Here are the latest tips and strategies from your uTS Community |

| Here on useThinkScript, we dive deep into the latest discussions and highlight the most valuable indicators, set ups, and strategies which could give you the edge in this week's markets. Scroll down to check out this week's must reads, carefully selected by uTS Moderators! |

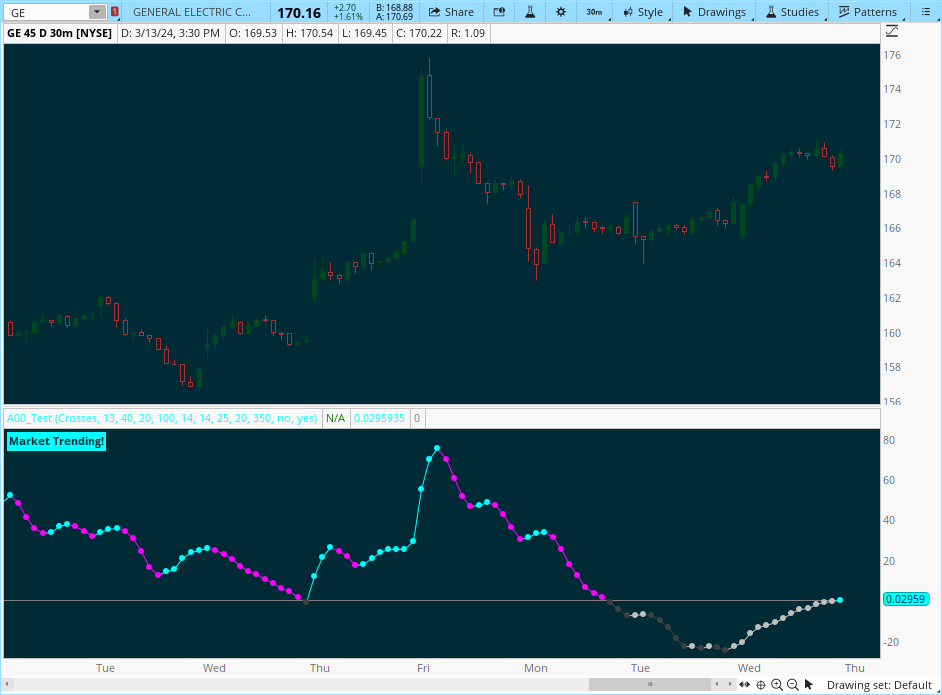

| Darth Tradicus said: The Scalper's Volatility Filter (𝒮𝒱𝐹) is a sophisticated technical indicator, designed to increase the profitability of lower timeframe trading. Due to the inherent decrease in the signal-to-noise ratio when trading on lower timeframes, it is critical to develop analysis methods to inform traders of the optimal market periods to trade - and more importantly, when you shouldn’t trade. The 𝒮𝒱𝐹 uses a blend of volatility and momentum measurements, to signal the dominant market condition - trending or ranging. |

|

| serendipity2020 said: A different approach to the MACD. Classic MACD uses exponential moving averages. In this version users can apply 11 different types of moving averages which they can benefit from their smoothness and vice versa sharpnesses... |

|

AVAILABLE TO VIP MEMBERS ONLY |

| Max said: BUY THE DIP Decided to merge multiple indicators into one. The core is William Vix and Momentum Keltner. It was made for Daily but looks promising on intraday charts also. Agenda: red/green arrows shows when we should go long. Blue - adds the position/move deltas e.t.c 1. What's the reasoning behind merging the VixFix with this indicator?

|

|

| Join our VIP Members Club to get access to our premium indicators including Buy The Dip, Advanced Market Moves and Take Profit. Your VIP membership includes: |

| ✓ Full access to public & private forums ✓ No Ads ✓ Priority community support ✓ Unlimited Postings ✓ Premium thinkorswim indicators ✓ Exclusive strategies, scanners, add-ons ✓ Discord chatroom with Trade Alerts |

| Henry1224 said: The Ichimoku Cloud is popular in that it displays support and resistance, momentum, and trend all in one view. TenkanSen and KijunSen are similar to moving averages and are analyzed in relationship to one another. |

|

FROM THE ARCHIVES: April 2020 |

| useThinkScript said: The TMO calculates momentum using the delta of price. Price delta gauges the change rate, providing a dynamic view of direction and intensity. Giving a much better picture of trend, tend reversals and divergence than momentum oscillators using price. |

|

Last edited by a moderator: