Wiinii

Member

UPDATED 1/28/23

VPA (Volume Price Analysis) taught by Anna Couling (A Complete Guide To Volume Price Analysis) and Thor Young (A Complete Day Trading System). This shows low/high volume candles/bars, but more importantly, candle anomalies/divergence (irregular bodies) often signifying a trend reversal or the direction the market makers want the stock to go.

Indicates:

Short_Candle_X = Candle % Shorter than average.

X_VolAvg = % higher or lower volume than average.

Volume_Candles_Average = Number of candles it's averaging anomalous candle size and volume to.

IMPORTANT NOTES How to trade these:

Shared Link: http://tos.mx/0XSGjXM (or use code below). Click here for --> Easiest way to load shared links

TROUBLESHOOTING:

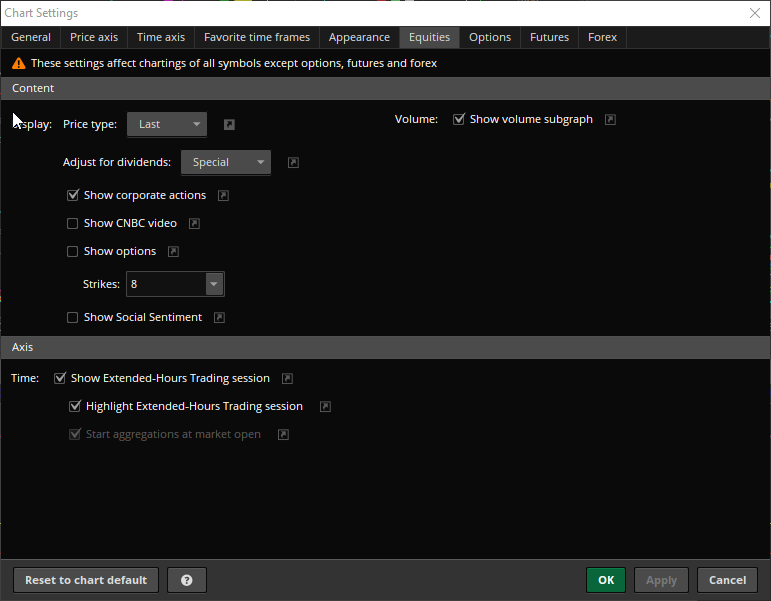

1. Above your chart click the Gear icon and check 'Show volume subgraph' like so:

2. General > Layout > Show price subgraph (need to check this option)

3. Appearance > Volume bars > Color as symbol ticks (need to check this option)

VPA (Volume Price Analysis) taught by Anna Couling (A Complete Guide To Volume Price Analysis) and Thor Young (A Complete Day Trading System). This shows low/high volume candles/bars, but more importantly, candle anomalies/divergence (irregular bodies) often signifying a trend reversal or the direction the market makers want the stock to go.

Indicates:

- Candles with high volume (bright green/red)

- Candles with low volume (dark green/red)

- Average volume (standard green/red)

- Detects candle anomaly: short candle and/or candle body but with high volume (Cyan/Magenta)

- Detects candle anomaly: tall candle and/or candle body but with low volume very light green/red (nearly white)

- I've added an RSI option for the short anomaly candles/bodies as well to help reduce the noise

Short_Candle_X = Candle % Shorter than average.

X_VolAvg = % higher or lower volume than average.

Volume_Candles_Average = Number of candles it's averaging anomalous candle size and volume to.

IMPORTANT NOTES How to trade these:

- Specifically, on the magenta/cyan anomaly candles ('magic candles' as my friends affectionally call them), you only trade them if the price reverses off of them (usually on the next candle).

- However, the next candle nearly always retests first, on all timeframes (you will see it do it to the 1min candles first, then again on the 5min, and so-on), so again see note 1 above.

- When you see one of these that seems to be in the middle of nowhere, you are most likely missing something! There's nearly always support/resistance there, be it daily or intraday price level, trendline, premarket high/low, previous day high/low/close, something! So if you don't see why, learn why and start looking for whatever that is in the future.

- I believe that these magic candles are actually someone taking profit, not buying or selling, which stalls the price and can signal for the bears/bulls to pounce, and this causes a reversal. So think about it, when the bulls start to take profit they sell, this causes other bulls to take profit and sell, and the bears see that and pounce and start shorting along with them - reversal!

Large buyers and sellers I believe are tall high volume and fast moving red and green candles. Otherwise large buyers and sellers enter trades when you see the L2 spinning but the price not moving, and likely over time rather than all at once. - Stocks often reverse on the low-volume tall anomaly candles instead, this means the market makers wanted to turn the price, so they just grab it and do it fast on low volume. But watch out! This sometimes means the MMs are about to purposely fake a bunch of people out, for example moving quickly through all of the MAs which makes people get in, only to drop it right back the other direction again. This gives them the momentum then need to break a level. Remember, the market moves on market orders (not limit orders), the best way to get market orders is by faking people out and using their stops as momentum.

- Lastly, if you see a reversal candle and it works in your favor, and you're very extended from the open so you might have caught a full reversal (perhaps near cam levels 3 and 4) - and then (I'm going to use a reversal from way up high, so you're going short - but this works the other way too) suddenly the price goes back up then spikes very hard up past the high of day, stalls, and then goes right back down on the next candle , that is a UTDAD (Up Thrust After Distribution, at the top) or Wykoff Spring (from the bottom), also known simply as the selling or buying climax . This usually looks like 2 tall candles nearly the same height and often wickless, and this happens on the 1-minute or 5-minute timeframe (not both). This too is meant to grab some momentum stops to shoot the other direction. Example Wykoff Spring on the 5min timeframe.

Shared Link: http://tos.mx/0XSGjXM (or use code below). Click here for --> Easiest way to load shared links

Code:

# VPA Candles & Bars with Anomaly Detector by Wiinii

# Version 1.2

# Original Volume-colored candles code by BenTen

#https://usethinkscript.com/threads/vpa-candles-bars-with-anomaly-detector-for-thinkorswim.13831/

#hint: Indicates candles with high volume (bright green/red), candles with low volume (dark green/red) average volume (standard green/red), and detects candle anomalies with high volume - short candles (Cyan/Magenta) and low volume - tall candles (very light green/red). \n Tall_Candle_X = Candle % Taller than average. \n Short_Candle_X = Candle % Shorter than average. \n X_VolAvg = % higher or lower volume than average. \n Volume_Candles_Average = Number of candles it's averaging anomalous candle size and volume to.

declare on_volume;

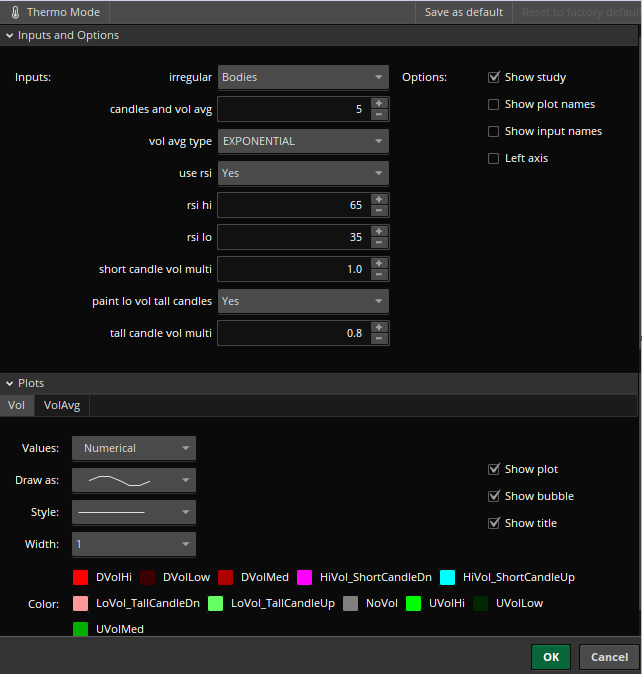

input Irregular = {default "Bodies", "Both", "Candles"};

input CandlesAndVolAvg = 5;

input VolAvgType = AverageType.EXPONENTIAL;

input Use_RSI = yes;

def RSIType = RSI(averageType = "EXPONENTIAL");

input RSIHi = 65;

input RSILo = 35;

input ShortCandleVolMulti = 1.0;

input PaintLoVolTallCandles = yes;

input TallCandleVolMulti = 0.8;

def AvgCandle = SimpleMovingAvg(price = (high[1] - low[1]), length = CandlesAndVolAvg);

def AvgCandleBody = Average(BodyHeight(), CandlesAndVolAvg);

def CurrentCandle = high - low;

plot Vol = volume;

Vol.SetHiding (1 == 1);

plot VolAvg = MovingAverage(VolAvgType, volume, CandlesAndVolAvg);

VolAvg.SetPaintingStrategy(PaintingStrategy.LINE);

VolAvg.SetDefaultColor(Color.CYAN);

def VolHi = volume > VolAvg * 1.2;

def VolMed = volume >= VolAvg * 0.8 and volume <= VolAvg * 1.2;

def VolLo = volume < VolAvg * 0.8;

def UVolHi = VolHi and close > open;

def UVolMed = VolMed and close > open;

def UVolLow = VolLo and close > open;

def DVolHi = VolHi and close < open;

def DVolMed = VolMed and close < open;

def DVolLow = VolLo and close < open;

def S_Candle = CurrentCandle <= AvgCandle;

def S_Body = BodyHeight() <= AvgCandleBody;

def ShortVolAnomolyCandleUp = if (if Irregular == irregular.Candles then S_Candle else if Irregular == irregular.Bodies then S_Body else S_Candle or S_Body) and (volume > VolAvg * ShortCandleVolMulti) and (if Use_RSI then (RSIType >= RSIHi or RSIType <= RSILo) else RSI()) and close > open then 1 else Double.NaN;

def ShortVolAnomolyCandleDn = if (if Irregular == irregular.Candles then S_Candle else if Irregular == irregular.Bodies then S_Body else S_Candle or S_Body) and (volume > VolAvg * ShortCandleVolMulti) and (if Use_RSI then (RSIType >= RSIHi or RSIType <= RSILo) else RSI()) and close < open then 1 else Double.NaN;

def T_Candle = CurrentCandle >= AvgCandle;

def T_Body = BodyHeight() >= AvgCandleBody;

def TallVolAnomolyCandleUp = if PaintLoVolTallCandles and (if Irregular == irregular.Candles then T_Candle else if Irregular == irregular.Bodies then T_Body else T_Candle or T_Body) and (volume < VolAvg * TallCandleVolMulti) and close > open then 1 else Double.NaN;

def TallVolAnomolyCandleDn = if PaintLoVolTallCandles and (if Irregular == irregular.Candles then T_Candle else if Irregular == irregular.Bodies then T_Body else T_Candle or T_Body) and (volume < VolAvg * TallCandleVolMulti) and close < open then 1 else Double.NaN;

Vol.DefineColor("UVolHi", CreateColor(0, 255, 0));

Vol.DefineColor("UVolMed", CreateColor(0, 175, 0));

Vol.DefineColor("UVolLow", CreateColor(0, 40, 0));

Vol.DefineColor("DVolHi", CreateColor(255, 0, 0));

Vol.DefineColor("DVolMed", CreateColor(175, 0, 0));

Vol.DefineColor("DVolLow", CreateColor(60, 0, 0));

Vol.DefineColor("NoVol", Color.GRAY);

Vol.DefineColor("HiVol_ShortCandleUp", Color.CYAN);

Vol.DefineColor("HiVol_ShortCandleDn", Color.MAGENTA);

Vol.DefineColor("LoVol_TallCandleUp", CreateColor(153,255,153));

Vol.DefineColor("LoVol_TallCandleDn", CreateColor(255,225,255));

AssignPriceColor(

if UVolHi then Vol.Color("UVolHi")

else if DVolHi then Vol.Color("DVolHi")

else if UVolMed then Vol.Color("UVolMed")

else if DVolMed then Vol.Color("DVolMed")

else if UVolLow then Vol.Color("UVolLow")

else if DVolLow then Vol.Color("DVolLow")

else Color.CURRENT);

AssignPriceColor(if ShortVolAnomolyCandleUp then Vol.Color("HiVol_ShortCandleUp") else Color.CURRENT);

AssignPriceColor(if ShortVolAnomolyCandleDn then Vol.Color("HiVol_ShortCandleDn") else Color.CURRENT);

AssignPriceColor(if TallVolAnomolyCandleUp then Vol.Color("LoVol_TallCandleUp") else Color.CURRENT);

AssignPriceColor(if TallVolAnomolyCandleDn then Vol.Color("LoVol_TallCandleDn") else Color.CURRENT);TROUBLESHOOTING:

1. Above your chart click the Gear icon and check 'Show volume subgraph' like so:

2. General > Layout > Show price subgraph (need to check this option)

3. Appearance > Volume bars > Color as symbol ticks (need to check this option)

Last edited: