Hi,

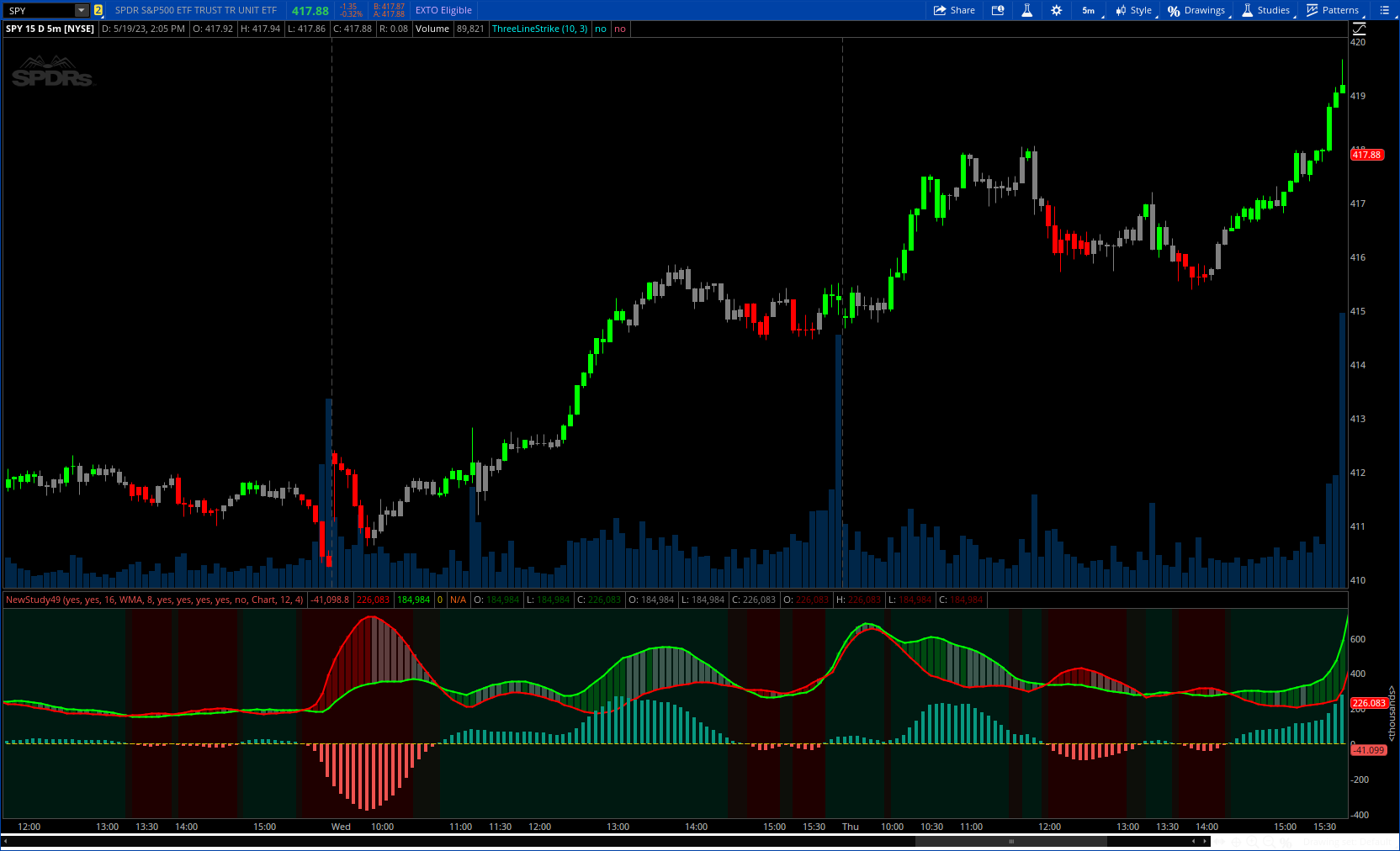

Anyone able to help to convert this into TOS? Thank you!

https://www.tradingview.com/script/...lume-EStimate-from-Pirce-Action-RedK-D-VESPA/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

https://mozilla.org/MPL/2.0/

// © RedKTrader - May 2023

//@version=5

indicator(title='Directional Volume Estimate from Pirce Action v1.0', shorttitle='RedK D_VESPA v1.0',

format=format.volume, timeframe='', timeframe_gaps=false, explicit_plot_zorder = true)

// Originally this was based on V.Viewer - it estimates and plots average supply & demand volume based on price action

// it uses the shape of a price bar to estimate the supply vs demand split of the traded volume

// & plots a moving average of both, and an estimated Average "Net Volume"

// This provides an insightful way to look at the traded volume compared to the classic volume histogram view

// ---------------------------------

//

// - Supply/Demand calc now includes 2-bar gaps (improved algo)

// - Add option for MA type for calculation

// - Add option to show Net Volume as 3-color bars

// - Visual simplification and improvements to be less distracting & more actionable

// - options to display/hide main visuals while maintaining the status line consistency (Avg Supply, Avg Demand, Avg Net)

// - add alerts for NetVol moving into Buy (crosses 0 up) or Sell (crosses 0 down) modes

// - implement a "sentiment" timeframe - options 1W, 1D, 1H

// using request.scurity() calls to bring in the data from the HTF and pass to the Calc_VESPA function

// ==============================================================================================

GetAverage(_data, _len, MAOption) =>

value = switch MAOption

'SMA' => ta.sma(_data, _len)

'EMA' => ta.ema(_data, _len)

'RMA' => ta.rma(_data, _len)

=>

ta.wma(_data, _len)

// &&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&

Calc_VESPA(bool VolumeOn, bool GapsOn) =>

// *********************************************************************************************************************

// Extrapolate avg estimated Buy & Sell volume per bar

// How the updated buy/sell average estimated volume algo works:

// buy volume is assoicated with price up-moves, sell volume is associated with price down-moves

// so each of the bulls and bears will get the equivalent of the top & bottom wicks,

// for up bars, bulls get the value of the "body", else the bears get the "body"

// open gaps are allocated to bulls or bears depending on the gap direction (if the option is selected)

// if there's no volume, then this will just reflect the price action split between buyers/sellers

// *********************************************************************************************************************

o = open

c = close

h = high

l = low

v = na(volume) or not VolumeOn ? 1 : volume

gap = o - c[1]

bull_gap = math.max(gap, 0)

bear_gap = math.abs(math.min(gap, 0))

body = math.abs(c - o)

BarRange = h - l

wick = BarRange - body

up_bar = c > o

bull = wick + (up_bar ? body : 0) + (GapsOn ? bull_gap : 0)

bear = wick + (up_bar ? 0 : body) + (GapsOn ? bear_gap : 0)

ViRange = bull + bear

// Rare cases with very low TF's (mainly FOREX) where no price movement occurs, ViRange (including gaps) = 0

BScore = ViRange > 0 ? bull / ViRange : 0.5

BuyVol = BScore * v

SellVol = v - BuyVol

// Return Estimated Buy & Sell Volume values

[BuyVol, SellVol]

// *********************************************************************************************************************

// inputs

// *********************************************************************************************************************

length = input.int(title='Volume Length', defval=16, minval=1)

AvgType = input.string("WMA", "Average type", options = ['SMA', 'EMA', 'RMA', 'WMA'])

smooth = input.int(title='Smoothing', defval=8, minval=1)

VolumeWeighted = input.bool(true, "Volume Weighted (Keep on)")

GapImpact = input.bool(true, "2-bar Gap Impact (Keep on)")

ShowNetVolBars = input.bool(true, "Show NetVol Bars")

ShowNetVolHisto = input.bool(true, "Show NetVol Histogram")

// *********************************************************************************************************************

// variables

// *********************************************************************************************************************

// Calculate estimated Buy & Sell colume

[B_BuyVol, B_SellVol] = Calc_VESPA(VolumeWeighted, GapImpact)

// Calc average Buy & Sell vol and NetVol from estimate

demand = ta.wma(GetAverage(B_BuyVol, length, AvgType), smooth)

supply = ta.wma(GetAverage(B_SellVol, length, AvgType), smooth)

NetVol = demand - supply

// *********************************************************************************************************************

// Plots -- classic volume bars have been removed

// *********************************************************************************************************************

col_red = color.new(#ff0000, 00)

col_green = color.new(#00ff00, 00)

col_hist_red = color.new(#ef5350, 25)

col_hist_green = color.new(#089981, 25)

col_gold = color.new(#ffeb3b, 20)

//plot(v, title='Volume', style=plot.style_columns, color=up_bar ? col_green : col_red, display=display.none)

// ======================================================================================================================

// NetVol Bars Plot

// ======================================================================================================================

nvo = fixnan(supply) // fixes NaN values - observed mainly on Renko

nvc = fixnan(demand)

nvh = math.max(nvo, nvc)

nvl = math.min(nvo, nvc)

rising = ta.change(NetVol) > 0

c_barup = color.new(#11ff20, 60)

c_bardn = color.new(#ff1111, 60)

c_bardj = color.new(#ffffff, 50)

c_barupb = color.new(#1b5e20, 50)

c_bardnb = color.new(#981919, 50)

c_bardjb = color.new(#9598a1, 50)

barcolor = nvc > nvo and rising ? c_barup : nvc < nvo and not rising ? c_bardn : c_bardj

borcolor = nvc > nvo and rising ? c_barupb : nvc < nvo and not rising ? c_bardnb : c_bardjb

plotcandle(nvo, nvh, nvl, nvc, 'NetVol Bars', barcolor, barcolor, bordercolor = borcolor,

display = ShowNetVolBars ? display.pane : display.none)

hline(0, title='zero line', linestyle=hline.style_dotted, color=col_gold,

display = ShowNetVolHisto ? display.all : display.none) //hides with histogram

plot(supply, title='Supply', color=col_red, linewidth=2)

plot(demand, title='Demand', color=col_green, linewidth=2)

// ======================================================================================================================

// Net Volume Histogram Plot

// ======================================================================================================================

c_NetVol = NetVol >= 0 ? col_hist_green : col_hist_red

plot(NetVol, title='NetVol Histogram', style=plot.style_columns, color = c_NetVol, linewidth = 4,

display = ShowNetVolHisto ? display.all : display.status_line + display.data_window)

// ======================================================================================================================

// Secondary TF Average Net Volume Plot

// ======================================================================================================================

S_gp = "Secondary TF"

ShowS_NetVol = input.bool(false, 'Show Secondary', group = S_gp, inline = "Senti_TF") // STF plot hidden by default

i_STF = input.string("Chart", 'TF', options = ['Chart', '1Wk', '1Day' , '1Hr'], group = S_gp, inline = "Senti_TF")

S_length = input.int(12, "Length", minval = 1, group = S_gp, inline = "Senti_L")

S_smooth = input.int(4, "Smooth", minval = 1, group = S_gp, inline = "Senti_L")

STF = switch i_STF

'1Wk' => 'W'

'1Day' => 'D'

'1Hr' => '60'

=>

timeframe.period

// Error trap here if selected secondary TF is lower than chart

float chartTF_Mins = timeframe.in_seconds() / 60

float i_STF_Mins = timeframe.in_seconds(STF) / 60

if chartTF_Mins > i_STF_Mins and ShowS_NetVol

runtime.error("Secondary timeframe must be equal to, or higher than, the chart's timeframe.")

[S_BuyVol, S_SellVol] = request.security(syminfo.tickerid, STF, Calc_VESPA(VolumeWeighted, GapImpact) )

S_demand = request.security(syminfo.tickerid, STF, ta.wma(GetAverage(S_BuyVol, S_length, AvgType), S_smooth))

S_supply = request.security(syminfo.tickerid, STF, ta.wma(GetAverage(S_SellVol, S_length, AvgType), S_smooth))

S_NetVol = S_demand - S_supply

c_S_NetVol = S_NetVol >= 0 ? color.aqua : color.orange

plot(S_NetVol, title='Secondary TF NetVol', color = c_S_NetVol, linewidth = 2,

display = ShowS_NetVol ? display.all : display.data_window)

// plot(S_supply, color = color.red)

// plot(S_demand, color = color.green)

// ======================================================================================================================

// Alerts

// ======================================================================================================================

// Primary TF Alerts

Al_NetVol_up = ta.crossover(NetVol, 0)

Al_NetVol_dn = ta.crossunder(NetVol, 0)

Al_NetVol_swing = Al_NetVol_up or Al_NetVol_dn

alertcondition(Al_NetVol_up, "A1. Avg NetVol Crossing 0 Up", "Avg NetVol Positive - Bullish Mode Detected!")

alertcondition(Al_NetVol_dn, "A2. Avg NetVol Crossing 0 Down", "Avg NetVol Negative - Bearish Mode Detected!")

alertcondition(Al_NetVol_swing, "A3. Avg NetVol Crossing 0", "Avg NetVol Swing - Possible Mode Reversal Detected!")

// Secondary TF Alerts

Al_SNetVol_up = ta.crossover(S_NetVol, 0)

Al_SNetVol_dn = ta.crossunder(S_NetVol, 0)

Al_SNetVol_swing = Al_SNetVol_up or Al_SNetVol_dn

alertcondition(Al_SNetVol_up, "B1. STF Avg NetVol Crossing 0 Up", "Secondary TF Avg NetVol Positive - Bullish Mode Detected!")

alertcondition(Al_SNetVol_dn, "B2. STF Avg NetVol Crossing 0 Down", "Secondary TF Avg NetVol Negative - Bearish Mode Detected!")

alertcondition(Al_SNetVol_swing, "B3. STF Avg NetVol Crossing 0", "Secondary TF Avg NetVol Swing - Possible Mode Reversal Detected!")