mbarcala

Active member

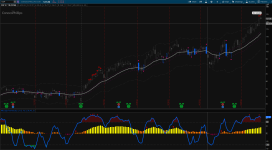

Here is a combination of QQE + Stochastic Indicator, its give you a nice and good possible entry and exit points with some custom levels of reversal.

Upper Indicator: https://usethinkscript.com/threads/break-keltner-bands-bkb-for-thinkorswim.11220/

Photo

14857[/ATTACH]']

script

Scanner

Watchlist Label

- QQE as Histogram

- Stochastic as Blue line

- Red and Green Arrows mean when QQE crosses up or down the qqe faster signal

- Gray level (30 = 80 and -30 = 20)

- Red Dots mean price goes over 45 = 95

Upper Indicator: https://usethinkscript.com/threads/break-keltner-bands-bkb-for-thinkorswim.11220/

Photo

14857[/ATTACH]']

script

Code:

# QQE and Stochastic Indicators by mbarcala at useThinkScript.com

declare lower;

input RSI_Period = 20;

input Slow_Factor = 5;

input qqeColLevel = 8.5;

input kPeriod = 14;

input dPeriod = 3;

input obosLevel = 30;

input stochLevel = 45;

input dotLevel = 3; # Position of the dots level up or down

def RSIndex = 4.236;

def Wilder_Period = RSI_Period * 2 - 1;

def rsi = RSI(price = close, length = RSI_Period);

def fullK = 100 * ((close - Lowest(low, kPeriod)) / (Highest(high, kPeriod) - Lowest(low, kPeriod)));

plot STOCHRSI = Round(ExpAverage(fullK, dPeriod) - 50, 2);

STOCHRSI.SetDefaultColor(CreateColor(0, 101, 255));

STOCHRSI.SetLineWeight(3);

#STOCHRSI.HideBubble();

STOCHRSI.HideTitle();

plot midline = 0;

midline.SetDefaultColor(Color.BLACK);

midline.SetLineWeight(1);

midline.HideTitle();

plot QQE = ExpAverage(rsi, Slow_Factor) - 50;

QQE.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

QQE.AssignValueColor(if QQE > midline and QQE < qqeColLevel then CreateColor(255, 120, 0) else

if QQE >= qqeColLevel then CreateColor(255, 250, 0) else

if QQE < midline and QQE > -qqeColLevel then CreateColor(118, 0, 60) else #CreateColor(230, 17, 125)

if QQE <= -qqeColLevel then CreateColor(230, 17, 125) else Color.CURRENT);

QQE.SetLineWeight(5);

QQE.HideBubble();

QQE.HideTitle();

def atr_rsi = AbsValue(QQE[1] - QQE);

def atr_rsi_ma = ExpAverage(atr_rsi, Wilder_Period);

def DeltaFastAtrRsi = ExpAverage(atr_rsi_ma, Wilder_Period) * RSIndex;

def newshortband = QQE + DeltaFastAtrRsi;

def newlongband = QQE - DeltaFastAtrRsi;

def longband = if QQE[1] > longband[1] and QQE > longband[1] then Max(longband[1], newlongband) else newlongband;

def shortband = if QQE[1] < shortband[1] and QQE < shortband[1] then Min(shortband[1], newshortband) else newshortband;

def trend = if Crosses(QQE, shortband[1]) then 1 else if Crosses(longband[1], QQE) then -1 else if !IsNaN(trend[1]) then trend[1] else 1;

def pFastAtrRsiTL = if trend == 1 then longband else shortband;

def udDots = 4;

plot qqeBrk = if QQE crosses above pFastAtrRsiTL then QQE + udDots else

if QQE crosses below pFastAtrRsiTL then QQE - udDots else Double.NaN;

qqeBrk.SetPaintingStrategy(PaintingStrategy.POINTS);

qqeBrk.SetDefaultColor(Color.BLACK);

qqeBrk.SetLineWeight(1);

qqeBrk.HideBubble();

qqeBrk.HideTitle();

plot qqeBrkBg = if QQE crosses above pFastAtrRsiTL then QQE + udDots else

if QQE crosses below pFastAtrRsiTL then QQE - udDots else Double.NaN;

qqeBrkBg.SetPaintingStrategy(PaintingStrategy.POINTS);

qqeBrkBg.AssignValueColor(if QQE crosses above pFastAtrRsiTL then Color.GREEN else

if QQE crosses below pFastAtrRsiTL then Color.RED else Color.CURRENT);

qqeBrkBg.SetLineWeight(5);

qqeBrkBg.HideBubble();

qqeBrkBg.HideTitle();

plot obLevel = midline + obosLevel;

obLevel.SetStyle(Curve.MEDIUM_DASH);

obLevel.SetDefaultColor(Color.DARK_GRAY);

obLevel.SetLineWeight(1);

obLevel.HideTitle();

plot osLevel = midline - obosLevel;

osLevel.SetStyle(Curve.MEDIUM_DASH);

osLevel.SetDefaultColor(Color.DARK_GRAY);

osLevel.SetLineWeight(1);

osLevel.HideTitle();

plot stochUpDn = if STOCHRSI > stochLevel then STOCHRSI + dotLevel else if STOCHRSI < -stochLevel then STOCHRSI - dotLevel else Double.NaN;

stochUpDn.SetPaintingStrategy(PaintingStrategy.POINTS);

stochUpDn.AssignValueColor(if STOCHRSI > stochLevel then Color.RED else if STOCHRSI < -stochLevel then Color.GREEN else Color.CURRENT);

stochUpDn.SetLineWeight(2);

stochUpDn.HideBubble();

stochUpDn.HideTitle();

AddCloud(STOCHRSI, midline + obosLevel, CreateColor(255, 0, 0), CreateColor(17, 17, 17));

AddCloud(midline - obosLevel, STOCHRSI, CreateColor(0, 255, 0), CreateColor(17, 17, 17));Scanner

Code:

#QQsToched Scanner

def kPeriod = 14;

def dPeriod = 3;

def fullK = 100 * ((close - Lowest(low, kPeriod)) / (Highest(high, kPeriod) - Lowest(low, kPeriod)));

plot STOCHRSI = ExpAverage(fullK, dPeriod) - 50;

plot obLevel = 35;

plot osLevel = -35;Watchlist Label

Code:

#QQsToched Label

def kPeriod = 14;

def dPeriod = 3;

def fullK = 100 * ((close - Lowest(low, kPeriod)) / (Highest(high, kPeriod) - Lowest(low, kPeriod)));

def STOCHRSI = ExpAverage(fullK, dPeriod) - 50;

def obLevel = 35;

def osLevel = -35;

def cond1 = STOCHRSI > obLevel;

def cond2 = STOCHRSI < osLevel;

AddLabel(yes, if cond1 then "ob" else

if cond2 then "os" else " ", Color.CURRENT);

AssignBackgroundColor(if cond1 then Color.DARK_RED else

if cond2 then Color.DARK_GREEN else CreateColor(10,10,10));Attachments

Last edited: