Options spreads in layman terms are two options of the same type (call or put) on the same underlying, one bought and another one being sold. They differ in terms of the strike prices or the expiration or both.

Let’s look at the different types of option spreads.

There are a couple of reasons why one would choose vertical spreads

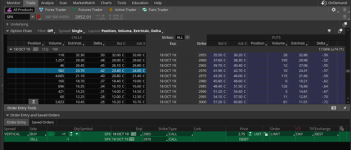

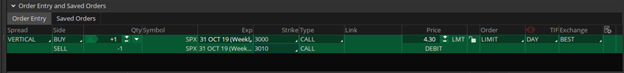

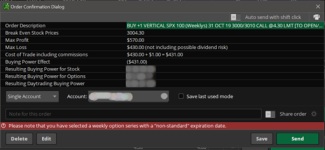

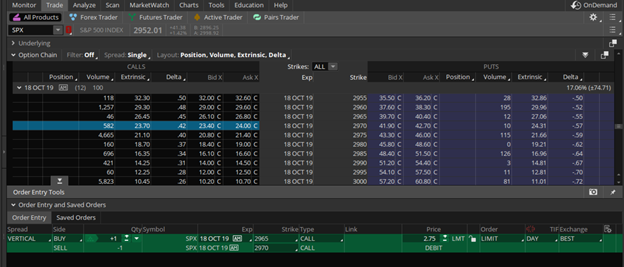

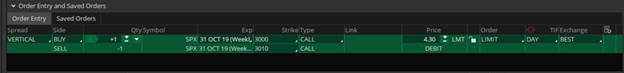

Consider the following trade being placed from ThinkOrSwim

This is an example of a bullish call spread with the following components,

The following are the cases at expiration,

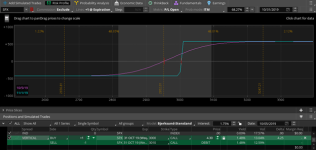

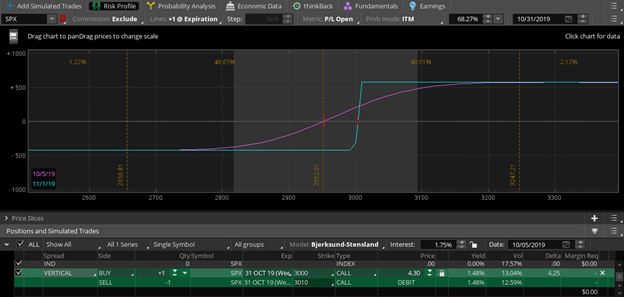

The Analyze tab, would give us a better idea on how this works out.

Next up: How to Buy your first call spreads.

Let’s look at the different types of option spreads.

Vertical Spreads

These are options spreads where the options are on the same expiry and the strike prices are different. Vertical spreads are the easiest of spreads to understand and we will be delving slightly deeper into verticals in the upcoming sectionHorizontal Spreads

These are advanced spreads where the options are on the same strike while being on different expirations. They are played to exploit IV premium during binary events like earnings.Diagonal Spreads

These are an added variant on Horizontal spreads where the strike prices differ as well along with the expiration date. One key thing to note is the options are always of the same type in spreads.Buying Vertical Spreads

Vertical spreads or the easiest of spreads to understand and possible the most common options strategies. They get their name from how they look on the option chain (see below)There are a couple of reasons why one would choose vertical spreads

- Getting a long option at a discounted price

- When IV is high, option prices are elevated, verticals help offset the IV to make a directional bet.

- Bullish Call Spread (a.k.a) Debit Call Spread

- Bearish Put Spread (a.k.a) Debit Put Spread

Bullish Call Spread

The bullish call spread allows traders to make a bullish bet by defining their maximum profit and getting long a call option discounted by a shorter call option at a higher strike.Consider the following trade being placed from ThinkOrSwim

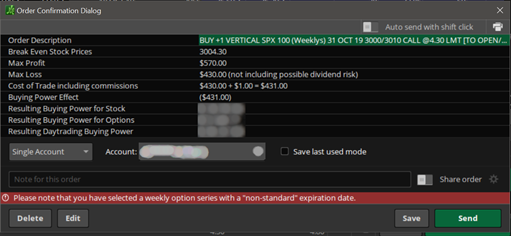

This is an example of a bullish call spread with the following components,

- Long 3000 Call - Buying the right to buy SPX at 3000

- Short 3010 Call - Selling the obligation to sell SPX at 3010

- Net Debit of 430$ (excluding commissions)

The following are the cases at expiration,

- SPX closes below 3004.30: We realize a loss up to a maximum of 430$

- SPX closes above 3004.30: We realize profits up to a maximum of 1000$ - 430$ = 570$

- SPX closes above 3004.30: Break even

The Analyze tab, would give us a better idea on how this works out.

Next up: How to Buy your first call spreads.

Attachments

Last edited by a moderator: