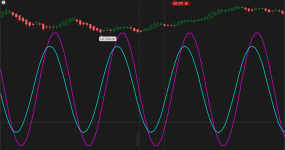

Hello, I've been frustrated a how different the TOS Hull moving average is compared to hand-coded versions (this has been noted by others on previous threads).

To try to nail down the discrepancies I want to create and chart synthetic data and apply the TOS Hull to it. (Code below)

Once I have the synthetic data in the chart and am applying the Hull to it:

I can't find in Chart Settings how to hide the original price data. Any help is greatly appreciated, thanks!

To try to nail down the discrepancies I want to create and chart synthetic data and apply the TOS Hull to it. (Code below)

Once I have the synthetic data in the chart and am applying the Hull to it:

I can't find in Chart Settings how to hide the original price data. Any help is greatly appreciated, thanks!

Code:

# Inputs

input period = 20; # Number of bars for one full sine wave cycle

input amplitude = 200; # Adjust amplitude for the sine wave

input hullPeriod = 13; # Period for the Hull Moving Average

# Calculate bar-based frequency

def barIndex = BarNumber(); # Get the bar number

def normalizedIndex = barIndex - Floor(barIndex / period) * period; # Modulus operation

def angle = normalizedIndex * 360 / period; # Calculate angle in degrees

# Generate sine wave

def SyntheticData = amplitude * Sin(angle * Double.Pi / 180); # Convert angle to radians

# Apply Hull Moving Average

def wma1 = WMA(SyntheticData, hullPeriod / 2); # WMA with half the Hull period

def wma2 = WMA(SyntheticData, hullPeriod); # WMA with the full Hull period

def hullMA = WMA(2 * wma1 - wma2, Sqrt(hullPeriod)); # Hull Moving Average formula

# Plot synthetic data and Hull MA

plot OriginalSyntheticData = SyntheticData;

OriginalSyntheticData.SetDefaultColor(Color.CYAN);

OriginalSyntheticData.SetLineWeight(2);

plot HullMovingAverage = hullMA;

HullMovingAverage.SetDefaultColor(Color.MAGENTA);

HullMovingAverage.SetLineWeight(2);Attachments

Last edited: