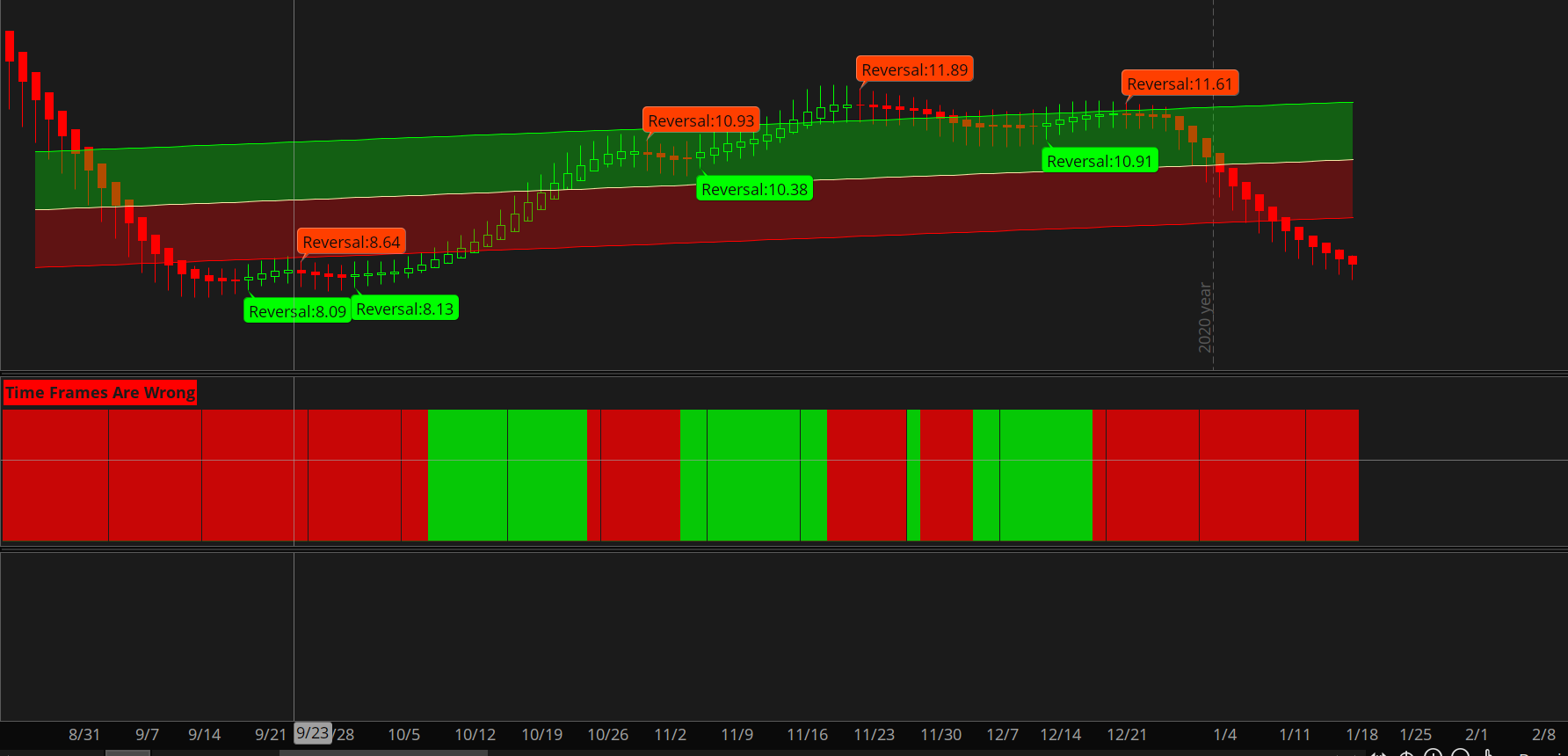

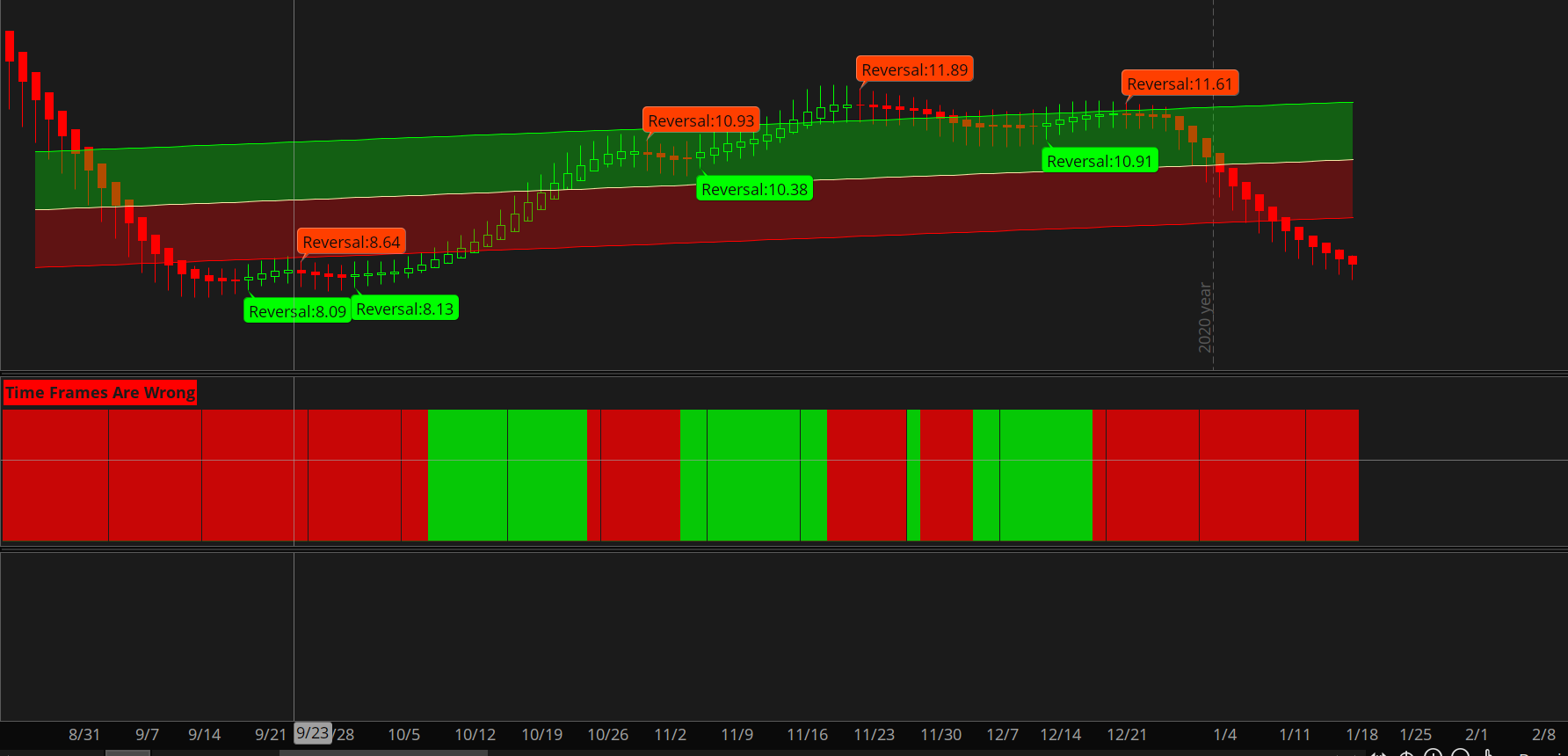

@BonBon I'm on the daily chart and it says time frames are wrong. Then the other doesn't even show up.

Your time frames cannot be lower than the main chart time frame etc. I adapted my script based on the below video and the accompanying script.

@BonBon I'm on the daily chart and it says time frames are wrong. Then the other doesn't even show up.

ooohhh I´m sorry my dear ,)

# Auto Fib V1.3

# tomsk

# 11.19.2019

#German_Burrito

# Automatically draws fibonacci retracements using the highest price and lowest price

# from the current view and timeframe.

#

# Fibonacci retracements use horizontal lines to indicate areas of support or resistance

# at the key Fibonacci levels before it continues in the original direction. These levels

# are created by drawing a trendline between two extreme points and then dividing the

# vertical distance by the key Fibonacci ratios of: 23.6%, 38.2%, 50%, 61.8%, 78.6%, and 100%.

# CHANGE LOG

#

# V1.0 - 12.18.2018 - BenTen - Initial release of Auto Fib, created by Ryan Hendricks

# V1.1 - 11.15.2019 - theelderwand - As script was difficult to read, made the following enhancements

# Expands to right

# Doesn't expand to left

# Custom colors for Fibonacci bars (0.618 is GOLD color)

# Custom line weights

# Code is modularized so you can add extra plots as needed

# V1.2 - 11.15.2019 - tomsk - Added an input selector for the colors of the label. You

# can select from any of the colors listed - red, orange,

# green, etc and bubbles for all the fib retracements will

# utilize that color.

# V1.3 - 11.19.2019 - tomsk - Modified the AddChartBubbles to be displayed on the right

# side of the chart. Please ensure that you increase the

# expansion area to that the bubbles have room to be displayed

# Chart Settings > Time Axis > Expansion Area

#

# V1.4 - 1.22.2021 - AspaTrader. - Modified to show fib levels for HA candles

#hint Price: Price used in the alerts on crossing retracement lines. <b>(Default is Close)</b>

#hint coefficient_0: Retracement Line 0: Retracement from the highest high to the lowest low.<b>(Default is 0%)</b>

#hint Coefficient_1: Retracement Line 1: Retracement from the highest high to the lowest low.<b>(Default is 23.6%)</b>

#hint Coefficient_2: Retracement Line 2: Retracement from the highest high to the lowest low.<b>(Default is 38.2%)</b>

#hint Coefficient_3: Retracement Line 3: Retracement from the highest high to the lowest low.<b>(Default is 50%)</b>

#hint Coefficient_4: Retracement Line 4: Retracement from the highest high to the lowest low.<b>(Default is 61.8%)</b>

#hint Coefficient_5: Retracement Line 5: Retracement from the highest high to the lowest low.<b>(Default is 78.6%)</b>

#hint Coefficient_6: Retracement Line 6: Retracement from the highest high to the lowest low.<b>(Default is 100%)</b>

#wizard input: Price

#wizard text: Inputs: Price:

#wizard input: coefficient_0

#wizard text: coefficient_0:

#wizard input: Coefficient_1

#wizard text: Coefficient_1:

#wizard input: Coefficient_2

#wizard text: Coefficient_2:

#wizard input: Coefficient_3

#wizard text: Coefficient_3:

#wizard input: Coefficient_4

#wizard text: Coefficient_4:

#wizard input: Coefficient_5

#wizard text: Coefficient_5:

#wizard input: Coefficient_6

#wizard text: Coefficient_6:

input period = 50;

input candleSmoothing = {default Valcu, Vervoort};

input slope_adjust_multiplier = 1.00;

input movingAverageType = {default TEMA, Exponential, Hull };

def slope_adj = slope_adjust_multiplier;

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Exponential:

openMA = CompoundValue(1, ExpAverage(open, period), open);

closeMA = CompoundValue(1, ExpAverage(close, period), close);

highMA = CompoundValue(1, ExpAverage(high, period), high);

lowMA = CompoundValue(1, ExpAverage(low, period), low);

case Hull:

openMA = CompoundValue(1, HullMovingAvg(open, period), open);

closeMA = CompoundValue(1, HullMovingAvg(close, period), close);

highMA = CompoundValue(1, HullMovingAvg(high, period), high);

lowMA = CompoundValue(1, HullMovingAvg(low, period), low);

case TEMA:

openMA = CompoundValue(1, TEMA(open, period), open);

closeMA = CompoundValue(1, TEMA(close, period), close);

highMA = CompoundValue(1, TEMA(high, period), high);

lowMA = CompoundValue(1, TEMA(low, period), low);

}

def haOpen;

def haClose;

switch (candleSmoothing){

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0 ) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

}

plot o = haOpen;

o.Hide();

def haLow = Min(lowMA, haOpen);

def haHigh = Max(highMA, haOpen);

def price = haClose;

def high = haHigh;

def low = haLow;

input coefficient_0 = 0.000;

input Coefficient_1 = .236;

input Coefficient_2 = .382;

input Coefficient_3 = .5;

input Coefficient_4 = .786;

input Coefficient_5 = .618;

input Coefficient_6 = 1.00;

input LabelColor = {default "MAGENTA", "CYAN", "PINK", "LIGHT_GRAY", "ORANGE", "RED", "GREEN", "GRAY", "WHITE"};

input n = 3;

def n1 = n + 1;

def a = HighestAll(haHigh);

def b = LowestAll(haLow);

def barnumber = BarNumber();

def c = if high == a then barnumber else Double.NaN;

def d = if low == b then barnumber else Double.NaN;

rec highnumber = CompoundValue(1, if IsNaN(c) then highnumber[1] else c, c);

def highnumberall = HighestAll(highnumber);

rec lownumber = CompoundValue(1, if IsNaN(d) then lownumber[1] else d, d);

def lownumberall = LowestAll(lownumber);

def upward = highnumberall > lownumberall;

def downward = highnumberall < lownumberall;

def x = AbsValue(lownumberall - highnumberall );

def slope = (a - b) / x;

def slopelow = (b - a) / x;

def day = GetDay();

def month = GetMonth();

def year = GetYear();

def lastDay = GetLastDay();

def lastmonth = GetLastMonth();

def lastyear = GetLastYear();

def isToday = If(day == lastDay and month == lastmonth and year == lastyear, 1, 0);

def istodaybarnumber = HighestAll(if isToday then barnumber else Double.NaN);

def line = b + (slope * (barnumber - lownumber));

def linelow = a + (slopelow * (barnumber - highnumber));

def currentlinelow = if barnumber <= lownumberall then linelow else Double.NaN;

def currentline = if barnumber <= highnumberall then line else Double.NaN;

plot FibFan = if downward then currentlinelow else if upward then currentline else Double.NaN;

FibFan.SetStyle(Curve.SHORT_DASH);

FibFan.AssignValueColor(Color.RED);

FibFan.HideBubble();

def range = a - b;

def value0 = range * coefficient_0;

def value1 = range * Coefficient_1;

def value2 = range * Coefficient_2;

def value3 = range * Coefficient_3;

def value4 = range * Coefficient_4;

def value5 = range * Coefficient_5;

def value6 = range * Coefficient_6;

def condition1 = downward and barnumber >= highnumberall;

def condition2 = upward and barnumber >= lownumberall;

plot Retracement0 = if condition1 then HighestAll(b + value0) else if condition2 then HighestAll(a - value0) else Double.NaN;

plot Retracement1 = if condition1 then HighestAll(b + value1) else if condition2 then HighestAll(a - value1) else Double.NaN;

plot Retracement2 = if condition1 then HighestAll(b + value2) else if condition2 then HighestAll(a - value2) else Double.NaN;

plot Retracement3 = if condition1 then HighestAll(b + value3) else if condition2 then HighestAll(a - value3) else Double.NaN;

plot Retracement4 = if condition1 then HighestAll(b + value4) else if condition2 then HighestAll(a - value4) else Double.NaN;

plot Retracement5 = if condition1 then HighestAll(b + value5) else if condition2 then HighestAll(a - value5) else Double.NaN;

plot Retracement6 = if condition1 then HighestAll(b + value6) else if condition2 then HighestAll(a - value6) else Double.NaN;

def xx = if condition1 then (barnumber - highnumberall) else (barnumber - lownumberall);

def mm = if condition1 then HighestAll((ohlc4 - Retracement6) / xx) else LowestAll((ohlc4 - Retracement6) / xx);

#PLOT FIBS with slope

# Y = MX + B

#y = end value, m = slope = x is time b = beg value

plot r7 = mm * slope_adj * xx + Retracement6;

plot r6 = mm * slope_adj * xx + Retracement5;

plot r5 = mm * slope_adj * xx + Retracement4;

plot r4 = mm * slope_adj * xx + Retracement3;

plot r3 = mm * slope_adj * xx + Retracement3;

plot r2 = mm * slope_adj * xx + Retracement2;

plot r1 = mm * slope_adj * xx + Retracement1;

plot r0 = mm * slope_adj * xx + Retracement0;

Retracement0.AssignValueColor(CreateColor(255, 255, 255));

Retracement0.SetLineWeight(4);

Retracement0.HideBubble();

#AddChartBubble((downward and haClose[n1]) and IsNaN(haClose[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes);

#AddChartBubble((upward and haClose[n1]) and IsNaN(haClose[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes);

Retracement2.AssignValueColor(CreateColor(0, 197, 49));

Retracement2.SetLineWeight(2);

Retracement2.HideBubble();

#AddChartBubble((downward and haClose[n1]) and IsNaN(haClose[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes);

#AddChartBubble((upward and haClose[n1]) and IsNaN(haClose[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes);

Retracement4.AssignValueColor(CreateColor(255, 215, 0));

Retracement4.SetLineWeight(5);

Retracement4.HideBubble();

#AddChartBubble((downward and haClose[n1]) and IsNaN(haClose[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes);

#AddChartBubble((upward and haClose[n1]) and IsNaN(haClose[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes);

Retracement6.AssignValueColor(CreateColor(255, 255, 255));

Retracement6.SetLineWeight(4);

Retracement6.HideBubble();

#AddChartBubble((downward and haClose[n1]) and IsNaN(haClose[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes);

#AddChartBubble((upward and haClose[n1]) and IsNaN(haClose[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes);

Alert((price crosses below Retracement0) , "Price crosses below Retracement Line 0");

Alert((price crosses above Retracement0) , "Price crosses above Retracement Line 0");

Alert((price crosses below Retracement2) , "Price crosses below Retracement Line 2");

Alert((price crosses above Retracement2) , "Price crosses above Retracement Line 2");

Alert((price crosses below Retracement4) , "Price crosses below Retracement Line 4");

Alert((price crosses above Retracement4) , "Price crosses above Retracement Line 4");

Alert((price crosses below Retracement6) , "Price crosses below Retracement Line 6");

Alert((price crosses above Retracement6) , "Price crosses above Retracement Line 6");

# End Auto Fib v1.3

AddChartBubble((barnumber == istodaybarnumber), Retracement0, Concat( "$", Round(Retracement0, 2)), Color.RED, yes);

AddChartBubble((barnumber == istodaybarnumber), Retracement2, Concat( "$", Round(Retracement2, 2)), Color.RED, yes);

AddChartBubble((barnumber == istodaybarnumber), Retracement4, Concat( "$", Round(Retracement4, 2)), Color.RED, yes);

AddChartBubble((barnumber == istodaybarnumber), Retracement6, Concat( "$", Round(Retracement6, 2)), Color.RED, yes);

r0.setlineWeight(2);

r1.setlineWeight(2);

r2.setlineWeight(2);

r3.setlineWeight(2);

r4.setlineWeight(2);

r5.setlineWeight(2);

r6.setlineWeight(2);

r7.setlineWeight(2);

R0.AssignValueColor(CreateColor(255, 255, 255));

R1.AssignValueColor(CreateColor(255, 255, 25));

R2.AssignValueColor(CreateColor(25, 255, 255));

R3.AssignValueColor(CreateColor(255, 255, 255));

R4.AssignValueColor(CreateColor(5, 215, 25));

R5.AssignValueColor(CreateColor(115, 155, 215));

R7.AssignValueColor(CreateColor(255, 255, 255));

retracement0.Hide();

retracement1.Hide();

retracement2.Hide();

retracement3.Hide();

retracement4.Hide();

retracement5.Hide();

retracement6.Hide();BonBon,Can you show me your chart along with the script?

#Heiken_Ashi based on Sylvan Verboort's Trading with HA Candlestick Oscillator

#Bon Bon _last update Jan 17th 2021

#Influenced by script from HoboTheClown / blt,[URL]http://www.thinkscripter.com[/URL], TD Hacolt etc.

#MTF based on HannTech's MTF_MACD script

#update 1/2/21 - changed the default moving average to TEMA. Changed the period to 35.

#update changed reversal arrows to reversal bubbles with price

### YOU MUST HAVE THE STYLE SETTING FIT STUDIES ENABLED ###

#hint: The style setting Fit Studies must be enabled to use these bars.

input period = 50;

input hideCandles = yes;

input candleSmoothing = {default Valcu, Vervoort};

input show_bubble_labels = yes;

input bubbles = yes;

input arrows = yes;

#input smoothingLength = 3;

input movingAverageType = {default TEMA, Exponential, Hull };

def openMA;

def closeMA;

def highMA;

def lowMA;

switch (movingAverageType) {

case Exponential:

openMA = CompoundValue(1, ExpAverage(open, period), open);

closeMA = CompoundValue(1, ExpAverage(close, period), close);

highMA = CompoundValue(1, ExpAverage(high, period), high);

lowMA = CompoundValue(1, ExpAverage(low, period), low);

case Hull:

openMA = CompoundValue(1, HullMovingAvg(open, period), open);

closeMA = CompoundValue(1, HullMovingAvg(close, period), close);

highMA = CompoundValue(1, HullMovingAvg(high, period), high);

lowMA = CompoundValue(1, HullMovingAvg(low, period), low);

case TEMA:

openMA = CompoundValue(1, TEMA(open, period), open);

closeMA = CompoundValue(1, TEMA(close, period), close);

highMA = CompoundValue(1, TEMA(high, period), high);

lowMA = CompoundValue(1, TEMA(low, period), low);

}

HidePricePlot(hideCandles);

def haOpen;

def haClose;

switch (candleSmoothing){

case Valcu:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

case Vervoort:

haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0 ) / 2.0), open);

haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

}

plot o = haOpen;

o.Hide();

def haLow = Min(lowMA, haOpen);

def haHigh = Max(highMA, haOpen);

#Zero Lag System - MetaStock Crossover Formula

#zero-lagging principle

#Zero-lagging TEMA average on closing prices

#Medium-term price reversals - upward trend

def avg = 34;

def TMA1 = reference TEMA(haClose, avg); # triple exponential moving average (TEMA) of 34 bars

def TMA2 = reference TEMA(TMA1, avg);

def Diff = TMA1 - TMA2;

def ZlHa = TMA1 + Diff; #Zero-lagging TEMA average on closing prices - medium term uptrend;

#Medium-term price reversals - downward trend

def TMA1_ = reference TEMA((high + low) / 2, avg);

def Diff2 = TMA1_ - TMA2;

def ZlCl = TMA1_ + Diff2; #Zero-lagging TEMA average on closing prices - medium term doenwardtrend;

def ZlDif = ZlCl - ZlHa; # Zero-Lag close - Zero-Lag HA(green candle) Uptrend when ZlDif is equal to or greater than zero

#uptrend {green candle}

def keep1 = if (haClose >= haOpen and haClose[1] >= haOpen[1]) then 1 else 0;

def keep2 = if ZlDif >= 0 then 1 else 0;

def keep3 = if (AbsValue(close - open) < ((high - low) * 0.35)) and high >= low[1] then 1 else 0;

def keeping = if (keep1 or keep2) then 1 else 0;

def keepall = if keeping or (keeping[1]) and close >= open or close >= (close[1]) then 1 else 0;

def utr = if keepall or (keepall[1]) and keep3 then 1 else 0;

#downtrend red candle

def keep1_ = if (haClose < haOpen and haClose[1] < haOpen[1]) then 1 else 0;

def keep2_ = if ZlDif < 0 then 1 else 0;

def keep3_ = if (AbsValue(close - open) < ((high - low) * 0.35)) and low <= high[1] then 1 else 0;

def keeping_ = if (keep1_ or keep2_) then 1 else 0;

def dkeepall_ = if keeping_ or (keeping_[1]) and close < open or close < (close[1]) then 1 else 0;

def dtr = if dkeepall_ or (dkeepall_[1] - 1) and keep3_ == 1 then 1 else 0; #downtrend

def upw = if dtr and (dtr[1]) and utr then 1 else 0;

def dnw = if !utr and (utr[1] ) and dtr then 1 else 0;

def results = if upw then 1 else if dnw then 0 else results[1];

#Change the color of HA and Japanese Candles - turn off to show only HA on chart

AssignPriceColor(if haClose >= haOpen

then Color.GREEN else

if haClose < haOpen

then Color.RED else Color.WHITE);

#Heiken_A script

#####################################################################################################

input charttype = ChartType.CANDLE;

def haopen_ = if haClose <= haOpen

then haOpen + 0

else Double.NaN;

def HAhi = if haClose <= haOpen

then haHigh

else Double.NaN;

def HAlo = if haClose <= haOpen

then haLow

else Double.NaN;

AddChart(growColor = Color.RED, neutralColor = Color.CURRENT, high = HAhi, low = HAlo, open = haopen_, close = haClose, type = ChartType.CANDLE);

def HAclose1 = ohlc4;

def HAopen1 = if haClose >= haOpen

then CompoundValue(1, (haOpen[1] + haClose[1]) / 2, (open[1] + close[1]) / 2)

else Double.NaN;

def haopen_1 = if haOpen <= haClose

then HAopen1 + 0 else Double.NaN;

def HAhigh1 = haHigh;

def HAlow1 = haLow;

AddChart(growColor = Color.GREEN, neutralColor = Color.CURRENT, high = HAhigh1, low = HAlow1, open = haopen_1, close = haClose, type = ChartType.CANDLE);

#####################################################################################################

#Buy and sell signals

def trend = haClose >= haOpen; #high color;

def trendup = trend and !trend[1];

def trendd = haClose < haOpen;

def trendDown = trendd and !trendd[1];

AddChartBubble(bubbles and trendup and trendup, HAlow1, ("Reversal:" + round(HAlow1, 2)), Color.GREEN, no);

AddChartBubble(bubbles and trendDown and trendDown, HAhigh1, ("Reversal:" + round(HAhigh1,2)), Color.LIGHT_RED, yes);# Backtest of BonBon Heiken_Ashi

# BonBon 1/24/2021

input period = 50;

def openMA = CompoundValue(1, Average(open, period), open);

def closeMA = CompoundValue(1, Average(close, period), close);

def highMA = CompoundValue(1, Average(high, period), high);

def lowMA = CompoundValue(1, Average(low, period), low);

def haOpen = CompoundValue(1, ( (haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1]) / 4.0 ) / 2.0), open);

def haClose = ((((openMA + highMA + lowMA + closeMA) / 4.0) + haOpen + Max(highMA, haOpen) + Min(lowMA, haOpen)) / 4.0);

def haLow = Min(lowMA, haOpen);

def haHigh = Max(highMA, haOpen);

def trend = haClose >= haOpen ;

def trendup = trend and !trend[1];

def trendd = haClose < haOpen ;

def trendDown = trendd and !trendd[1];

AddOrder(OrderType.BUY_TO_OPEN, trendup, halow, 100, color.light_green, color.light_green,"BUY");

AddOrder(OrderType.SELL_TO_CLOSE,trenddown, hahigh, 100,color.red, color.red,"SELL");def price = close;

def superfast_length = 21;

def fast_length = 50;

def slow_length = 100;

def displace = 0;

def mah = reference TEMA(haHigh, avg);

def mal = reference TEMA(haLow, avg);

def mov_avg21 = reference TEMA(price[-displace], superfast_length);

def mov_avg50 = reference TEMA(price[-displace], fast_length);

def mov_avg100 = reference TEMA(price[-displace], slow_length);

#moving averages

def Superfast = mov_avg21;

def Fast = mov_avg50;

def Slow = mov_avg100;

def stopbuy = mov_avg21 <= mov_avg50;

def buynow = !buy[1] and buy;

def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0);

def Buy_Signal = buysignal[1] == 0 and buysignal == 1;

#Alert(condition = buysignal[1] == 0 and buysignal == 1, text = "Buy Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

def Momentum_Down = buysignal[1] == 1 and buysignal == 0;

#Alert(condition = buysignal[1] == 1 and buysignal == 0, text = "Momentum_Down", sound = Sound.Bell, "alert type" = Alert.BAR);

def stopsell = mov_avg21 >= mov_avg50;

def sellnow = !sell[1] and sell;

def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0);

def Sell_Signal = sellsignal[1] == 0 and sellsignal;

#Alert(condition = sellsignal[1] == 0 and sellsignal == 1, text = "Sell Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

def Momentum_Up = sellsignal[1] == 1 and sellsignal == 0;

#Alert(condition = sellsignal[1] == 1 and sellSignal == 0, text = "Momentum_Up", sound = Sound.Bell, "alert type" = Alert.BAR);

def Colorbars = if buysignal == 1 then 1 else if sellsignal == 1 then 2 else if buysignal == 0 or sellsignal == 0 then 3 else 0;

#Colorbars.Hide();

#Colorbars.DefineColor("Buy_Signal_Bars", Color.GREEN);

#Colorbars.DefineColor("Sell_Signal_Bars", Color.RED);

#Colorbars.DefineColor("Neutral", Color.PLUM);

def HA = ZigZagHighLow("price h" = mah, "price l" = mal, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal);

rec HASave = if !IsNaN(HA) then HA else GetValue(HASave, 1);

def chg = (if HASave == mah then mah else mal) - GetValue(HASave, 1);

def isUp = chg >= 0;

def HA_L = if !IsNaN(HA) and !isUp then mal else GetValue(HA_L, 1);

def HA_H = if !IsNaN(HA) and isUp then mah else GetValue(HA_H, 1);

def dir = CompoundValue(1, if HA_L != HA_L[1] or mal == HA_L[1] and mal == HASave then 1 else if HA_H != HA_H[1] or mah == HA_H[1] and mah == HASave then -1 else dir[1], 0);

def signal = CompoundValue(1, if dir > 0 and mal > HA_L then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and mah < HA_H then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0);

def showarrows = yes;

def barnumber = BarNumber()[10];

def U1 = showarrows and signal > 0 and signal[1] <= 0;

def D1 = showarrows and signal < 0 and signal[1] >= 0;

# Plot Signals

def bull = signal > 0 and signal[1] <= 0;

#bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#bull.SetDefaultColor(Color.YELLOW);

#bull.SetLineWeight(2);

def bear = signal < 0 and signal[1] >= 0;

#bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#bear.SetDefaultColor(Color.YELLOW);

#bear.SetLineWeight(2);

#Buy Signal

AddChartBubble((barnumber and U1), if isUp then halow1 else hahigh1, if showarrows and signal > 0 and signal[1] <= 0 then "Reversal:" + round(halow1,2) else "" , if Colorbars == 3 then Color.PLUM else Color.UPTICK, no);

#Sellsignal

AddChartBubble((barnumber and D1), if isUp then halow1 else hahigh1, if showarrows and signal < 0 and signal[1] >= 0 then "Reversal:" + round(hahigh1,2) else "" , if Colorbars == 3 then Color.PLUM else Color.DOWNTICK, yes);@JoeSD I took a look at your code once again. It appears you might have your candles hidden. You must change your "hidecandles" to "no" if you want to see the candles. You have it as "yes".@BonBon Yes, I had the appearance set as you showed??? Not sure why I ONLY see the HA Smoothed and not the regular charts.???

BonBon, Yes that took care of it and thanks again. Joe@JoeSD I took a look at your code once again. It appears you might have your candles hidden. You must change your "hidecandles" to "no" if you want to see the candles. You have it as "yes".

input hidecandles = no;

You add it to the original code on the first page.i'm a wee bit perplexified. where does this code go?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.