Author Message:

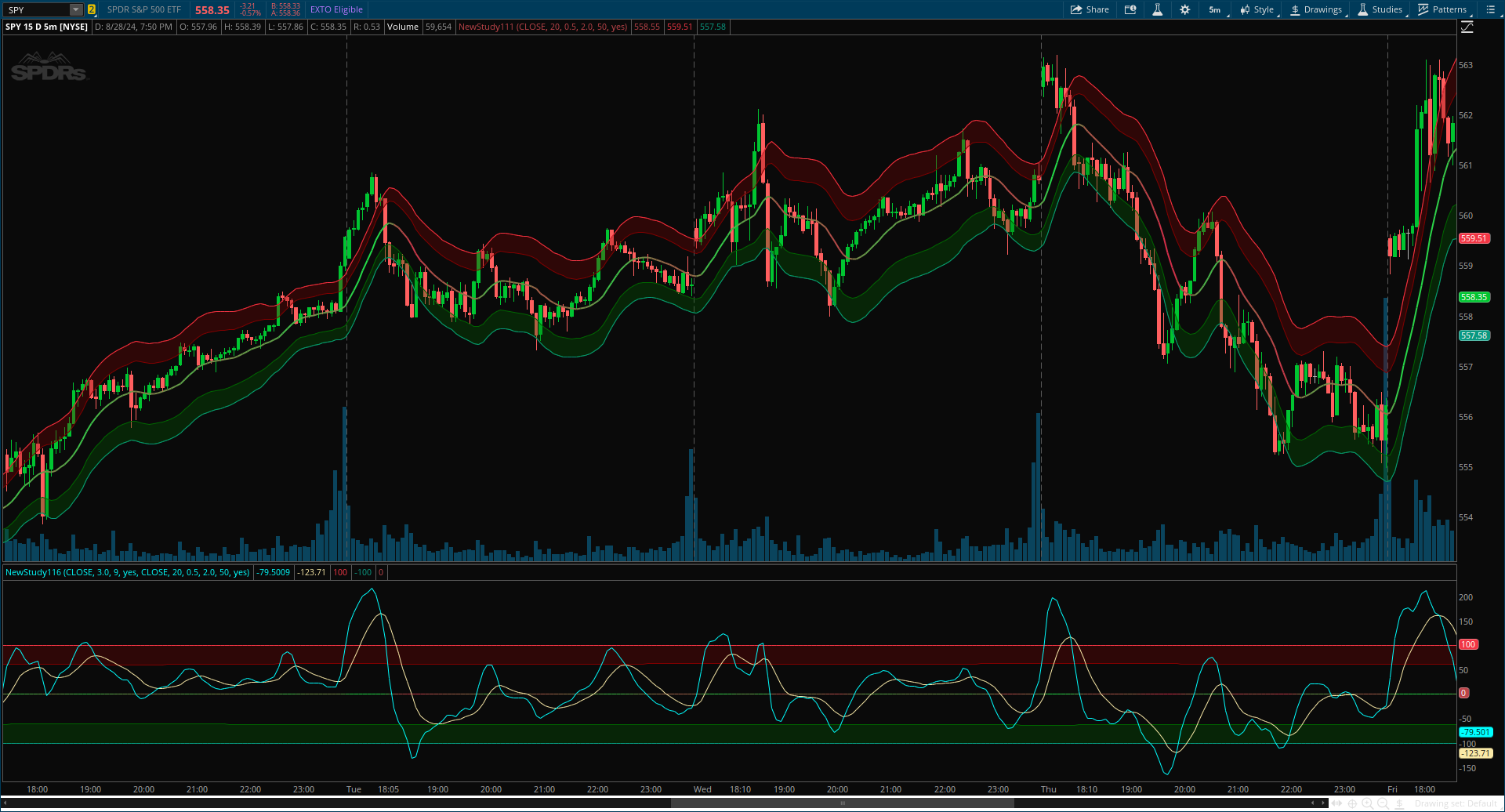

This indicator combines a traditional Keltner Channel overlay with an oscillator, providing a comprehensive view of price action, trend, and momentum. The core of this indicator is its advanced ATR calculation, which uses statistical methods to provide a more robust measure of volatility.

Upper Study :

CSS:

#// Indicator For TOS

#// © MyTradingCoder

#indicator("Advanced Keltner Channel/Oscillator [MyTradingCoder]")

# Converted by Sam4Cok@Samer800 - 0/2024

input source = close; #, "Source", group = filter_group)

input length = 20; #, "Length", step = 0.5, minval = 2, group = filter_group)

input Q = 0.50;#, "Q", step = 0.125, minval = 0.125, group = filter_group)

input Multiplier = 2.0; #, "Multiplier", minval = 0, step = 0.25, group = atr_group)

input atrPeriod = 50; #, "Length", minval = 1, group = atr_group)

input atr_smoothing = yes; #(true, "Smoothing", group = atr_group) ? 2 : 1

def na = Double.NaN;

#-- Color

DefineGlobalColor("up", CreateColor(8, 153, 129));

DefineGlobalColor("dn", CreateColor(242, 54, 69));

#// filter {

script biquad_lpf {

input source = close;

input length = 10;

input Q = 0.5;

def na = Double.NaN;

def pi = Double.Pi;

def isfirst = BarNumber() <= 1;

def fc = Min(0.5, 1 / length);

def omega = 2 * pi * fc;

def cos_omega = Cos(omega);

def alpha = Sin(omega) / (2 * Q);

def a0 = 1 / (1 + alpha);

def b = 1 - cos_omega;

def a1;

def a2;

def b0;

def b1;

def b2;

if isfirst {

a1 = -2 * cos_omega * a0;

a2 = (1 - alpha) * a0;

b0 = b / 2 * a0;

b1 = b * a0;

b2 = b0;

} else {

a1 = if !a1[1] then na else a1[1];

a2 = if !a2[1] then na else a2[1];

b0 = if !b0[1] then na else b0[1];

b1 = if !b1[1] then na else b1[1];

b2 = if !b2[1] then na else b2[1];

}

def biquad;

def prQuad = CompoundValue(1, if !biquad[1] then source else biquad[1], source);

def x = if source then source else x[1];

def x1 = CompoundValue(1, if source[1] then source[1] else x, source);

def x2 = CompoundValue(1, if source[2] then source[2] else x1, x1);

def y1 = CompoundValue(1, if prQuad then prQuad else x, x);

def y2 = CompoundValue(1, if prQuad[1] then prQuad[1] else y1, y1);

biquad = b0 * x + b1 * x1 + b2 * x2 - a1 * y1 - a2 * y2;

plot out = if isfirst then source else biquad;

}

script advanced_atr {

input period = 50;

def tr = high - low;

def sumTr = Sum(Sqr(tr), period);

def rms = Sqrt(sumTr / Max(1, period -1));

def z = tr / rms;

def clamped_z = Min(z, 10);

def rounded_z = Round(clamped_z, 2);

def zidx = Floor(rounded_z * 100);

def z_idx = if isNaN(zidx) then 0 else zidx;

def lookback = 1001;

def rang_observations = if z_idx != 0 then z_idx else rang_observations[1];

def mode = (if period<=1 then 100 else 56) / 100 * rms;

def average = Average(rang_observations + 1, lookback) / 100 * rms;

plot avg = average;

plot mod = mode;

}

script smoothing {

input source = close;

input smoothing = yes;

def length = if smoothing then 2 else 1;

def wma = WMA(source, length);

def smooth = Average(wma, length);

plot out = smooth;

}

script normal_delta_scale {

input source = close;

input atr = 1;

input degree = 2;

def pi = Double.Pi;

def delta = (source - source[degree]) / atr;

def todegrees = ATan(delta) * 180 / pi;

def color_scale = (todegrees + 90) / 180;

plot out = color_scale;

}

def average = advanced_atr(atrPeriod).avg;

def mode = advanced_atr(atrPeriod).mod;

def biquad = biquad_lpf(source, length, Q);

def midline = smoothing(mode * Multiplier, atr_smoothing);

def maxline = smoothing(average * Multiplier, atr_smoothing);

def top_midline = biquad + midline;

def top_maxline = biquad + maxline;

def bottom_midline = biquad - midline;

def bottom_maxline = biquad - maxline;

def color_scale = normal_delta_scale(biquad, mode);

def delta_color = if IsNaN(color_scale) then 0 else

if color_scale > 1 then 255 else

if color_scale < 0 then 0 else color_scale * 255;

def top_mid_line = if top_midline then top_midline else na;

def bottom_mid_line = if bottom_midline then bottom_midline else na;

plot centerLine = if biquad then biquad else na;

plot top_max_line = if top_maxline then top_maxline else na;

plot bot_max_line = if bottom_maxline then bottom_maxline else na;

centerLine.SetLineWeight(2);

centerLine.AssignValueColor(CreateColor(255 - delta_color, delta_color, 72));

top_max_line.SetDefaultColor(GlobalColor("dn"));

bot_max_line.SetDefaultColor(GlobalColor("up"));

AddCloud(top_max_line, top_mid_line, Color.DARK_RED, Color.DARK_RED, yes);

AddCloud(bottom_mid_line, bot_max_line, Color.DARK_GREEN, Color.DARK_GREEN, yes);

#-- END of CODELower Study:

CSS:

#// Indicator for TOS

#// © MyTradingCoder

#indicator("Advanced Keltner Channel/Oscillator [MyTradingCoder]")

# Converted by Sam4Cok@Samer800 - 08/2024

Declare lower;

input osc_source = close; #, "Source", group = osc_settings)

input SourceSmoothing = 3.0; #, "Source Smoothing", step = 0.5, minval = 0, group = osc_settings) + 1

input signalLinePeriod = 9; #, "Signal Period", minval = 1, group = osc_settings)

input NormalizeOscillator = yes; #(true, "Normalize Oscillator", group = osc_settings)

input source = close; #, "Source", group = filter_group)

input length = 20; #, "Length", step = 0.5, minval = 2, group = filter_group)

input Q = 0.50;#, "Q", step = 0.125, minval = 0.125, group = filter_group)

input Multiplier = 2.0; #, "Multiplier", minval = 0, step = 0.25, group = atr_group)

input atrPeriod = 50; #, "Length", minval = 1, group = atr_group)

input atr_smoothing = yes; #(true, "Smoothing", group = atr_group) ? 2 : 1

def na = Double.NaN;

def last = isNaN(close);

def osc_length = SourceSmoothing + 1;

#-- Color

DefineGlobalColor("up", CreateColor(8,153,129));

DefineGlobalColor("dn", CreateColor(242,54,69));

#// osc {

Script make_osc {

input source = close;

input min = low;

input max = high;

input center = hl2;

input normalize = yes;

def norm = -100 + (source - min) * 200 / (max - min);

def make_osc = if normalize then norm else source - center;

plot out = make_osc;

}

#// filter {

#// filter {

script biquad_lpf {

input source = close;

input length = 10;

input Q = 0.5;

def na = Double.NaN;

def pi = Double.Pi;

def isfirst = BarNumber() <= 1;

def fc = Min(0.5, 1 / length);

def omega = 2 * pi * fc;

def cos_omega = Cos(omega);

def alpha = Sin(omega) / (2 * Q);

def a0 = 1 / (1 + alpha);

def b = 1 - cos_omega;

def a1;

def a2;

def b0;

def b1;

def b2;

if isfirst {

a1 = -2 * cos_omega * a0;

a2 = (1 - alpha) * a0;

b0 = b / 2 * a0;

b1 = b * a0;

b2 = b0;

} else {

a1 = if !a1[1] then na else a1[1];

a2 = if !a2[1] then na else a2[1];

b0 = if !b0[1] then na else b0[1];

b1 = if !b1[1] then na else b1[1];

b2 = if !b2[1] then na else b2[1];

}

def biquad;

def prQuad = CompoundValue(1, if !biquad[1] then source else biquad[1], source);

def x = if source then source else x[1];

def x1 = CompoundValue(1, if source[1] then source[1] else x, source);

def x2 = CompoundValue(1, if source[2] then source[2] else x1, x1);

def y1 = CompoundValue(1, if prQuad then prQuad else x, x);

def y2 = CompoundValue(1, if prQuad[1] then prQuad[1] else y1, y1);

biquad = b0 * x + b1 * x1 + b2 * x2 - a1 * y1 - a2 * y2;

plot out = if isfirst then source else biquad;

