I am wondering if anyone has a similar indicator of this by Shadow Trader? Its a weighted version of the Advance/Decline

https://www.shadowtrader.net/weighted-ad-line-thinkscript/

https://www.shadowtrader.net/weighted-ad-line-thinkscript/

# # Sources:

# best with 5 mins timeframe.

# concept from shadowtrader.net

# coded by TWOO

# https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

# sector-breakdown

declare lower;

input open_time = 930;

input xlpwt = 6.2; #ConsumerStaples

input xluwt = 2.6; #Utilities

input xlcwt = 9.6; #Communications

input xlfwt = 11.5; #Financials

input xlbwt = 2.6; #Materials

input xliwt = 8.0; #Industrials

input xlewt = 3.7; #Energy

input xlrewt = 2.6; #RealEstate

input xlvwt = 13.3; #HealthCare

input xlkwt = 28.1; #InformationTechnology

input xlywt = 11.8; #ConsumerDiscretionary

def SectorCount = 11;

def Scale = 5000;

#SP500 ETF sectors percent change

script PC {

input Symbol = "SPX";

def isFirstBar = GetTime() == RegularTradingStart(GetYYYYMMDD()) + 1;

def O = if isFirstBar then close(Symbol) else O[1];

def C = close(Symbol);

plot PctChg = (C - O) / O;

}

def xlkPctChg = PC("XLK");

def xlyPctChg = PC("XLY");

def xlvPctChg = PC("XLV");

def xlfPctChg = PC("XLF");

def xlcPctChg = PC("XLC");

def xliPctChg = PC("XLI");

def xlpPctChg = PC("XLP");

def xlrePctChg = PC("XLRE");

def xlePctChg = PC("XLE");

def xlbPctChg = PC("XLB");

def xluPctChg = PC("XLU");

def xlkSizing = xlkPctChg * xlkwt;

def xlvSizing = xlvPctChg * xlvwt;

def xlySizing = xlyPctChg * xlywt;

def xlfSizing = xlfPctChg * xlfwt;

def xlcSizing = xlcPctChg * xlcwt;

def xliSizing = xliPctChg * xliwt;

def xlpSizing = xlpPctChg * xlpwt;

def xleSizing = xlePctChg * xlewt;

def xlreSizing = xlrePctChg * xlrewt;

def xlbSizing = xlbPctChg * xlbwt;

def xluSizing = xluPctChg * xluwt;

def combinedSizing = Scale * (

xlkSizing +

xlvSizing +

xlySizing +

xlfSizing +

xlcSizing +

xliSizing +

xlpSizing +

xleSizing +

xlreSizing +

xlbSizing +

xluSizing

) / SectorCount;

# Weighted_AD

plot Weighted_AD = if !IsNaN(combinedSizing) then combinedSizing else Double.NaN;

Weighted_AD.DefineColor("Lower", Color.YELLOW);

Weighted_AD.DefineColor("Higher", Color.MAGENTA);

Weighted_AD.AssignValueColor(if Weighted_AD < Weighted_AD[1] then Weighted_AD.Color("Lower") else Weighted_AD.Color("Higher"));

Weighted_AD.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

#Zeroline

plot zero = 0;

zero.SetDefaultColor(Color.GRAY);

zero.HideBubble();

zero.HideTitle();

# SPX Non_Weighted_AD

def spxcombinedSizing = Scale *

(xlkPctChg +

xlvPctChg +

xlyPctChg +

xlfPctChg +

xlcPctChg +

xliPctChg +

xlpPctChg +

xlePctChg +

xlrePctChg +

xlbPctChg +

xluPctChg);

plot Non_Weighted_AD = spxcombinedSizing ;

Non_Weighted_AD.SetDefaultColor(Color.WHITE);

Non_Weighted_AD.SetPaintingStrategy(PaintingStrategy.LINE);

# NDX Non_Weighted_AD

def NDXPctChg = PC("NDX") * 35000;

plot Non_Weighted_NDX = NDXPctChg ;

Non_Weighted_NDX.SetDefaultColor(Color.CYAN);

Non_Weighted_NDX.SetLineWeight(1);

Non_Weighted_NDX.Hide();

Non_Weighted_NDX.HideBubble();

Non_Weighted_NDX.HideTitle();

AddVerticalLine(( GetDay() <> GetDay()[1]), "", Color.YeLLOW, Curve.SHORT_DASH);

#SP500 ETF sectors BUBBLE

Script pct {

input Symbol = "SPX";

def aggregationPeriod = AggregationPeriod.DAY;

def price = open(Symbol, period = aggregationPeriod);

def diff = close (Symbol) - open(Symbol, period = aggregationPeriod);

plot d_pct = 100 * diff / price;

}

def XLK_d_pct = pct(“XLK”) ;

def XLV_d_pct = pct(“XLV”) ;

def XLY_d_pct = pct(“XLY”) ;

def XLC_d_pct = pct(“XLC”) ;

def XLF_d_pct = pct(“XLF”) ;

def XLI_d_pct = pct(“XLI”) ;

def XLP_d_pct = pct(“XLP”) ;

def XLRE_d_pct = pct(“XLRE”) ;

def XLB_d_pct = pct(“XLB”) ;

def XLU_d_pct = pct(“XLU”) ;

def XLE_d_pct = pct(“XLE”) ;

AddLabel(yes, "InfoTech 29.2%: " + XLK_d_pct, (if xlk_d_pct > 0 then Color.GREEN else if xlk_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Healthcare 13.3%: " + XLV_d_pct, (if xlv_d_pct > 0 then Color.GREEN else if xlv_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "ConsDisc 12.5%: " + XLY_d_pct, (if xly_d_pct > 0 then Color.GREEN else if xly_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Comms 10.2%: " + XLC_d_pct, (if xlc_d_pct > 0 then Color.GREEN else if xlc_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Financials 10.7%: " + XLF_d_pct, (if xlf_d_pct > 0 then Color.GREEN else if xlf_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Industrials 7.8%: " + XLI_d_pct,(if xli_d_pct > 0 then Color.GREEN else if xli_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "ConsStaples 5.9%: " + XLP_d_pct, (if xlp_d_pct > 0 then Color.GREEN else if xlp_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "RealEstate 2.8%: " + XLRE_d_pct,(if xlre_d_pct > 0 then Color.GREEN else if xlre_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Materials 2.6%: " + XLB_d_pct, (if xlb_d_pct > 0 then Color.GREEN else if xlb_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Utilities 2.5%: " + XLU_d_pct, (if xlu_d_pct > 0 then Color.GREEN else if xlu_d_pct < 0 then color.RED else Color.gray));

AddLabel(yes, "Energy 2.7%: " + XLE_d_pct,(if xle_d_pct > 0 then Color.GREEN else if xle_d_pct < 0 then color.RED else Color.gray));plot Data = closeThey use these 11 sectors of S&P with the weight values from this: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#dataLooking for the same thing. I'm both impressed, and confused, as to how they were able to specify the ADSPD for particular sectors, instead of the broader market. Any tips or clues would be appreciated.

Are there advanced/decline symbols for these ETFs?They use these 11 sectors of S&P with the weight values from this: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

SECTOR

INDEX WEIGHT

Information Technology XLK

29.2%

Health Care XLY

13.3%

Consumer Discretionary XLV

12.5%

Financials XLF

10.7%

Communication Services XLC

10.2%

Industrials XLI

7.8%

Consumer Staples XLP

5.9%

Real Estate XLRE

2.8%

Energy XLRE

2.7%

Materials XLB

2.6%

Utilities XLU

2.5%

https://usethinkscript.com/threads/can-we-access-advance-decline-for-sp500-sectors.9331/Are there advanced/decline symbols for these ETFs?

It could be using the ETFs, or it could be using the Sector Indexes ( XLF versus $SP500#40 ).

It may be using the change from the Open, or the change from the Prior Close.

And, It may be using a different weighting table than me. His info-tech is 27.9, but I used 29.2 from this weighting table, for example.

However, I've more or less deciphered it. I am decently certain that this is nonsense, and that it doesn't even use advance decline at all. It certainly does not use advance decline of individual sectors, that's for sure. Its based on the percentage change in the indexes -- basic average, and by weighting percentage.

It could be using the ETFs, or it could be using the Sector Indexes ( XLF versus $SP500#40 ).

It may be using the change from the Open, or the change from the Prior Close.

