message from the Author

// Description:

// ============

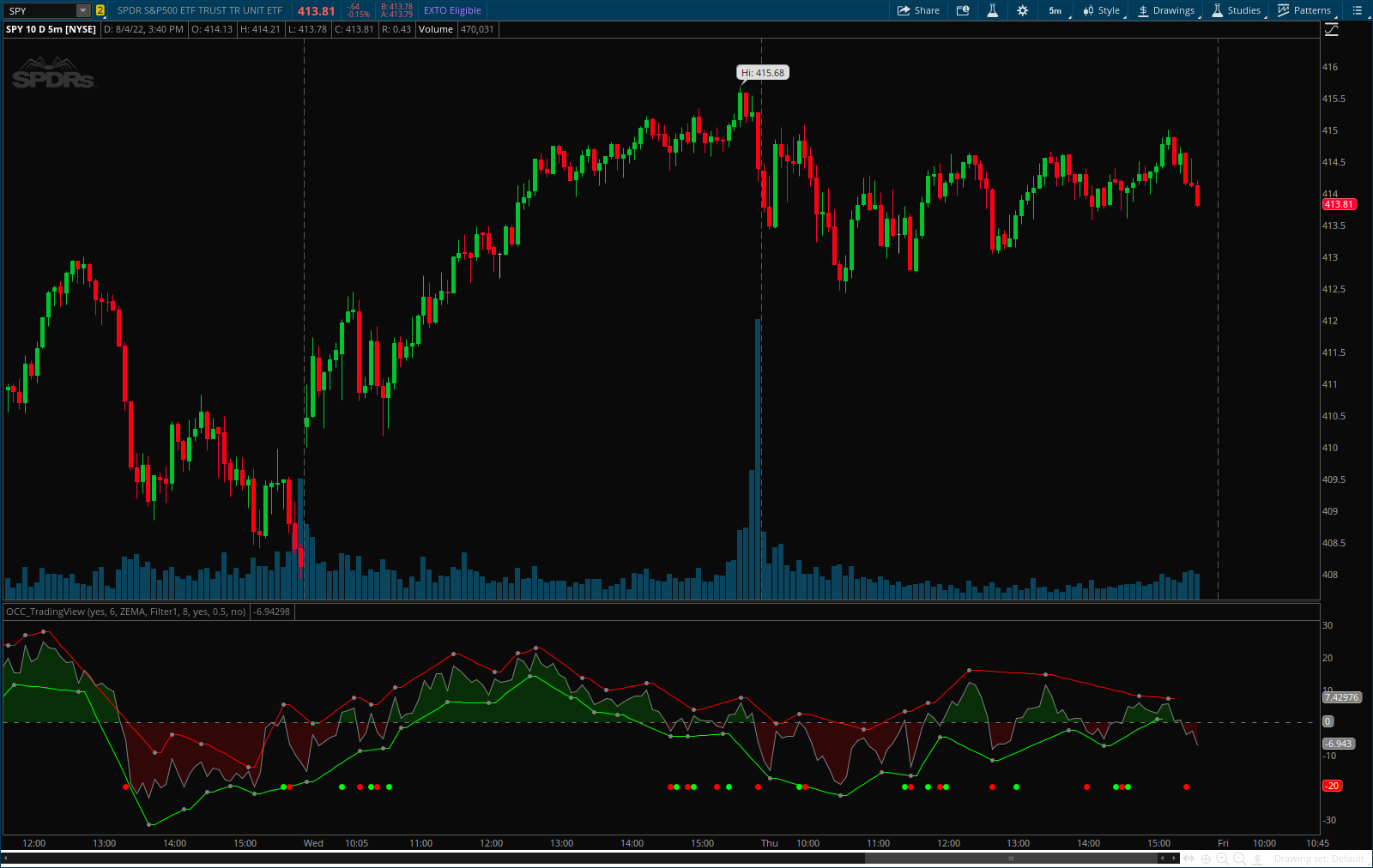

// Strategy based around Open-Close Crossovers. NRP is the Non repaint version.

// * USE AT YOUR OWN RISK *

CODE BELOW

// Description:

// ============

// Strategy based around Open-Close Crossovers. NRP is the Non repaint version.

// * USE AT YOUR OWN RISK *

CODE BELOW

CSS:

#// Description:

#// Strategy based around Open-Close Crossovers. NRP is the Non repaint version.

#// *** USE AT YOUR OWN RISK ***

#// Copyright 2017, 2019 JustUncleL

#https://www.tradingview.com/script/BLY1wfiD-Open-Close-Cross-Alerts-NoRepaint-Version-by-JustUncleL/

#// The GNU General Public License can be found here

#// <http://www.gnu.org/licenses/>.

#study(title="Open Close Cross Alerts NoRepaint Version by JustUncleL"

#// Revision: NRP

#// Author: JustIncleL

# Converted and Mod by Sam4COK @ Samer800 - 08/2022

declare lower;

#// === INPUTS ===

input useResolution = yes; #"Use Alternate Resolution?"

input MultiplierForResolution = 6; #"Multiplier for Alernate Resolution"

input basisType = {default "ZEMA", "VAR", "SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "HullMA", "SSMA", "TMA"};

input Signal = {default Filter1 , Filter2}; #MA Period"

input MAPeriod = 8; #"MA Period"

input DivChannel = no; #"Show Divergence Channel"

input ChannelWidth = 0.5; #"Divergence Channel Width Factor (Stddev)"

input Divergence = no; #"Show Regular Divergence"

#// === /INPUTS ===

def na = Double.NaN;

def intRes = if useResolution then MultiplierForResolution else 1;

script nz {

input data = 1;

input repl = 0;

def ret_val = if IsNaN(data) then repl else data;

plot return = ret_val;

}

########### Theme 1################

DefineGlobalColor("green100" , CreateColor(0, 128, 0));

DefineGlobalColor("lime100" , CreateColor(0, 255, 0));

DefineGlobalColor("red100" , CreateColor(255, 0, 0));

DefineGlobalColor("blue100" , CreateColor(0, 0, 255));

DefineGlobalColor("darkred100" , CreateColor(139, 0, 0));

DefineGlobalColor("aqua100" , CreateColor(0,255,255));

DefineGlobalColor("gray100" , CreateColor(128,128,128));

######################

#// SuperSmoother filter

#// © 2013 John F. Ehlers

#variant_supersmoother(src, len) =>

script variant_supersmoother {

input src = close;

input len = 0;

def a1 = Exp(-1.414 * 3.14159 / len);

def b1 = 2 * a1 * Cos(1.414 * 3.14159 / len);

def c2 = b1;

def c3 = -a1 * a1;

def c1 = 1 - c2 - c3;

def v9 = c1 * (src + nz(src[1])) / 2 + c2 * nz(v9[1]) + c3 * nz(v9[2]);

plot result = v9;

}

#variant_smoothed(src, len) =>

script variant_smoothed {

input src = close;

input len = 0;

def sma_1 = SimpleMovingAvg(src, len);

def v5 = if IsNaN(v5[1]) then sma_1 else (v5[1] * (len - 1) + src) / len;

plot resullt = v5;

}

#variant_zerolagema(src, len) =>

script variant_zerolagema {

input src = close;

input len = 0;

def lag = (len - 1) / 2;

def emaSrc = src + src - src[lag];

def v10 = ExpAverage(emaSrc, len);

plot result = v10;

}

#variant_doubleema(src, len) =>

script variant_doubleema {

input src = close;

input len = 0;

def v2 = ExpAverage(src, len);

def v6 = 2 * v2 - ExpAverage(v2, len);

plot result = v6;

}

#vwma(source, length)

script VWMA {

input x = close;

input y = 15;

def VWMA = SimpleMovingAvg(x * volume, y) / SimpleMovingAvg(volume, y);

plot result = VWMA;

}

#variant_tripleema(src, len) =>

script variant_tripleema {

input src = close;

input len = 0;

def v2 = ExpAverage(src, len);

def v7 = 3 * (v2 - ExpAverage(v2, len)) + ExpAverage(ExpAverage(v2, len), len);

plot result = v7;

}

#variant_lag(p, g) =>

script variant_lag {

input p = 0;

input g = 0;

def L0;

def L1;

def L2;

def L3;

L0 = (1 - g) * p + g * nz(L0[1]);

L1 = -g * L0 + nz(L0[1]) + g * nz(L1[1]);

L2 = -g * L1 + nz(L1[1]) + g * nz(L2[1]);

L3 = -g * L2 + nz(L2[1]) + g * nz(L3[1]);

def f = (L0 + 2 * L1 + 2 * L2 + L3) / 6;

plot result = f;

}

#variant(type, src, len) =>

script variant {

input type = "ZEMA";

input src = close;

input len = 0;

def ema_1 = ExpAverage(src, len);

def wma_1 = WMA(src, len);

def vwma_1 = vwma(src, len);

def variant_smoothed__1 = variant_smoothed(src, len);

def variant_doubleema__1 = variant_doubleema(src, len);

def variant_tripleema__1 = variant_tripleema(src, len);

def wma_2 = WMA(src, len / 2);

def wma_3 = WMA(src, len);

def wma_4 = WMA(2 * wma_2 - wma_3, Round(Sqrt(len)));

def variant_supersmoother__1 = variant_supersmoother(src, len);

def variant_zerolagema__1 = variant_zerolagema(src, len);

def sma_1 = SimpleMovingAvg(src, len);

def sma_2 = SimpleMovingAvg(sma_1, len);

def sma_3 = SimpleMovingAvg(src, len);

def ma = if type == "EMA" then ema_1 else if type == "WMA" then wma_1 else

if type == "VWMA" then vwma_1 else if type == "SMMA" then variant_smoothed__1 else

if type == "DEMA" then variant_doubleema__1 else if type == "TEMA" then variant_tripleema__1 else

if type == "HullMA" then wma_4 else if type == "SSMA" then variant_supersmoother__1 else

if type == "ZEMA" then variant_zerolagema__1 else if type == "TMA" then sma_2 else sma_3;

plot result = ma;

}

#// === SERIES SETUP ===

def closeSeries = variant(basisType, close, MAPeriod);

def openSeries = variant(basisType, open, MAPeriod);

def closeOpenAvg = (closeSeries + openSeries) / 2;

#// Simulate Alternate resolution Series by increasing MA period.

def closeSeriesAlt = variant(basisType, close, MAPeriod * intRes);

def openSeriesAlt = variant(basisType, open, MAPeriod * intRes);

#// === /SERIES ===

#// === ALERT ===

def xlong = closeSeriesAlt crosses above openSeriesAlt;

def xshort = closeSeriesAlt crosses below openSeriesAlt;

def longCond = if Signal == Signal.Filter1 then xlong else

if isNan(longCond[1]) then (xlong or xlong[1]) and close>closeSeriesAlt and close>=open else na;

def shortCond = if Signal == Signal.Filter1 then xshort else

if isNan(shortCond[1])then (xshort or xshort[1]) and close<closeSeriesAlt and close<=open else na;

#// === /ALERT conditions

#// === PLOTTING ===

def diff = closeSeriesAlt - openSeriesAlt;

def pcd = 50000.0 * diff / closeOpenAvg;

def alert = longCond or shortCond;

def trendColour = if closeSeriesAlt > openSeriesAlt then 1 else 0;

plot ZeroLine = 0;

ZeroLine.SetStyle(Curve.SHORT_DASH);

ZeroLine.SetDefaultColor(GlobalColor("gray100"));

ZeroLine.HideTitle();

plot pcdLine = pcd; #"OCC Difference Factor"

pcdLine.AssignValueColor(if DivChannel then GlobalColor("gray100") else if trendColour > 0 then GlobalColor("lime100") else GlobalColor("red100"));

plot Dots = if alert then -20 else na; # "OCC Alert Plot"

Dots.SetPaintingStrategy(PaintingStrategy.POINTS);

Dots.AssignValueColor(if trendColour > 0 then GlobalColor("lime100") else GlobalColor("red100"));

Dots.SetLineWeight(4);

Dots.HideTitle();

AddCloud(pcd, ZeroLine, GlobalColor("green100"), GlobalColor("darkred100") , no);

#// || Functions

#f_top_fractal(_src) =>

script f_top_fractal {

input _src = close;

def top_fractal = _src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0];

plot return = top_fractal;

}

#f_bot_fractal(_src) =>

script f_bot_fractal {

input _src = close;

def bot_fractal = _src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0];

plot result = bot_fractal;

