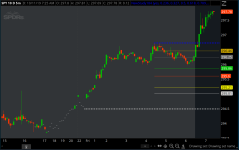

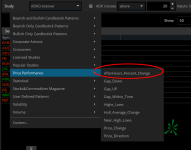

This indicator for ThinkorSwim will automatically plot overnight High and Low on your chart. In addition, the indicator will also include Fibonacci retracement based on the highest and lowest values from pre-market.

This can be useful for anyone who often plays pre-market breakout or breakdown. You may want to check out this strategy as well.

This can be useful for anyone who often plays pre-market breakout or breakdown. You may want to check out this strategy as well.

thinkScript Code

Rich (BB code):

# GlobeX or Overnight High / Low with Fibonacci Values

# Mobius

# V01.2012

input PlotOverNightExtremes = yes;

input coeff_1 = .236;

input coeff_2 = .327;

# gmh: added the rest of the Fibs

input coeff_3 = .500;

input coeff_4 = .618;

input coeff_5 = .789;

input coeff_6 = .882;

def o = open;

def h = high;

def l = low;

def c = close;

def v = volume;

def bar = BarNumber();

def GlobeX = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if GlobeX and !Globex[1]

then v

else if GlobeX

then vol[1] + v

else Double.NaN;

def GlobeX_Volume = vol;

def ONhigh = if GlobeX and !Globex[1]

then h

else if Globex and

h > ONhigh[1]

then h

else ONhigh[1];

def ONhighBar = if GlobeX and h == ONhigh

then Bar

else double.nan;

def ONlow = if GlobeX and !GlobeX[1]

then l

else if GlobeX and

l < ONlow[1]

then l

else ONlow[1];

def ONlowBar = if GlobeX and l == ONlow

then Bar

else double.nan;

def OverNightHigh = if BarNumber() == HighestAll(ONhighBar)

then ONhigh

else OverNightHigh[1];

def OverNightLow = if BarNumber() == HighestAll(ONlowBar)

then ONlow

else OverNightLow[1];

plot ONH = if OverNightHigh > 0

then OverNightHigh

else Double.NaN;

ONH.SetHiding(!PlotOverNightExtremes);

ONH.SetPaintingStrategy(PaintingStrategy.SQUARES);

ONH.SetDefaultColor(Color.BLUE);

ONH.HideBubble();

ONH.HideTitle();

plot ONL = if OverNightLow > 0

then OverNightLow

else Double.NaN;

ONL.SetHiding(!PlotOverNightExtremes);

ONL.SetPaintingStrategy(PaintingStrategy.SQUARES);

ONL.SetDefaultColor(Color.LIGHT_GRAY);

ONL.HideBubble();

ONL.HideTitle();

def MaxBar = Max(HighestAll(ONhighBar), HighestAll(ONlowBar));

plot coeff1 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_1) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_1)

else double.nan;

plot coeff2 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_2) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_2)

else double.nan;

plot coeff3 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_3) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_3)

else double.nan;

plot coeff4 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_4) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_4)

else double.nan;

plot coeff5 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_5) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_5)

else double.nan;

plot coeff6 = if HighestAll(ONhighBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then ((OverNightHigh - OverNightLow) * coeff_6) + OverNightLow

else if HighestAll(ONlowBar) == MaxBar and OverNightLow > 0 and OverNightHigh > 0

then OverNightHigh - ((OverNightHigh - OverNightLow) * coeff_6)

else double.nan;

#

# End Code GlobeX High Low with Fibs Shareable Link

https://tos.mx/oNY5Yw

Last edited: