|

| Here on useThinkScript, we dive deep into the latest discussions and highlight the most valuable indicators, set ups, and strategies which could give you the edge in this week's markets. Scroll down to check out this week's must reads, carefully selected by uTS Moderators! |

| samer800 said: The Golden Swap indicator, focuses on identifying reversal points around the key levels indicated by the indicator. This pattern works by analyzing the relationship between current and past price movements, considering factors like price symmetry, baseline boundaries, and precision pin bar formations. It can offer insights into potential market reversals, allowing for more precise entries and exits. |

|

| samer800 said: Half Trend Channel [BigBeluga] is a powerful trend-following indicator designed to identify trend direction, fakeouts, and potential reversal points. The combination of upper/lower bands, midline coloring, and specific signals makes it ideal for spotting trend continuation and market reversals. |

|

AVAILABLE TO VIP MEMBERS ONLY |

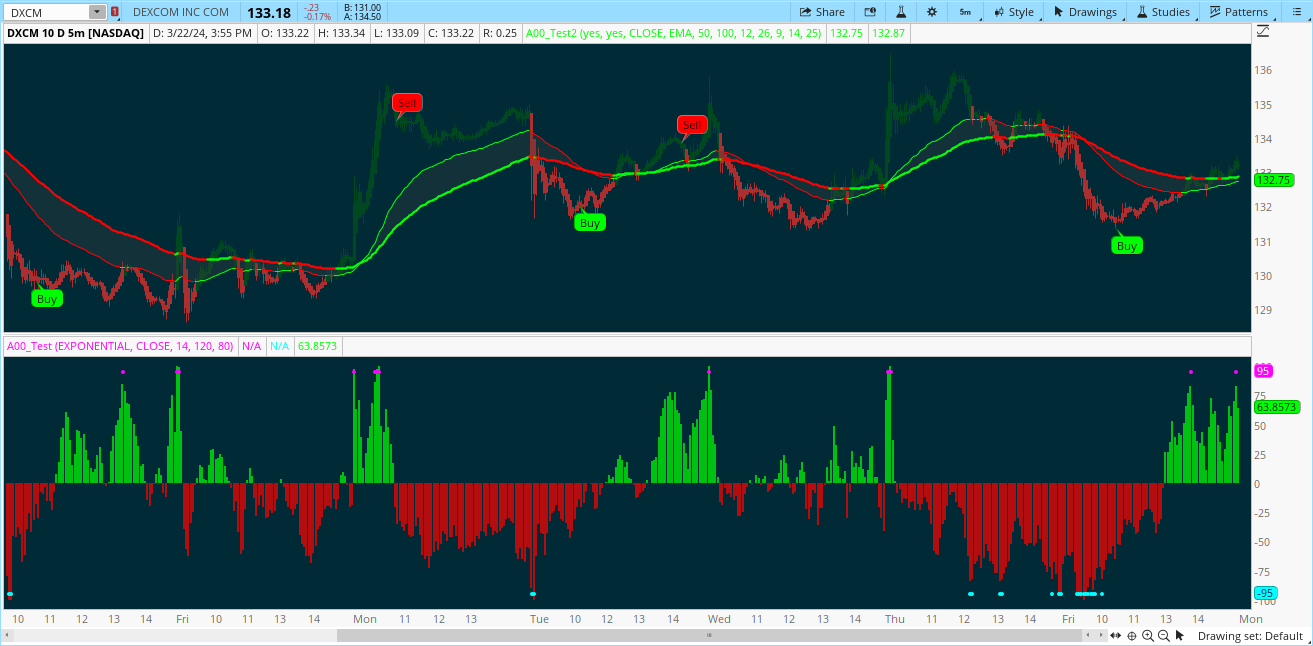

| khpro59 said: Its 2025, lets kill it. I have been laying low, I had a great 2024 trading year and traded extremely defensively for essentially the last quarter of 2024 - so ive been quiet. Well, I'm back with a whole new desk setup and even a new suite of trading tools I hope you wonderful folks will enjoy. You may be familiar with my post, ATR Breakout Strategy for Directional Options. Well I still utilize that script, but have added a LOT more to it. I will be adding the entire kit and kaboodle below for your use, but please just remove anything you do not want. One man gathers what another man spills... so whats good for me, might not be for you, pick and choose what you want to keep as to not have your charts cluttered. Lets dig in... |

|

| Join our VIP Members Club to get access to our premium indicators including Buy The Dip, Advanced Market Moves and Take Profit. Your VIP membership includes: |

| ✓ Full access to public & private forums ✓ No Ads ✓ Priority community support ✓ Unlimited Postings ✓ Premium thinkorswim indicators ✓ Exclusive strategies, scanners, add-ons ✓ Discord chatroom with Trade Alerts |

| DigitsM said: This script helps you identify the relative strength of bulls and bears in the market. It calculates the difference between the high and the moving average for bulls, and the difference between the moving average and the low for bears. Then it normalizes the values between -100 and 100 using the highest and lowest values of the last "bars back" periods. This allows you to compare the current strength of bulls and bears relative to their historical strength. The output of the script is a colored column chart that represents the difference between the normalized bulls and bears values. If the chart is mostly green, it means the bulls are currently stronger than the bears, and vice versa for a mostly red chart. Additionally, the script provides bullish and bearish signals based on when the normalized bulls cross above or below the user-defined "Line Height" value. You can use this script to help you identify potential trend changes in the market, as well as to confirm existing trends. |

|

FROM THE ARCHIVES: OCT 2019 |

| MerryDay said: Z-score oscillator measures how far a data point is from the mean, displaying whether it's above or below the average. Day traders use the Z-score to spot potential entry and exit points by measuring how far a stock's price deviates from its historical average. It helps identify when a stock is "overbought" (high positive Z-score) or "oversold" (low negative Z-score), signaling possible price reversals. Key points: Identifying Price Deviations: The Z-score converts price data into standard deviations, with larger values showing stronger deviations from the average. Mean Reversion Strategy: Traders buy when a stock is oversold (low Z-score) and sell when overbought (high Z-score), aiming for the price to return to its average. |

|

Last edited by a moderator: