The following code is the standard Charles Schwab ATRTrailingStop code provided in Thinkorswim.

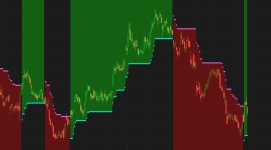

Question: what piece of code would need to be added to it in order to have a green cloud when the price is above the ATRTrailingStop and a red cloud when the price is below the ATRTrailingStop?

I appreciate any assistance. Thank you.

———————

# Charles Schwab & Co. (c) 2009-2025

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Buy", GetColor(0));

TrailingStop.DefineColor("Sell", GetColor(1));

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Sell")

else TrailingStop.Color("Buy"));

Question: what piece of code would need to be added to it in order to have a green cloud when the price is above the ATRTrailingStop and a red cloud when the price is below the ATRTrailingStop?

I appreciate any assistance. Thank you.

———————

# Charles Schwab & Co. (c) 2009-2025

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

input averageType = AverageType.WILDERS;

Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor);

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot TrailingStop = trail;

TrailingStop.SetPaintingStrategy(PaintingStrategy.POINTS);

TrailingStop.DefineColor("Buy", GetColor(0));

TrailingStop.DefineColor("Sell", GetColor(1));

TrailingStop.AssignValueColor(if state == state.long

then TrailingStop.Color("Sell")

else TrailingStop.Color("Buy"));