estimate 1 minute volume levels, based on the same time on past days.

display a purple volume bar, after the last bar, that represents a target value, for the current 1 minute volume bar.

this looks back at volume bars, of the same time, over multiple days(the quantity on the chart), and finds an average, to determine a target.

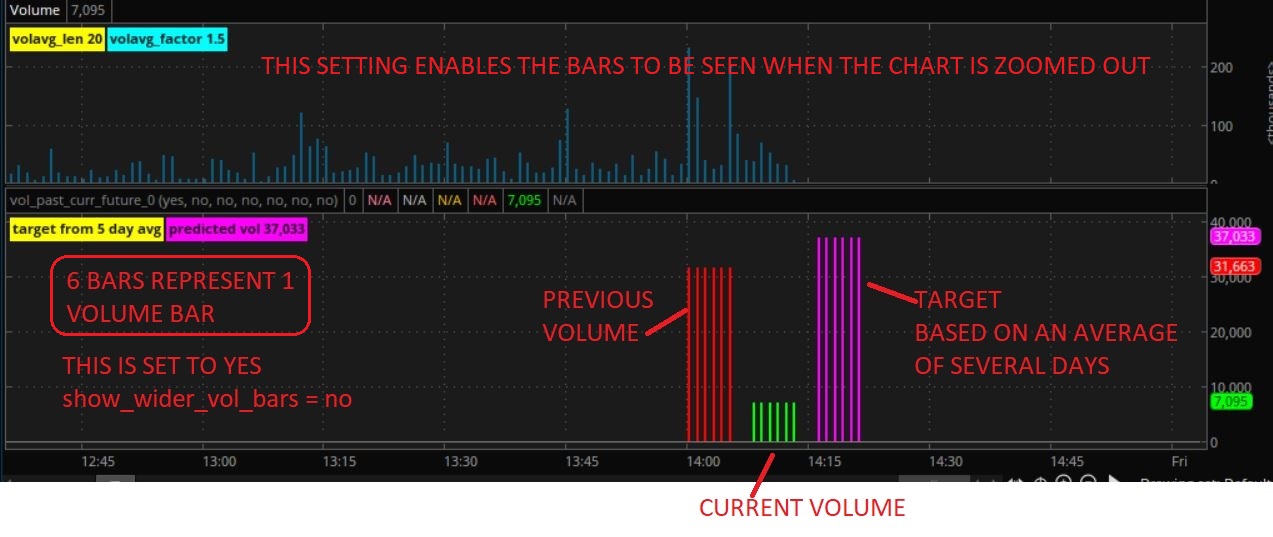

it shows the previous and the current volume bars.

set the chart to 1 minute.

this is a lower study. the volume bar chart doesn't need to be on.

the previous and current volume bars are color coded depending on the price candle.

. if an up bar then green.

. if a down bar then red.

i'm a visual guy. i don't like to squint. i like to make things that are easy to see. this is why i made a wider bar option.

2 output options, determined by this input , show_wider_vol_bars

. = no , 3 normal sized bars.

. = yes , 6 bars are used to represent each of the 3 bars. making it easier to see when zoomed out.

3 labels, quantity of days used in average, current volume, target volume.

notes:

I used a chart of 1m 5days. it is set up with constants to work on a 1 minute chart.

as the current volume bar rises, it will affect the average, which affects the target level.

it uses an offset of 390 to look back 1 day at the same time. 390 min in a day. extended hours need to be off.

if a day has missing bars from a halt or no volume, the average and target will be off.

(i started out wanting to use clouds, but ran into rec errors. so i just used histograms. ..why some vars start with cld_)

i made it from this request

https://usethinkscript.com/threads/...ustom-coding-graveyard.8162/page-2#post-75650

post 32 @BLL

normal bars

show_wider_vol_bar = yes

uses 6 bars to represent each bar. easier to see when zoomed out

display a purple volume bar, after the last bar, that represents a target value, for the current 1 minute volume bar.

this looks back at volume bars, of the same time, over multiple days(the quantity on the chart), and finds an average, to determine a target.

it shows the previous and the current volume bars.

set the chart to 1 minute.

this is a lower study. the volume bar chart doesn't need to be on.

the previous and current volume bars are color coded depending on the price candle.

. if an up bar then green.

. if a down bar then red.

i'm a visual guy. i don't like to squint. i like to make things that are easy to see. this is why i made a wider bar option.

2 output options, determined by this input , show_wider_vol_bars

. = no , 3 normal sized bars.

. = yes , 6 bars are used to represent each of the 3 bars. making it easier to see when zoomed out.

3 labels, quantity of days used in average, current volume, target volume.

notes:

I used a chart of 1m 5days. it is set up with constants to work on a 1 minute chart.

as the current volume bar rises, it will affect the average, which affects the target level.

it uses an offset of 390 to look back 1 day at the same time. 390 min in a day. extended hours need to be off.

if a day has missing bars from a halt or no volume, the average and target will be off.

(i started out wanting to use clouds, but ran into rec errors. so i just used histograms. ..why some vars start with cld_)

i made it from this request

https://usethinkscript.com/threads/...ustom-coding-graveyard.8162/page-2#post-75650

post 32 @BLL

Ruby:

# vol_past_curr_future_0e

#-----------------

# halcyonguy

# 22-03-03

# volume estimator

#-----------------

# notes:

# use a chart of 1m 5days.

# this looks back at vol bars of the same time, over multiple days, and finds an avg, to determine a target.

# as current vol bar rises, it will affect the future bar target level

# and depending on how many days are used in the average

# uses offset of 390. 390 min in a day. ext hours need to be off

# -------------------------------------------------------------

declare lower;

def na = double.nan;

def bn = barnumber();

def v = volume;

def lastbar = !isnan(close[0]) and isnan(close[-1]);

# time enable for previous bar and lastbar

def x = if ( lastbar[-1] or lastbar[0] ) then 1 else 0;

plot z = 0;

z.assignValueColor( color.gray);

# calc day #

def d = getday();

def newday = d[1] <> d;

def daycnt = if bn == 1 then 1 else if newday then daycnt[1] + 1 else daycnt[1];

# look at several past days , at bars at the same time, as the current bar,

# read v[390] and add it to current bar

# and avg them, and compare to current vol

def off = 390;

def vbarsum = if daycnt == 1 then v else vbarsum[off] + v;

def vavg = floor(vbarsum/daycnt);

input show_wider_vol_bars = no;

addlabel(1, "target volume from " + daycnt + " day avg", color.yellow);

addlabel(1, "current volume " + v, color.cyan);

# prev and current

plot Vol1 = if !show_wider_vol_bars and x then volume else na;

Vol1.setPaintingStrategy(paintingStrategy.HISTOGRAM);

Vol1.assignValueColor(if close > open then color.GREEN else if close < open then color.RED else color.LIGHT_GRAY);

# future

plot Vol2 = if !show_wider_vol_bars and lastbar[1] then vavg[1] else na;

Vol2.setPaintingStrategy(paintingStrategy.HISTOGRAM);

Vol2.assignValueColor( color.magenta);

def predictedv = if lastbar[0] then vavg[0] else predictedv[1];

addlabel(1, "predicted vol " + predictedv , color.magenta);

# -------------------------------------------------------------

# ---- wider bars ---------------------------

# prev ------------------------------------------

# the group of 6 bars starts 13 bars before last bar, [-13]

def cld_p = if ( lastbar[-13] or lastbar[-12] or lastbar[-11] or lastbar[-10] or lastbar[-9] or lastbar[-8] ) then 1 else 0;

def cld_p_top = if lastbar[-13] then v[-12] else if cld_p then cld_p_top[1] else na;

def cld_p_dir = if lastbar[-13] and close[-12] > open[-12] then 1

else if lastbar[-13] and close[-12] < open[-12] then -1

else if lastbar[-13] then 0

else na;

def cld_p_dir2 = if cld_p == 0 then na

else if lastbar[-13] then cld_p_dir

else cld_p_dir2[1];

plot Vol_p = if show_wider_vol_bars and cld_p then cld_p_top else na;

Vol_p.setPaintingStrategy(paintingStrategy.HISTOGRAM);

Vol_p.assignValueColor(if cld_p_dir2 == 1 then color.GREEN else if cld_p_dir2 == -1 then color.RED else color.LIGHT_GRAY);

# current ----------------------------------------

# the group of 6 bars starts 5 bars before last bar, [-5]

# the right bar of the 6 bars, aligns with the lastbar

def cld_c = if ( lastbar[0] or lastbar[-1] or lastbar[-2] or lastbar[-3] or lastbar[-4] or lastbar[-5] ) then 1 else 0;

input testc1 = no;

addchartbubble(testc1 and cld_c, 0, "-", color.cyan, no);

def cld_c_top = if lastbar[-5] then v[-5] else if cld_c then cld_c_top[1] else na;

def cld_c_dir = if lastbar[-5] and close[-5] > open[-5] then 1

else if lastbar[-5] and close[-5] < open[-5] then -1

else if lastbar[-5] then 0

else na;

def cld_c_dir2 = if cld_c == 0 then na

else if lastbar[-5] then cld_c_dir

else cld_c_dir2[1];

plot Vol_c = if show_wider_vol_bars and cld_c then cld_c_top else na;

Vol_c.setPaintingStrategy(paintingStrategy.HISTOGRAM);

#Vol_c.assignValueColor(if cld_c_dir == 1 then color.GREEN else if cld_c_dir == -1 then color.RED else color.LIGHT_GRAY);

Vol_c.assignValueColor(if cld_c_dir2 == 1 then color.GREEN else if cld_c_dir2 == -1 then color.RED else color.LIGHT_GRAY);

# future------------------------------------------

# the group of 6 bars starts 3 bars after last bar, [3]

def cld_f = if ( lastbar[3] or lastbar[4] or lastbar[5] or lastbar[6] or lastbar[7] or lastbar[8] ) then 1 else 0;

def cld_f_top = if lastbar[3] then vavg[3] else if cld_f then cld_f_top[1] else na;

plot Vol_f = if show_wider_vol_bars and cld_f then cld_f_top else na;

Vol_f.setPaintingStrategy(paintingStrategy.HISTOGRAM);

Vol_f.assignValueColor( color.magenta);

#normal bars

show_wider_vol_bar = yes

uses 6 bars to represent each bar. easier to see when zoomed out