And, It may be using a different weighting table than me. His info-tech is 27.9, but I used 29.2 from this weighting table, for example.

However, I've more or less deciphered it. I am decently certain that this is nonsense, and that it doesn't even use advance decline at all. It certainly does not use advance decline of individual sectors, that's for sure. Its based on the percentage change in the indexes -- basic average, and by weighting percentage.

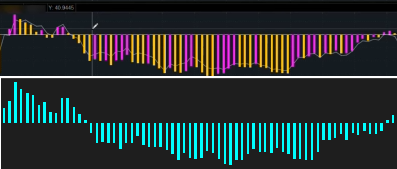

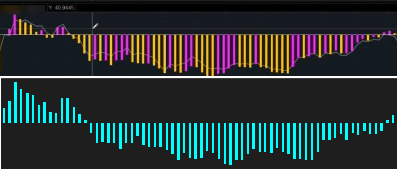

They use the open to start the calculation. The line is for the 11 unweighted sectors and the histogram is for the weighted sectors.This is what I have so far. Not a bad start, but there are some issues I need to resolve.

https://tos.mx/id4OV5H

# # Sources:

# https://siblisresearch.com/data/us-sector-weightings/

# https://seekingalpha.com/etfs-and-funds/etf-tables/sectors

# debug

def transpose = .05;

def SectorCount = 11;

def NewDay = secondsFromTime(0930) < secondsFromTime(0930)[1];

def InformationTechnology = 27.63; #XLK

def HealthCare = 13.25; #XLV

def ConsumerDiscretionary = 12.36; #XLY

def Financials = 11.39; #XLF

def Communications = 11.29; #XLC

def Industrials = 8.04; #XLI

def ConsumerStaples = 5.77; #XLP

def Energy = 2.75; #XLE

def RealEstate = 2.58; #XLRE

def Materials = 2.48; #XLB

def Utilities = 2.46; #XLU

def xlkWeight = InformationTechnology;

def xlvWeight = HealthCare;

def xlyWeight = ConsumerDiscretionary;

def xlfWeight = Financials;

def xlcWeight = Communications;

def xliWeight = Industrials;

def xlpWeight = ConsumerStaples;

def xleWeight = Energy;

def xlreWeight = RealEstate;

def xlbWeight = Materials;

def xluWeight = Utilities;

def xlk = close("XLK");

def xlv = close("XLV");

def xly = close("XLY");

def xlf = close("XLF");

def xlc = close("XLC");

def xli = close("XLI");

def xlp = close("XLP");

def xle = close("XLE");

def xlre = close("XLRE");

def xlb = close("XLB");

def xlu = close("XLU");

def xlkChangePercent = (xlk - xlk[1]) / xlk[1];

def xlvChangePercent = (xlv - xlv[1]) / xlv[1];

def xlyChangePercent = (xly - xly[1]) / xly[1];

def xlfChangePercent = (xlf - xlf[1]) / xlf[1];

def xlcChangePercent = (xlc - xlc[1]) / xlc[1];

def xliChangePercent = (xli - xli[1]) / xli[1];

def xlpChangePercent = (xlp - xlp[1]) / xlp[1];

def xleChangePercent = (xle - xle[1]) / xle[1];

def xlreChangePercent = (xlre - xlre[1]) / xlre[1];

def xlbChangePercent = (xlb - xlb[1]) / xlb[1];

def xluChangePercent = (xlu - xlu[1]) / xlu[1];

def xlkSizing = xlkChangePercent * xlkWeight;

def xlvSizing = xlvChangePercent * xlvWeight;

def xlySizing = xlyChangePercent * xlyWeight;

def xlfSizing = xlfChangePercent * xlfWeight;

def xlcSizing = xlcChangePercent * xlcWeight;

def xliSizing = xliChangePercent * xliWeight;

def xlpSizing = xlpChangePercent * xlpWeight;

def xleSizing = xleChangePercent * xleWeight;

def xlreSizing = xlreChangePercent * xlreWeight;

def xlbSizing = xlbChangePercent * xlbWeight;

def xluSizing = xluChangePercent * xluWeight;

def combinedSizing = ((

xlkSizing +

xlvSizing +

xlySizing +

xlfSizing +

xlcSizing +

xliSizing +

xlpSizing +

xleSizing +

xlreSizing +

xlbSizing +

xluSizing

) / SectorCount);

def cumuCombinedSizing = if newday then combinedSizing else cumuCombinedSizing[1] + combinedSizing;

# Display

AddLabel(yes, "InfoTech " + AsPercent(xlkSizing), if xlkSizing > 0 then color.GREEN else color.RED);

plot zeroLine = 0;

zeroLine.AssignValueColor(color.WHITE);

plot cumuSectorWeightAD = cumuCombinedSizing + transpose;

cumuSectorWeightAD.AssignValueColor(if cumuSectorWeightAD > cumuSectorWeightAD[1] then color.MAGENTA else color.YELLOW);

cumuSectorWeightAD.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

They use the change from the open. Their Info-tech weight is 29.3, pretty much the same as yours. They use the ETFs as I indicated in my first reply.

It could be using the ETFs, or it could be using the Sector Indexes ( XLF versus $SP500#40 ).

It may be using the change from the Open, or the change from the Prior Close.

And, It may be using a different weighting table than me. His info-tech is 27.9, but I used 29.2 from this weighting table, for example.

However, I've more or less deciphered it. I am decently certain that this is nonsense, and that it doesn't even use advance decline at all. It certainly does not use advance decline of individual sectors, that's for sure. Its based on the percentage change in the indexes -- basic average, and by weighting percentage.

If its not much to ask for, could it still be possible for you to share this script here or something similar? Thanks in advanceIts the percentage change, from the close of the first bar, of all the sectors, multiplied by weight, added together, and brought to scale. Which is totally pointless, because SPX is already weighted properly to begin with; the percentage change of SPX itself already accomplishes this perfectly. This is just a bad measurement of the percent change in SPX with a bunch of ridiculous extra steps. To cap it off, all the final values are multiplied by five for no reason.

Here it is with SPX's percentage change from the close of its first bar (yellow):

Here is the closing price of the first bar of SPY (blue dash) :

The indicator will just cross the zero line when ever SPX (spy in this image) crosses above or below the close of its first bar...

declare lower;

def S5CONDD = close(symbol = "S5CONDD"); # CONSUMER DISCRETIONARY

def S5CONSD = close(symbol = "S5CONSD"); # CONSUMER STAPLES

def S5HLTHD = close(symbol = "S5HLTHD"); # HEALTH CARE

def S5INDUD = close(symbol = "S5INDUD"); # INDUSTRIALS

def S5INFTD = close(symbol = "S5INFTD"); # INFORMATION TECHNOLOGY

def S5MATRD = close(symbol = "S5MATRD"); # MATERIALS

def S5REASD = close(symbol = "S5REASD"); # REAL ESTATE

def S5TELSD = close(symbol = "S5TELSD"); # COMMUNICATION SERVICES

def S5UTILD = close(symbol = "S5UTILD"); # UTILITIES

def SPFD = close(symbol = "SPFD"); # FINANCIALS

def SPND = close(symbol = "SPND"); # ENERGY

def S5CONDD_Weight = 1.0;

def S5CONSD_Weight = 1.0;

def S5HLTHD_Weight = 1.0;

def S5INDUD_Weight = 1.0;

def S5INFTD_Weight = 1.0;

def S5MATRD_Weight = 1.0;

def S5REASD_Weight = 1.0;

def S5TELSD_Weight = 1.0;

def S5UTILD_Weight = 1.0;

def SPFD_Weight = 1.0;

def SPND_Weight = 1.0;

AddLabel(yes, "S5CONDD " + S5CONDD, color.black);

AddLabel(yes, "S5CONSD " + S5CONSD, color.black);

AddLabel(yes, "S5HLTHD " + S5HLTHD, color.black);

AddLabel(yes, "S5INDUD " + S5INDUD, color.black);

AddLabel(yes, "S5INFTD " + S5INFTD, color.black);

AddLabel(yes, "S5MATRD " + S5MATRD, color.black);

AddLabel(yes, "S5REASD " + S5REASD, color.black);

AddLabel(yes, "S5TELSD " + S5TELSD, color.black);

AddLabel(yes, "S5UTILD " + S5UTILD, color.black);

AddLabel(yes, "SPFD " + SPFD, color.black);

AddLabel(yes, "SPND " + SPND, color.black);

plot weighted_total = (S5CONDD * S5CONDD_weight) + (S5CONSD * S5CONSD_weight) + (S5HLTHD * S5HLTHD_weight) + (S5INDUD * S5INDUD_weight) + (S5INFTD * S5INFTD_weight) + (S5MATRD * S5MATRD_weight) + (S5REASD * S5REASD_weight) + (S5TELSD * S5TELSD_weight) + (S5UTILD * S5UTILD_weight) + (SPFD * SPFD_weight) + (SPND * SPND_weight);

plot unweighted_total = (S5CONDD + S5CONSD + S5HLTHD + S5INDUD + S5INFTD + S5MATRD + S5REASD + S5TELSD + S5UTILD + SPFD + SPND) / 11;Is this supposed work ?nothing's showing upIt could be done (since they have at that site and want $95 for their work).

I don't know what the sector tickers are through ThinkOrSwim, and I stole these from the trading view website, and I don't know the weightings, but it might go something like this:

Code:declare lower; def S5CONDD = close(symbol = "S5CONDD"); # CONSUMER DISCRETIONARY def S5CONSD = close(symbol = "S5CONSD"); # CONSUMER STAPLES def S5HLTHD = close(symbol = "S5HLTHD"); # HEALTH CARE def S5INDUD = close(symbol = "S5INDUD"); # INDUSTRIALS def S5INFTD = close(symbol = "S5INFTD"); # INFORMATION TECHNOLOGY def S5MATRD = close(symbol = "S5MATRD"); # MATERIALS def S5REASD = close(symbol = "S5REASD"); # REAL ESTATE def S5TELSD = close(symbol = "S5TELSD"); # COMMUNICATION SERVICES def S5UTILD = close(symbol = "S5UTILD"); # UTILITIES def SPFD = close(symbol = "SPFD"); # FINANCIALS def SPND = close(symbol = "SPND"); # ENERGYdef S5CONDD = close(symbol = "S5CONDD"); # CONSUMER DISCRETIONARY def S5CONDD_Weight = 1.0; def S5CONSD_Weight = 1.0; def S5HLTHD_Weight = 1.0; def S5INDUD_Weight = 1.0; def S5INFTD_Weight = 1.0; def S5MATRD_Weight = 1.0; def S5REASD_Weight = 1.0; def S5TELSD_Weight = 1.0; def S5UTILD_Weight = 1.0; def SPFD_Weight = 1.0; def SPND_Weight = 1.0; AddLabel(yes, "S5CONDD " + S5CONDD, color.black); AddLabel(yes, "S5CONSD " + S5CONSD, color.black); AddLabel(yes, "S5HLTHD " + S5HLTHD, color.black); AddLabel(yes, "S5INDUD " + S5INDUD, color.black); AddLabel(yes, "S5INFTD " + S5INFTD, color.black); AddLabel(yes, "S5MATRD " + S5MATRD, color.black); AddLabel(yes, "S5REASD " + S5REASD, color.black); AddLabel(yes, "S5TELSD " + S5TELSD, color.black); AddLabel(yes, "S5UTILD " + S5UTILD, color.black); AddLabel(yes, "SPFD " + SPFD, color.black); AddLabel(yes, "SPND " + SPND, color.black); plot sumTotal = (S5CONDD * S5CONDD_weight) + (S5CONSD * S5CONSD_weight) + (S5HLTHD * S5HLTHD_weight) + (S5INDUD * S5INDUD_weight) + (S5INFTD * S5INFTD_weight) + (S5MATRD * S5MATRD_weight) + (S5REASD * S5REASD_weight) + (S5TELSD * S5TELSD_weight) + (S5UTILD * S5UTILD_weight) + (SPFD * SPFD_weight) + (SPND * SPND_weight);

-mashume

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

VWOP: Volume Weighted & Oscillated Price for ThinkOrSwim | Indicators | 13 | |

|

|

Time Weighted Average Price (TWAP) Indicator for ThinkorSwim | Indicators | 35 | |

| V | Volume Weighted Moving Average (VWMA) for ThinkorSwim | Indicators | 18 | |

|

|

Advance/Decline Line Indicator for ThinkorSwim | Indicators | 33 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.