|

| Here on useThinkScript, we dive deep into the latest discussions and highlight the most valuable indicators, set ups, and strategies which could give you the edge in this week's markets. Scroll down to check out this week's must reads, carefully selected by uTS Moderators! |

| finnovator said: "Hindenburg's Omen" is a technical indicator in financial analysis designed to predict a potential significant decline or a stock market crash. How it works

|

|

| samer800 said: Here my conversion with option of AlphaTrend and AlphaTrend Max With Trend Magic; we had some problems.

|

|

AVAILABLE TO VIP MEMBERS ONLY |

| rewardiaz said: Recently, I was introduced to $TICK, and after a deep dive into its functionality, I’ve uncovered its potential value in scalping. My research indicates that $TICK measures the difference between the number of stocks trading on an uptick and those trading on a downtick on the New York Stock Exchange (NYSE). With this understanding, I decided to create an indicator to visualize this process. I’m not sure if others already have this or if it’s available within our community, but I believe it could be a helpful addition to our toolkit. Nevertheless, happy trading Understanding $TICK Movements This study categorizes $TICK values into three distinct ranges, reflecting varying degrees of market activity... |

|

| Join our VIP Members Club to get access to our premium indicators including Buy The Dip, Advanced Market Moves and Take Profit. Your VIP membership includes: |

| ✓ Full access to public & private forums ✓ No Ads ✓ Priority community support ✓ Unlimited Postings ✓ Premium thinkorswim indicators ✓ Exclusive strategies, scanners, add-ons ✓ Discord chatroom with Trade Alerts |

| Sesqui said: This indicator implements the Optimum Predictor Indicator from Dr Ehler's book, "Rocket Science for Traders" in thinkscript and is provided for educational purposes. The indicator implements Dr Ehler's algorithm which adds phasors of the smoothed and detrended price data and applies the Homodyne Discriminator to the result, returning the price cycle period (eg time to complete a full cycle). The price cycle period is then refined via more detrending and EMA smoothing per the algorithm in Dr Ehler's book. The predictor line is plotted on the lower chart. The algorithm is supplemented by computing the slope of the predictor line using a 2nd order accurate finite difference expression. The predictor line is colored green when its slope > 0 and red when its slope < 0. |

|

FROM THE ARCHIVES: JUN 2023 |

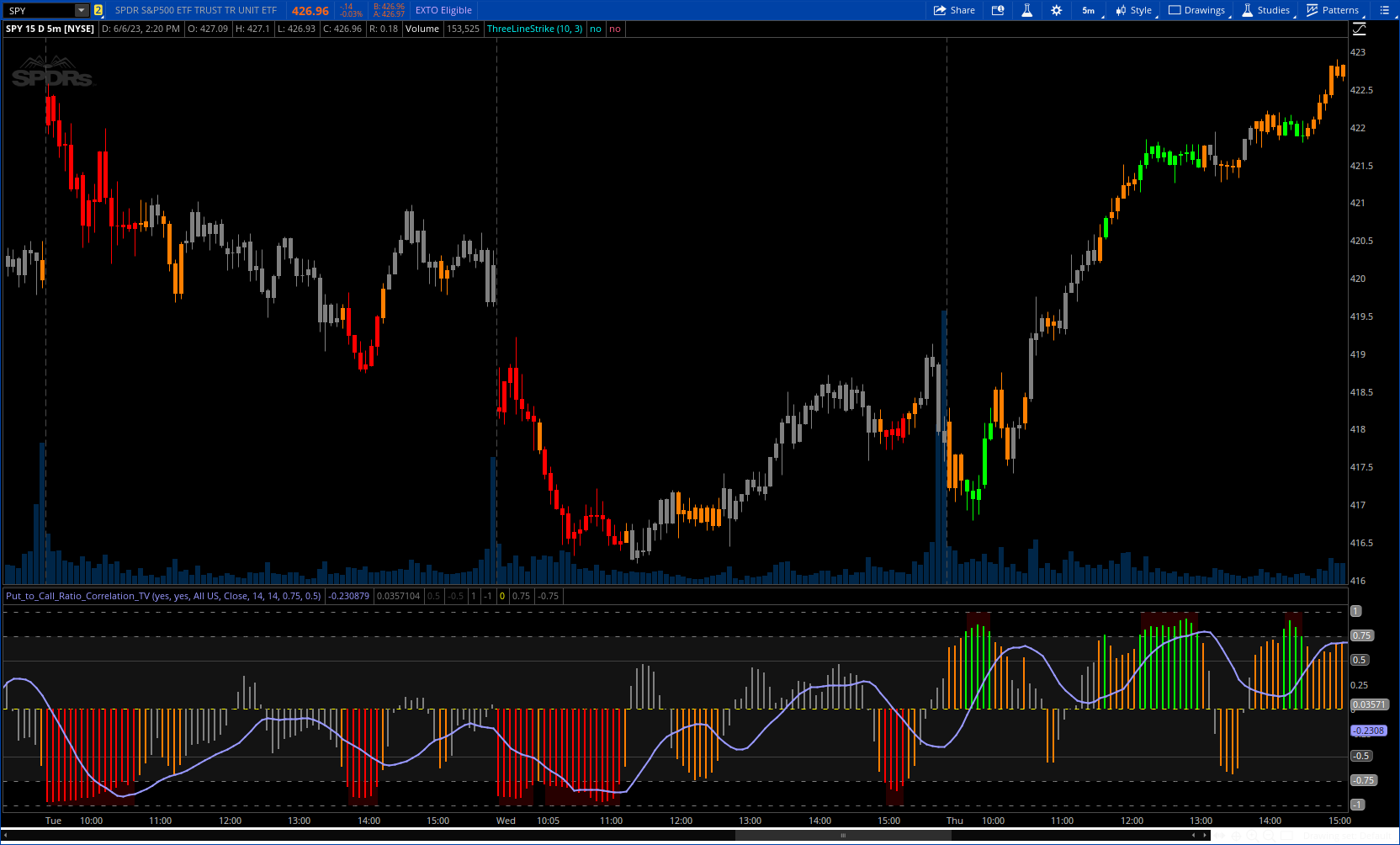

| samer800 said: This indicator is very simple. It pulls the data from the index and runs a correlation assessment against whichever ticker you are on. Its helpful to correlate with indices such as SPY, IWM and QQQ, but I have had success correlating with individual tickers such as NVDA and AMD. |

|

Last edited by a moderator: