SealTrades

New member

I've been playing with a strategy that has been working well for me, even with the current market volatility. I'm mainly wanting to put it out there so people who are more experienced can play Devil's Advocate and point out things maybe I'm not considering. I've tried to keep the rules simple.

Indicator: Dynamic RSI (free) from TOS Indicators (https://tosindicators.com/indicators/dynamic-rsi)

Rules

Credit Spread Parameters

Indicator: Dynamic RSI (free) from TOS Indicators (https://tosindicators.com/indicators/dynamic-rsi)

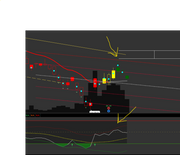

- I disable the trend lines and clean it up a bit by making some of the lines 60% transparent (see image below).

Rules

- Bullish Stock (stacked EMAs, Market Pulse, whatever you use to define the trend) = sell ATM Credit Spread when RSI hits bottom Bollinger Band.

- Bearish Stock = sell ATM Credit Spread when RSI hits top Bollinger Band

- No setup when Squeeze is firing.

- No setup if I don't receive at least 30% of the spread in credit, but I average about 40%+ because of the contrarian nature of the setup.

- No setup if the stock doesn't respect the RSI Bollinger Bands. This is easy enough to determine by reviewing previous price action when the RSI hits the bands.

- Use whatever other confluence you like, but I find the RSI hitting the Bollinger Bands is pretty indicative of a top/bottom depending on the trend. I'll use trend lines or the TTM_LRC with a 21 length on the daily chart (one month of trading days) and weekly/monthly pivot points on the hourly chart as extra confluence. When the price is hitting all three (RSI Bollinger, pivot point, and 1 or 2 standard deviation line on the LRC) it's an A+ setup. Given the forgiving nature of 45 DTE credit spreads, however, if the trend is strong enough I'll place a trade just off the RSI as long as there's no squeeze in sight.

Credit Spread Parameters

- 45 DTE, ATM $5 spread

- Once filled, BTC order place for 50% of credit received

- At around half way to expiration, if 50% hasn't been hit, I tend to start seeing what the price action is doing to decide if I'm going to close it or let it run

- Since my Risk to Reward is usually 1.5:1 or even closer to 1:1 I don't use stops. The only losses I've had so far came from closing orders early that would have ended up winners based on the closing price at expiration. With that said, my max loss is nothing more than I'm willing to lose, and the win rate is well over 50%.

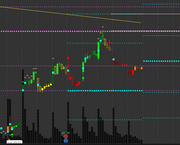

- I took this trade intra day off the Daily chart. At the time (but not captured in the screenshot), RSI was penetrating the upper band so I placed an STO order for the 55/60 spread for a credit of 1.80 (36% of the spread). The grey horizontal lines are what I use as a visual reference for my spreads. I place a "mid point" line where I want to start keeping an eye on the price action.

- My 50% profit target hit the next day, but it usually takes a week or two. IV might have still been high from earnings.

- Confluence: Notice that it was also hitting the 2 Standard deviation line on the LRC and was close to my trendline. In the second picture, notice it being rejected by the monthly pivot point (purple dotted line).