# RSI-Laguerre Self Adjusting With Fractal Energy Gaussian Price Filter

# Mobius

# V01.12.2016

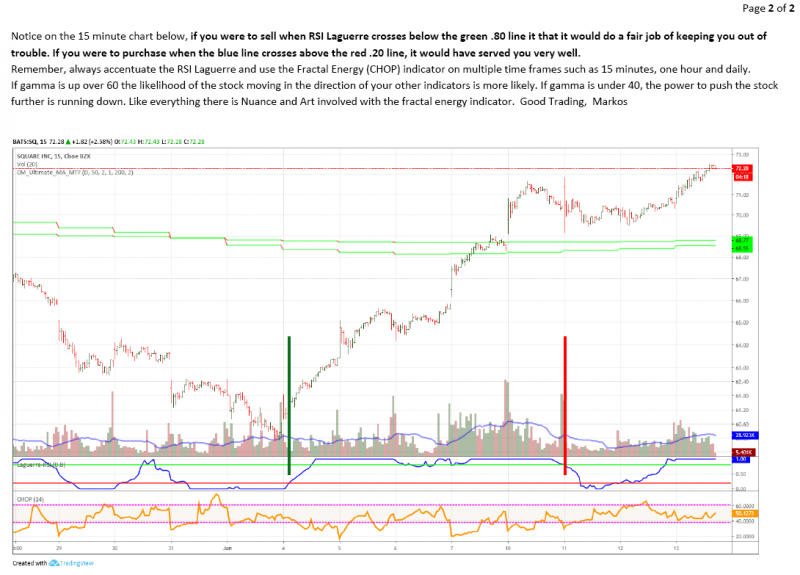

# Both Fractal Energy and RSI are plotted. RSI in cyan and FE in yellow. Look for trend exhaustion in the FE and a reversal of RSI or Price compression in FE and an RSI reversal.

declare lower;

#Inputs:

input nFE = 8;#hint nFE: length for Fractal Energy calculation.

input AlertOn = yes;

input Glength = 13;

input betaDev = 8;

input data = close;

def w = (2 * Double.Pi / Glength);

def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

def alpha = (-beta + Sqrt(beta * beta + 2 * beta));

def Go = Power(alpha, 4) * open +

4 * (1 – alpha) * Go[1] – 6 * Power( 1 - alpha, 2 ) * Go[2] +

4 * Power( 1 - alpha, 3 ) * Go[3] - Power( 1 - alpha, 4 ) * Go[4];

def Gh = Power(alpha, 4) * high +

4 * (1 – alpha) * Gh[1] – 6 * Power( 1 - alpha, 2 ) * Gh[2] +

4 * Power( 1 - alpha, 3 ) * Gh[3] - Power( 1 - alpha, 4 ) * Gh[4];

def Gl = Power(alpha, 4) * low +

4 * (1 – alpha) * Gl[1] – 6 * Power( 1 - alpha, 2 ) * Gl[2] +

4 * Power( 1 - alpha, 3 ) * Gl[3] - Power( 1 - alpha, 4 ) * Gl[4];

def Gc = Power(alpha, 4) * data +

4 * (1 – alpha) * Gc[1] – 6 * Power( 1 - alpha, 2 ) * Gc[2] +

4 * Power( 1 - alpha, 3 ) * Gc[3] - Power( 1 - alpha, 4 ) * Gc[4];

# Variables:

def o;

def h;

def l;

def c;

def CU1;

def CU2;

def CU;

def CD1;

def CD2;

def CD;

def L0;

def L1;

def L2;

def L3;

plot RSI;

plot OS;

plot OB;

#plot M;

# Calculations

o = (Go + Gc[1]) / 2;

h = Max(Gh, Gc[1]);

l = Min(Gl, Gc[1]);

c = (o + h + l + Gc) / 4;

plot gamma = Log(Sum((Max(Gh, Gc[1]) - Min(Gl, Gc[1])), nFE) /

(Highest(gh, nFE) - Lowest(Gl, nFE)))

/ Log(nFE);

gamma.SetDefaultColor(Color.BLUE);

gamma.SetLineWeight(1);

gamma.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

L0 = (1 – gamma) * Gc + gamma * L0[1];

L1 = -gamma * L0 + L0[1] + gamma * L1[1];

L2 = -gamma * L1 + L1[1] + gamma * L2[1];

L3 = -gamma * L2 + L2[1] + gamma * L3[1];

if L0 >= L1

then {

CU1 = L0 - L1;

CD1 = 0;

} else {

CD1 = L1 - L0;

CU1 = 0;

}

if L1 >= L2

then {

CU2 = CU1 + L1 - L2;

CD2 = CD1;

} else {

CD2 = CD1 + L2 - L1;

CU2 = CU1;

}

if L2 >= L3

then {

CU = CU2 + L2 - L3;

CD = CD2;

} else {

CU = CU2;

CD = CD2 + L3 - L2;

}

RSI = if CU + CD <> 0 then CU / (CU + CD) else 0;

RSI.SetDefaultColor(Color.Cyan);

OS = if IsNaN(c) then Double.NaN else 0.2;

OS.SetDefaultColor(Color.Gray);

OS.HideBubble();

OS.HideTitle();

OB = if IsNaN(c) then Double.NaN else 0.8;

OB.SetDefaultColor(Color.Gray);

OB.HideBubble();

OB.HideTitle();

#M = if IsNaN(c) then Double.NaN else 0.5;

#M.SetStyle(Curve.Points);

#M.SetDefaultColor(Color.Gray);

#M.HideBubble();

#M.HideTitle();

plot FEh = if isNaN(c) then double.nan else .618;

FEh.SetStyle(Curve.Long_Dash);

FEh.HideBubble();

FEh.SetDefaultColor(Color.Dark_Gray);

FEh.HideTitle();

plot FEl = if isNaN(c) then double.nan else .382;

FEl.SetStyle(Curve.Long_Dash);

FEl.SetDefaultColor(Color.Dark_Gray);

FEl.HideBubble();

FEl.HideTitle();

AddCloud(0, OS, Color.GRAY, Color.GRAY);

AddCloud(OB, 1, Color.GRAY, Color.GRAY);

#Alert(AlertOn and RSI crosses below .9, "", Alert.BAR, Sound.Bell);

#Alert(AlertOn and RSI crosses above .1, "", Alert.BAR, Sound.Bell);

# End Code RSI_Laguerre Self Adjusting with Fractal Energy

# Trade Management

def ATR = Average(TrueRange(h,c,l), 20);

def longCond = if RSI crosses above .2

then c

else if RSI < .8

then double.nan

else longCond[1];

def shortCond = if RSI crosses below .8

then c

else if RSI > .2

then double.nan

else shortCond[1];

def upperTarget = if !isNaN(longCond) and ((RSI > RSI[1]) or (RSI > .8))

then Round((longCond + (1.5 * ATR)) / TickSize(), 0) * TickSize()

else if !isNaN(shortCond) or ((RSI < RSI[1]) or (RSI crosses below .2))

then double.nan

else upperTarget[1];

def upperBreached = if close crosses above upperTarget

then 1

else if close crosses below .5

then 0

else upperBreached[1];

def lowerTarget = if !isNaN(shortCond)

then Round((shortCond - (1.5 * ATR)) / TickSize(), 0) * TickSize()

else if !isNaN(longCond)

then double.nan

else lowerTarget[1];

def LTbreach = if close crosses below lowerTarget

then 1

else if RSI crosses above .5

then 0

else LTbreach[1];

#addLabel(upperTarget, if upperBreached

#then "Target Breached " + AsDollars(upperTarget)

#else "Target = " + AsDollars(Round(upperTarget, 2)), color.green);

#addLabel(lowerTarget, if LTbreach

#then "Target Breached " + AsDollars(LowerTarget)

# else "Target = " + AsDollars(Round(lowerTarget, 2)), color.red);

def FE_Consolidation = gamma > .62 and gamma[1] < .62;

#AddLabel(FE_Consolidation, " Fractal Energy Consolidation ", Color.YELLOW);

def FE_Exhaustion = gamma < .38 and gamma[1] > .38;

#AddLabel(FE_Exhaustion, " Fractal Energy Exhaustion ", Color.YELLOW);

AddChartBubble(FE_Consolidation, gamma, "C", COLOR.WHITE);

AddChartBubble(FE_Exhaustion, gamma, "E", COLOR.WHITE);

#Vertical Lines

def short = RSI crosses below .80;

def long = RSI crosses above .20;

AddVerticalLine(short, close, Color.RED, Curve.SHORT_DASH);

AddVerticalLine(long, close, Color.GREEN, Curve.SHORT_DASH);

RSI.DefineColor("Up", CreateColor( 0, 220, 0));

RSI.DefineColor("Down", Color.MAGENTA);

RSI.SetLineWeight(4);

RSI.AssignValueColor(if RSI > RSI[1] and RSI[1] > RSI [2] then RSI.Color("Up") else if RSI < RSI[1] and RSI[1] < RSI [2] then RSI.Color("Down") else color.YELLOW);

#Gamma Line Color

gamma.DefineColor("Con", CreateColor( 153, 153, 153));

gamma.DefineColor("EX", CreateColor( 153, 153, 153));

gamma.AssignValueColor(if gamma > .62 then gamma.Color("Con") else if gamma < .38 then gamma.Color("EX") else color.LIME);

AddCloud(gamma, .62, Color.GRAY, Color.Current);

AddCloud(gamma, .38, Color.Current, Color.GRAY);