}

#f_fractalize(_src) =>

script f_fractalize {

input _src = close;

def bot_fractal__1 = f_bot_fractal(_src);

def fractalize = if f_top_fractal(_src) then 1 else if bot_fractal__1 then -1 else 0;

plot return = fractalize;

}

def rsi_high = pcd;

def rsi_low = pcd;

def offset_ = ChannelWidth * StDev(pcd, 20);

def fractal_top_rsi = if f_fractalize(rsi_high) > 0 then rsi_high[2] else na;

def fractal_bot_rsi = if f_fractalize(rsi_low) < 0 then rsi_low[2] else na;

def top_rsi = fractal_top_rsi + offset_;

def bot_rsi = fractal_bot_rsi - offset_;

plot RSI_HD = if DivChannel then top_rsi[-2] else na;

plot RSI_LD = if DivChannel then bot_rsi[-2] else na;

RSI_HD.SetPaintingStrategy(PaintingStrategy.POINTS);

RSI_HD.SetDefaultColor(GlobalColor("gray100"));

RSI_HD.SetLineWeight(2);

RSI_HD.HideTitle();

RSI_LD.SetPaintingStrategy(PaintingStrategy.POINTS);

RSI_LD.SetDefaultColor(GlobalColor("gray100"));

RSI_LD.SetLineWeight(2);

RSI_LD.HideTitle();

#--------------------------------------------------------------

def LastUP = CompoundValue(1, if isNaN(RSI_HD) then RSI_HD[1] else RSI_HD, 0);

def LastDN = CompoundValue(1, if isNan(RSI_LD) then RSI_LD[1] else RSI_LD, 0);

#--------------------------------------------------------------

plot channelUP = LastUP;

channelup.SetStyle(Curve.FIRM);

channelup.SetDefaultColor(Color.RED);

channelup.EnableApproximation();

channelUP.HideTitle();

plot channeldn = LastDN;

channeldn.SetStyle(Curve.FIRM);

channeldn.SetDefaultColor(Color.GREEN);

channeldn.EnableApproximation();

channeldn.HideTitle();

##### DIVERGANCE

def bar = BarNumber();

def n = 20;

def CurrH = if pcd > 0

then fold i = 1 to Floor(n / 2)

with p = 1

while p

do pcd > GetValue(pcd, -i)

else 0;

def CurrPivotH = if (bar > n and

pcd == Highest(pcd, Floor(n / 2)) and CurrH) then pcd else na;

def CurrL = if pcd < 0

then fold j = 1 to Floor(n / 2)

with q = 1

while q

do pcd < GetValue(pcd, -j)

else 0;

def CurrPivotL = if (bar > n and

pcd == Lowest(pcd, Floor(n / 2)) and CurrL) then pcd else na;

def CurrPHBar = if !IsNaN(CurrPivotH) then bar else CurrPHBar[1];

def CurrPLBar = if !IsNaN(CurrPivotL) then bar else CurrPLBar[1];

def PHpoint = if !IsNaN(CurrPivotH) then CurrPivotH else PHpoint[1];

def PLpoint = if !IsNaN(CurrPivotL) then CurrPivotL else PLpoint[1];

def priorPHBar = if PHpoint != PHpoint[1] then CurrPHBar[1] else priorPHBar[1];

def priorPLBar = if PLpoint != PLpoint[1] then CurrPLBar[1] else priorPLBar[1];

def HighPivots = bar >= HighestAll(priorPHBar);

def LowPivots = bar >= HighestAll(priorPLBar);

def pivotHigh = if HighPivots then CurrPivotH else na;

def pivotLow = if LowPivots then CurrPivotL else na;

plot PlotHline = if Divergence then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.RED);

PlotHline.SetStyle(Curve.SHORT_DASH);

PlotHline.HideTitle();

plot PlotLline = if Divergence then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.LIME);

PlotLline.SetStyle(Curve.SHORT_DASH);

PlotLline.HideTitle();

plot PivotDot = if Divergence then if !IsNaN(pivotHigh) then pivotHigh else

if !IsNaN(pivotLow) then pivotLow else na else na;

PivotDot.SetDefaultColor(Color.YELLOW);

PivotDot.SetPaintingStrategy(PaintingStrategy.POINTS);

PivotDot.SetLineWeight(3);

PivotDot.HideTitle();

#//eof