}

Script ema {

input source = close;

input length = 9;

def bar = BarNumber();

def prefilter = if bar < 2 then source else Average(source, 2);

def alpha = 2 / (length + 1);

def smoothed = CompoundValue(1, alpha * prefilter + (1 - alpha) * smoothed[1],alpha * prefilter);

plot ema = if length > 1 then smoothed else source;

}

script advanced_atr {

input period = 50;

def tr = high - low;

def sumTr = Sum(Sqr(tr), period);

def rms = Sqrt(sumTr / Max(1, period -1));

def z = tr / rms;

def clamped_z = Min(z, 10);

def rounded_z = Round(clamped_z, 2);

def zidx = Floor(rounded_z * 100);

def z_idx = if isNaN(zidx) then 0 else zidx;

def lookback = 1001;

def rang_observations = if z_idx != 0 then z_idx else rang_observations[1];

def mode = (if period<=1 then 100 else 56) / 100 * rms;

def average = Average(rang_observations + 1, lookback) / 100 * rms;

plot avg = average;

plot mod = mode;

}

Script smoothing {

input source = close;

input smoothing = yes;

def length = if smoothing then 2 else 1;

def wma = wma(source, length);

def smooth = Average(wma, length);

plot out = smooth;

}

Script normal_delta_scale {

input source = close;

input atr = 1;

input degree = 2;

def pi = Double.Pi;

def delta = (source - source[degree]) / atr;

def todegrees = atan(delta) * 180 / pi;

def color_scale = (todegrees + 90) / 180;

plot out = color_scale;

}

def average = advanced_atr(atrPeriod).avg;

def mode = advanced_atr(atrPeriod).mod;

def biquad = biquad_lpf(source, length, Q);

def midline = smoothing(mode * Multiplier, atr_smoothing);

def maxline = smoothing(average * Multiplier, atr_smoothing);

def top_midline = biquad + midline;

def top_maxline = biquad + maxline;

def bottom_midline = biquad - midline;

def bottom_maxline = biquad - maxline;

def color_scale = normal_delta_scale(biquad, mode);

def delta_color = if isNaN(color_scale) then 0 else

if color_scale>1 then 255 else

if color_scale<0 then 0 else color_scale * 255;

#// osc {

def osc_midline_top = make_osc(top_midline, bottom_maxline, top_maxline, biquad, NormalizeOscillator);

def osc_midline_bottom = make_osc(bottom_midline, bottom_maxline, top_maxline, biquad, NormalizeOscillator);

def osc_max_top = make_osc(top_maxline, bottom_maxline, top_maxline, biquad, no);

def osc_max_bot = make_osc(bottom_maxline, bottom_maxline, top_maxline, biquad, no);

def osc_maxline_top = if last then na else if NormalizeOscillator then 100 else osc_max_top;

def osc_maxline_bottom = if last then na else if NormalizeOscillator then -100 else osc_max_bot;

def osc_normal = make_osc(osc_source, bottom_maxline, top_maxline, biquad, NormalizeOscillator);

def osc_line = ema(osc_normal, osc_length);

def osc_signal = ema(osc_line, signalLinePeriod);

def top_mid_line_osc = if osc_midline_top then osc_midline_top else na;

def bottom_mid_line_osc = if osc_midline_bottom then osc_midline_bottom else na;

plot Oscillator = if osc_line then osc_line else na;

plot Signal = if osc_signal then osc_signal else na;

plot top_max_line_osc = if osc_maxline_top then osc_maxline_top else na;

plot bottom_max_line_osc = if osc_maxline_bottom then osc_maxline_bottom else na;

plot zero = if last then na else 0;

Oscillator.SetDefaultColor(Color.CYAN);

Signal.SetDefaultColor(GetColor(8));

zero.AssignValueColor(CreateColor(255 - delta_color, delta_color, 72));

top_max_line_osc.SetDefaultColor(GlobalColor("dn"));

bottom_max_line_osc.SetDefaultColor(GlobalColor("up"));

AddCloud(top_max_line_osc, top_mid_line_osc, Color.DARK_RED, Color.DARK_RED, yes);

AddCloud(bottom_mid_line_osc, bottom_max_line_osc, Color.DARK_GREEN, Color.DARK_GREEN, yes);

#-- END of CODE