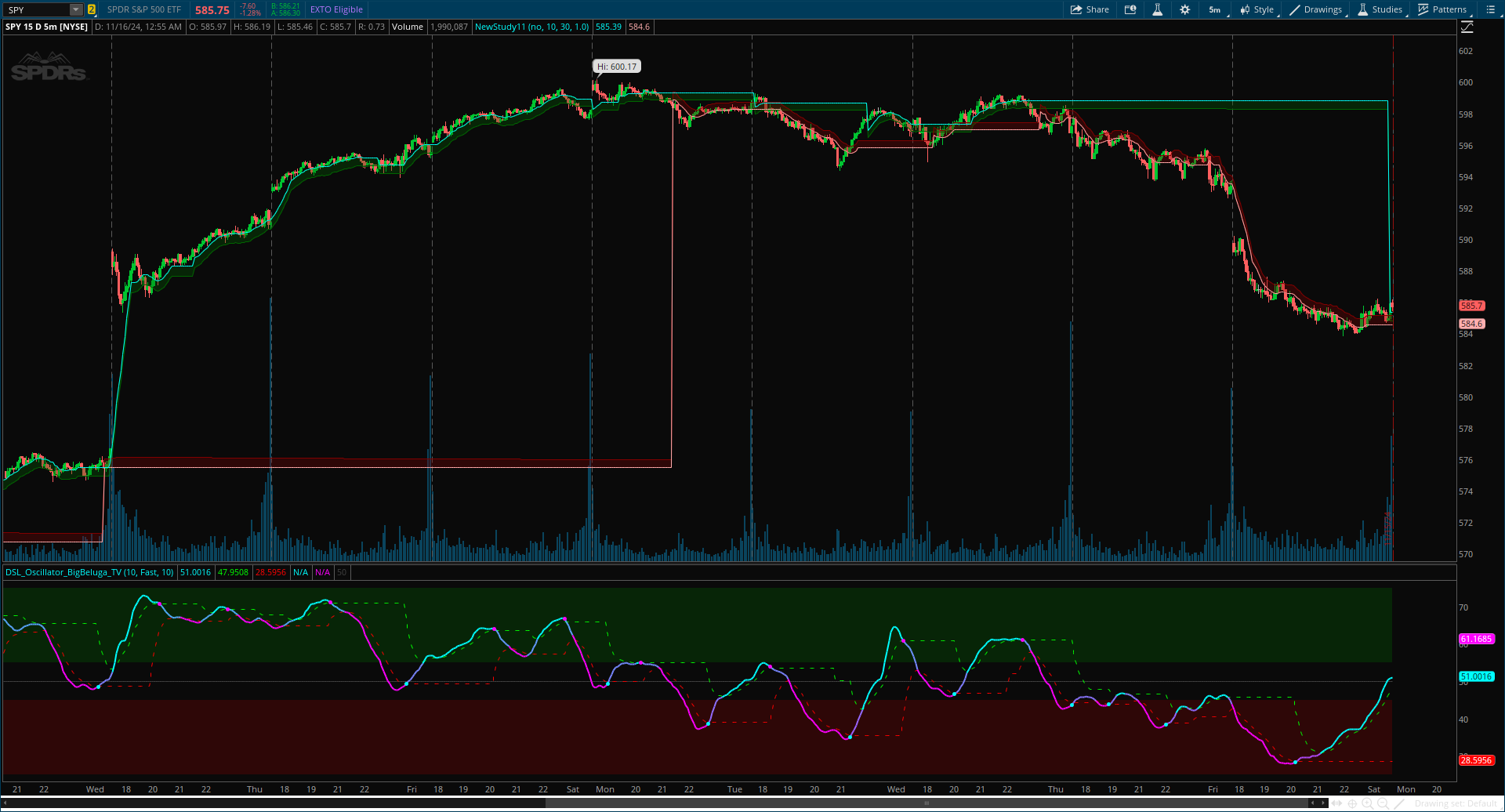

The DSL Trend Analysis [ChartPrime] indicator utilizes Discontinued Signal Lines (DSL) deployed directly on price, combined with dynamic bands, to analyze the trend strength and momentum of price movements. By tracking the high and low price values and comparing them to the DSL bands, it provides a visual representation of trend momentum, highlighting both strong and weakening phases of market direction.

Author Message - Lower Study:

The DSL (Discontinued Signal Lines) Oscillator is an advanced technical analysis tool that combines elements of the Relative Strength Index (RSI), Discontinued Signal Lines, and Zero-Lag Exponential Moving Average (ZLEMA). This versatile indicator is designed to help traders identify trend direction, momentum, and potential reversal points in the market.

CODE - Upper:

CSS:

#// Indicator for TOS

#// © ChartPrime

#indicator("DSL Trend Analysis [ChartPrime]", overlay = true)

# Converted by Sam4Cok@Samer800 - 11/2024

input colorBars = yes;

input dslLength = 10; # "Length" // Length for calculating DSL

input OffsetForThresholdLevels = 30; # "Offset" // Offset for threshold levels

input BandsWidth = 1.0; # "Bands Width" // Width for ATR-based bands

def na = Double.NaN;

def last = IsNaN(close);

#// 𝙄𝙉𝘿𝙄𝘾𝘼𝙏𝙊𝙍 𝘾𝘼𝙇𝘾𝙐𝙇𝘼𝙏𝙄𝙊𝙉𝙎

#// Function to calculate DSL lines based on price

script dsl_price {

input price = close;

input len = 10;

input offset = 30;

# // Initialize DSL lines as NaN (not plotted by default)

def sma = Average(price, len);

# // Dynamic upper and lower thresholds calculated with offset

def threshold_up = Highest(high, len)[offset];

def threshold_dn = Lowest(low, len)[offset];

# // Calculate the DSL upper and lower lines based on price compared to the thresholds

def dsl_up = if price > threshold_up then sma else dsl_up[1];

def dsl_dn = if price < threshold_dn then sma else dsl_dn[1];

# // Return both DSL lines

plot up = dsl_up;

plot dn = dsl_dn;

}

#// Function to calculate DSL bands based on ATR and width multiplier

script dsl_bands {

input dsl_up = high;

input dsl_dn = low;

input width = 1;

def atr = ATR(Length = 200) * width; #// ATR-based calculation for bands

def upper = dsl_up - atr; # // Upper DSL band

def lower = dsl_dn + atr; # // Lower DSL band

plot up = upper;

plot lo = lower;

}

#// Get DSL values based on the closing price

def dsl_up = dsl_price(close, dslLength, OffsetForThresholdLevels).up;

def dsl_dn = dsl_price(close, dslLength, OffsetForThresholdLevels).dn;

#// Calculate the bands around the DSL lines

def dsl_up1 = dsl_bands(dsl_up, dsl_dn, BandsWidth).up;

def dsl_dn1 = dsl_bands(dsl_up, dsl_dn, BandsWidth).lo;

#// Determine the trend color based on the relationship between price, DSL lines, and bands

def trend_col = if high > dsl_up1 and high < dsl_up and high > dsl_dn1 then 1 else

if low > dsl_dn and low < dsl_dn1 then -1 else

if high > dsl_up then 2 else if low < dsl_dn then -2 else 0;

#// 𝙑𝙄𝙎𝙐𝘼𝙇𝙄𝙕𝘼𝙏𝙄𝙊𝙉

# Bar Color

AssignPriceColor(if !colorBars then Color.CURRENT else

if trend_col == 2 then Color.GREEN else

if trend_col == 1 then Color.DARK_GREEN else

if trend_col ==-1 then Color.DARK_RED else

if trend_col ==-2 then Color.RED else Color.GRAY);

#// Plot the DSL lines on the chart

plot pu = if dsl_up then dsl_up else na; # "DSL Up"

plot pd = if dsl_dn then dsl_dn else na; # "DSL Down"

#// Plot the DSL bands

def pu1 = if dsl_up1 then dsl_up1 else na; # "DSL Upper Band"

def pd1 = if dsl_dn1 then dsl_dn1 else na; # "DSL Lower Band"

pu.SetDefaultColor(Color.CYAN);

pd.SetDefaultColor(Color.PINK);

AddCloud(pu, pu1, Color.DARK_GREEN, Color.DARK_GREEN, yes);

AddCloud(pd, pd1, Color.DARK_RED, Color.DARK_RED, yes);

#AddLabel(1, "Upper Band (" + AsDollars(dsl_up) + ")", Color.CYAN);

#AddLabel(1, "Lower Band (" + AsDollars(dsl_dn) + ")", Color.PINK);

# end of codeCode Lower :

CSS:

#// Indicator for TOS

#// © BigBeluga

#indicator("DSL Oscillator [BigBeluga]")

# Converted by Sam4Cok@Samer800 - 11/2024

Declare lower;

input dslLength = 10; #, "Length")

input dslLinesMode = {Default "Fast", "Slow"}; #])("Fast", "DSL Lines Mode", == "Fast" ? 2 : 1

input rsiLength = 10;

def na = Double.NaN;

def last = isNaN(close);

#// CALCULATIONS

#// Calculate RSI with a period of 10

def nRSI = rsi(Price = close,Length = rsiLength);

#// Zero-Lag Exponential Moving Average function

Script zlema {

input src = close;

input length = 10;

def lag = floor((length - 1) / 2);

def ema_data = 2 * src - src[lag];

def ema2 = ExpAverage(ema_data, length);

plot out = ema2;

}

#// Discontinued Signal Lines

Script dsl_lines {

input src = close;

input length = 10;

input dsl_mode = "Fast";

def dsl = if dsl_mode=="Fast" then 2 else 1;

def sma = Average(src, length);

def up; def dn;

def up1 = if up[1] then up[1] else 0;

def dn1 = if dn[1] then dn[1] else 0;

up = if (src > sma) then up1 + dsl / length * (src - up[1]) else up1;

dn = if (src < sma) then dn1 + dsl / length * (src - dn[1]) else dn1;

plot u = up;

plot d = dn;

}

#// Calculate DSL lines for RSI

def lvlu = dsl_lines(nRSI, dslLength, dslLinesMode).u;

def lvld = dsl_lines(nRSI, dslLength, dslLinesMode).d;

#// Calculate DSL oscillator using ZLEMA of the average of upper and lower DSL Lines

def dsl_osc = zlema((lvlu + lvld) / 2, 10);

#// Calculate DSL Lines for the oscillator

def level_up = dsl_lines(dsl_osc, 10, dslLinesMode).u;

def level_dn = dsl_lines(dsl_osc, 10, dslLinesMode).d;

#// PLOT

#// Plot the DSL oscillator

def col = if isNaN(dsl_osc) then 0 else

if dsl_osc > level_up then 100 else

if dsl_osc < level_dn then 0 else dsl_osc;

plot dslOsc = dsl_osc; #, color = color, linewidth = 2)

dslOsc.SetLineWeight(2);

dslOsc.AssignValueColor(CreateColor(255 - col*2.55, col * 2.55, 255));

#// Plot upper and lower DSL Lines

plot lvlUp = if level_up then level_up else na;

plot lvlDn = if level_dn then level_dn else na;

lvlUp.SetStyle(Curve.SHORT_DASH);

lvlDn.SetStyle(Curve.SHORT_DASH);

lvlUp.SetDefaultColor(Color.GREEN);

lvlDn.SetDefaultColor(Color.RED);

#// Detect crossovers for signal generation

def up = (dsl_osc Crosses Above level_dn) and dsl_osc < 55;

def dn = (dsl_osc Crosses Below level_up) and dsl_osc > 50;

#// Plot signals on the oscillator

plot upPoint = if up[-1] then dsl_osc else na;

plot dnPoint = if dn[-1] then dsl_osc else na;

upPoint.SetLineWeight(2);

dnPoint.SetLineWeight(2);

upPoint.SetStyle(Curve.POINTS);

dnPoint.SetStyle(Curve.POINTS);

upPoint.SetDefaultColor(Color.CYAN);

dnPoint.SetDefaultColor(Color.MAGENTA);

#// Plot horizontal lines for visual reference

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

plot mid = if last then na else 50;

def ob = if last then na else 75;

def os = if last then na else 25;

mid.SetDefaultColor(Color.DARK_GRAY);

AddCloud(ob, mid+5, Color.DARK_GREEN);

AddCloud(mid-5, os, Color.DARK_RED);

#-- END of CODE