"The Anti" (Anti-Climax) - Its a Linda Raschke indicator for exhaustion

mod note:

Bullish Rules:

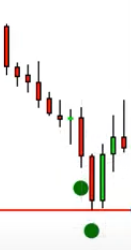

Bullish Pattern: Set of 3 candles where the distance between the lows of the candles red or green (body or wick) are accelerating/increasing is distance from each other. (Ex. Below)

Bearish rules are optionable, can usually just reverse the bullish rules.

Reverse the bullish rules

What defines a setup candle?

Bullish = 1st green candle with a higher low after the Anti-Climax push you buy 1tick above that 1st green candle (Ex. below) and place the stop 1tick below that green candle.

Why is the bullish candle called a bullish candle?

The candle must be green and have a higher low (body or wick) than the previous candle. The candle can have a higher high than the previous candle.

Within how many candles does the bullish candle have to appear after the 3 or more candles?

Good question, as long as there’s "acceleration" lower and the candles meet the criteria (Set of 3 candles where the distance on the lows of the candles are increasing red or green (body or wick) the pattern remains in play. There might be 3,4,5 + consecutive bars and then the trigger bar “Green higher low” appears. (Ex. See below of a powerful move that triggered multiple 3 candle Anti-Climax patterns)

Within how many bars does a buy candle have to happen?

After the trigger candle (1st green higher low candle) the trade entry should be triggered within 2 days. If it does not, the trade is invalidated.

post a link that talk about this strategy: This is a 4min video detailing the strategy:

mod note:

For the ThinkOrSwim code, you must scroll down to the next post

Bullish Rules:

Bullish Pattern: Set of 3 candles where the distance between the lows of the candles red or green (body or wick) are accelerating/increasing is distance from each other. (Ex. Below)

Bearish rules are optionable, can usually just reverse the bullish rules.

Reverse the bullish rules

What defines a setup candle?

Bullish = 1st green candle with a higher low after the Anti-Climax push you buy 1tick above that 1st green candle (Ex. below) and place the stop 1tick below that green candle.

Why is the bullish candle called a bullish candle?

The candle must be green and have a higher low (body or wick) than the previous candle. The candle can have a higher high than the previous candle.

Within how many candles does the bullish candle have to appear after the 3 or more candles?

Good question, as long as there’s "acceleration" lower and the candles meet the criteria (Set of 3 candles where the distance on the lows of the candles are increasing red or green (body or wick) the pattern remains in play. There might be 3,4,5 + consecutive bars and then the trigger bar “Green higher low” appears. (Ex. See below of a powerful move that triggered multiple 3 candle Anti-Climax patterns)

Within how many bars does a buy candle have to happen?

After the trigger candle (1st green higher low candle) the trade entry should be triggered within 2 days. If it does not, the trade is invalidated.

post a link that talk about this strategy: This is a 4min video detailing the strategy:

Attachments

Last edited by a moderator: