4/29/24 update:

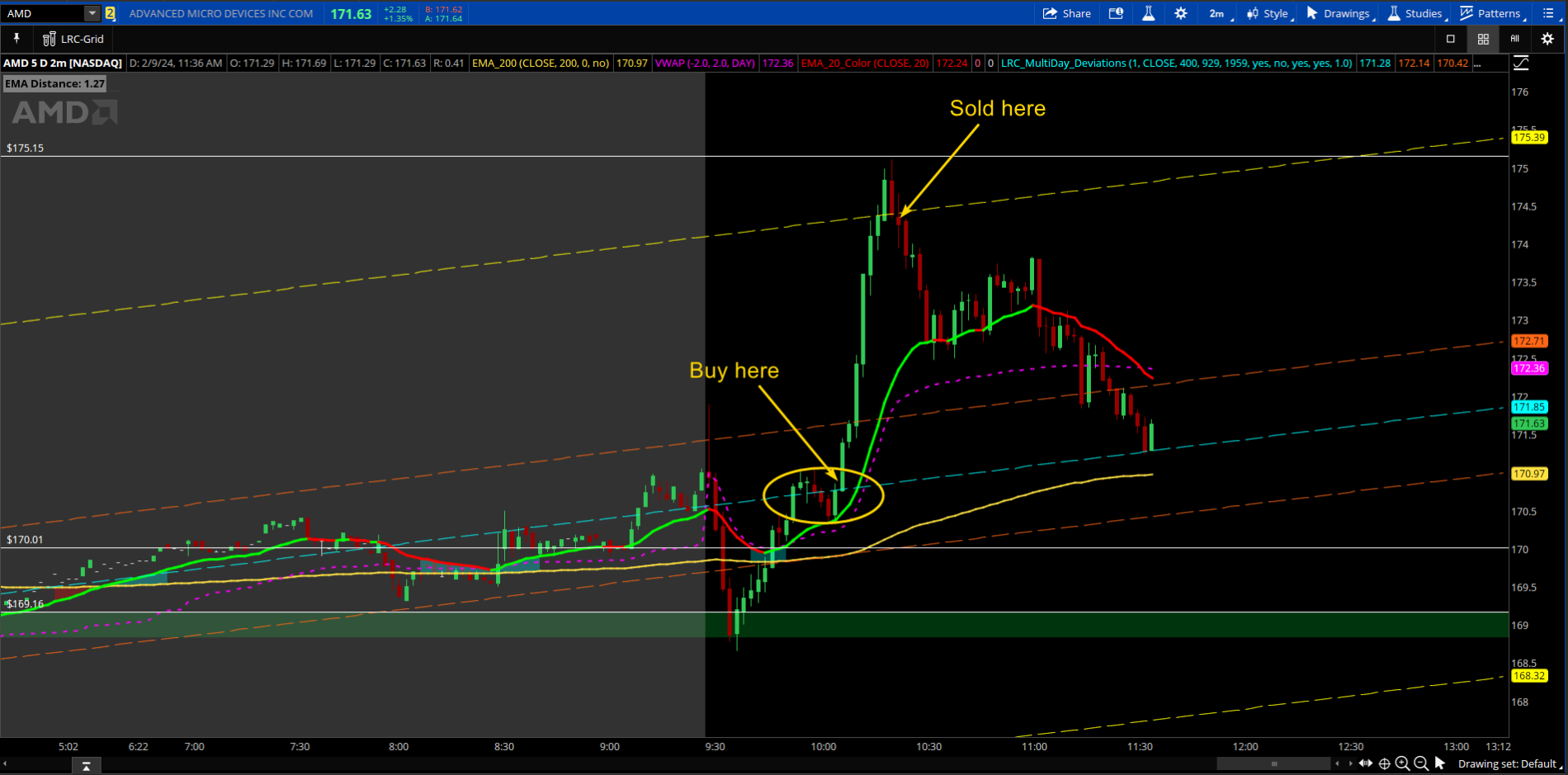

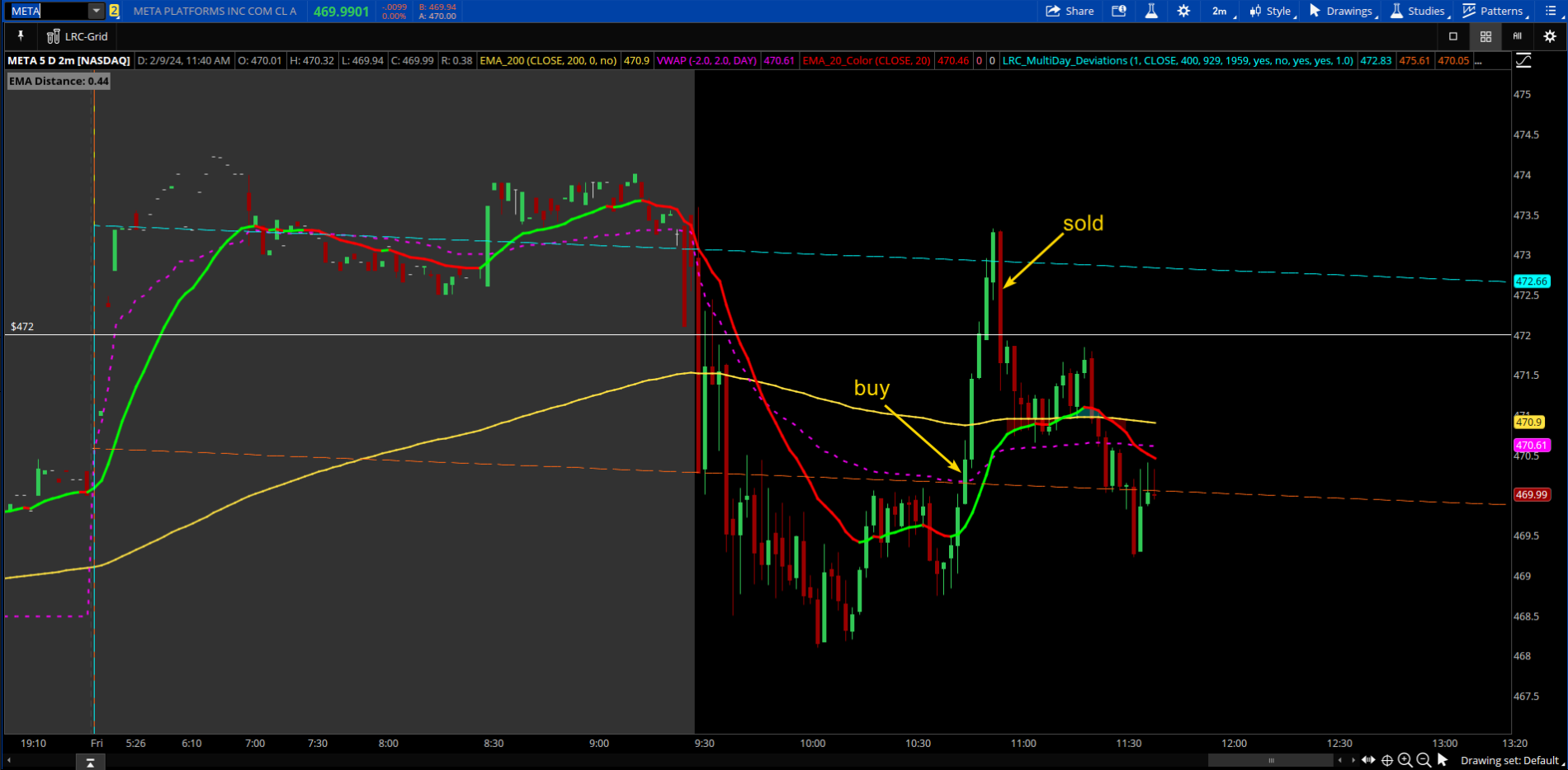

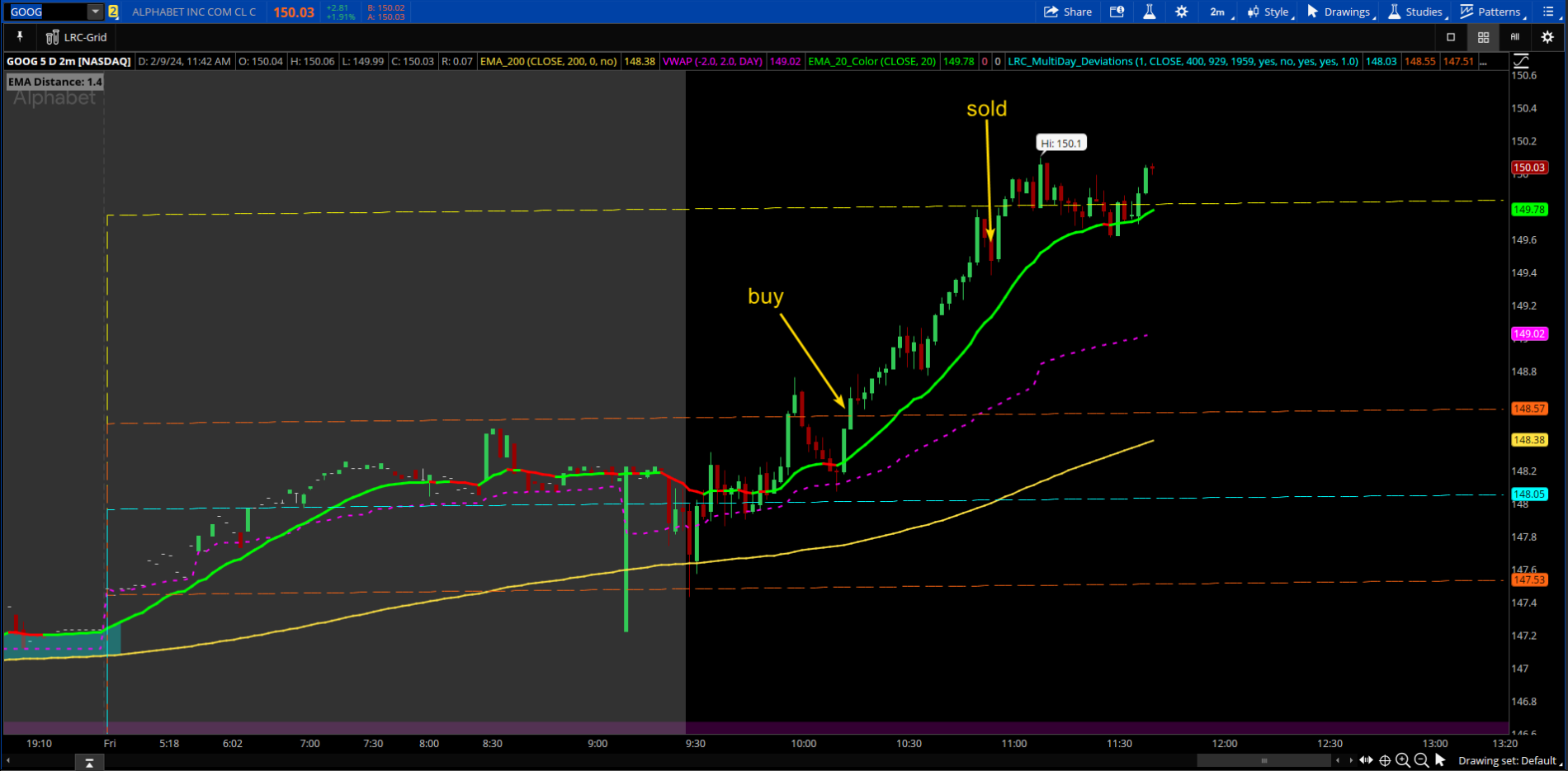

Guys, This is somewhat of a game changer for me. I have profited more in the last few days using this indicator. See chart where I bought and sold. Here is my grid if anyone is interested. http://tos.mx/!d1bHIhA6 Click here for --> Easiest way to load shared links

This chart setup uses manually drawn green dashed support and resistance lines

read more: https://usethinkscript.com/threads/...tions-in-thinkorswim.18367/page-4#post-140779

How I trade this strategy: USE the 2m TF (Expansion Bars to the right must be between 10 and 50)

1) I use my grids on separate monitors and look for possible trades to set up.

-- Look for the price to be getting close or crossing one of the LRC lines

-- (SAFE) Like for the price to be above the 200 and 20 EMAs at the time of LRC line cross for CALLS

-- (Aggressive) price to be above the 200 EMA and approaching the 20 EMA at the time of LRC line cross for CALLS. Be prepared for reversal off of the 20 EMA. Same goes if you trade from the 20 EMA into the 200 EMA. (This is riskier but can yield great trades)

--Visa Versa for PUTS!

2) Always have major support/resistance levels plotted out as these areas also determine whether I take a trade or scale out or take all profit. DO not trade into a major S/R level if #(1) above is a perfect setup. It is not worth the risk, however, if you do, be ready to take a loss and move on.

3) Pay attention to QQQ, NQ, ES, and SPY while preparing to enter your trades. For example: If NQ is under 18000 and all of the above is setting up for calls, I will not take the trade until NQ is clearly holding over the 18000 level. This is true for all major levels.

4) I scale out as I go. If price reaches a level of interest I will scale out and see if there is a rejection or a continuation through that area. This could be S/R, Pre day low/high, Pre market Low/High etc..

--I use the 20 EMA as my guide to hold runners. If price does not close above or below the 20 EMA twice, I will continue to hold. You may find this to risky. (You do You). I find that price likes to use the 20 EMA as s/r so it will close over it but then the next candle will continue the trend.

I will add more as I get more experience..

*******************************

I want to stress the importance of support/resistance levels. They take precedence over the A-LRC in that if you have a perfect LRC setup but you will be trading directly into a S/R Level, Then I do not take the trade. I will wait until the s/r level has been broken and a confirmed continuation takes place before I enter a trade.

********************************

Here are the Codes:

LRC-V.2 - This works for All and is what I use on the chart I trade with - https://tos.mx/!bRJfYOTJ

***Updated***LRC_V4 - http://tos.mx/!YoqXeGmM This version gives 6 levels. You may turn them off if you do not wish to use them.

Workspace: https://tos.mx/!niiF8VvV

mod note:

Here is a link to the video.

Here is my chart with all three LRC and the other indicators I use. https://tos.mx/O2Uwdha

Guys, This is somewhat of a game changer for me. I have profited more in the last few days using this indicator. See chart where I bought and sold. Here is my grid if anyone is interested. http://tos.mx/!d1bHIhA6 Click here for --> Easiest way to load shared links

This chart setup uses manually drawn green dashed support and resistance lines

read more: https://usethinkscript.com/threads/...tions-in-thinkorswim.18367/page-4#post-140779

How I trade this strategy: USE the 2m TF (Expansion Bars to the right must be between 10 and 50)

1) I use my grids on separate monitors and look for possible trades to set up.

-- Look for the price to be getting close or crossing one of the LRC lines

-- (SAFE) Like for the price to be above the 200 and 20 EMAs at the time of LRC line cross for CALLS

-- (Aggressive) price to be above the 200 EMA and approaching the 20 EMA at the time of LRC line cross for CALLS. Be prepared for reversal off of the 20 EMA. Same goes if you trade from the 20 EMA into the 200 EMA. (This is riskier but can yield great trades)

--Visa Versa for PUTS!

2) Always have major support/resistance levels plotted out as these areas also determine whether I take a trade or scale out or take all profit. DO not trade into a major S/R level if #(1) above is a perfect setup. It is not worth the risk, however, if you do, be ready to take a loss and move on.

3) Pay attention to QQQ, NQ, ES, and SPY while preparing to enter your trades. For example: If NQ is under 18000 and all of the above is setting up for calls, I will not take the trade until NQ is clearly holding over the 18000 level. This is true for all major levels.

4) I scale out as I go. If price reaches a level of interest I will scale out and see if there is a rejection or a continuation through that area. This could be S/R, Pre day low/high, Pre market Low/High etc..

--I use the 20 EMA as my guide to hold runners. If price does not close above or below the 20 EMA twice, I will continue to hold. You may find this to risky. (You do You). I find that price likes to use the 20 EMA as s/r so it will close over it but then the next candle will continue the trend.

I will add more as I get more experience..

*******************************

I want to stress the importance of support/resistance levels. They take precedence over the A-LRC in that if you have a perfect LRC setup but you will be trading directly into a S/R Level, Then I do not take the trade. I will wait until the s/r level has been broken and a confirmed continuation takes place before I enter a trade.

********************************

Here are the Codes:

LRC-V.2 - This works for All and is what I use on the chart I trade with - https://tos.mx/!bRJfYOTJ

***Updated***LRC_V4 - http://tos.mx/!YoqXeGmM This version gives 6 levels. You may turn them off if you do not wish to use them.

Workspace: https://tos.mx/!niiF8VvV

mod note:

unfortunately, many members will not have shared links enabled until after the May 13 integration

Here is a link to the video.

Last edited: