it is possible to use numbers to define a desired painting strategy, instead of the words listed here.

https://tlc.thinkorswim.com/center/reference/thinkScript/Constants/PaintingStrategy

can use this

. z2.SetPaintingStrategy(2);

instead of this

. z2.SetPaintingStrategy(PaintingStrategy.POINTS);

but i think the number has to be a constant. the number can't come from a formula.

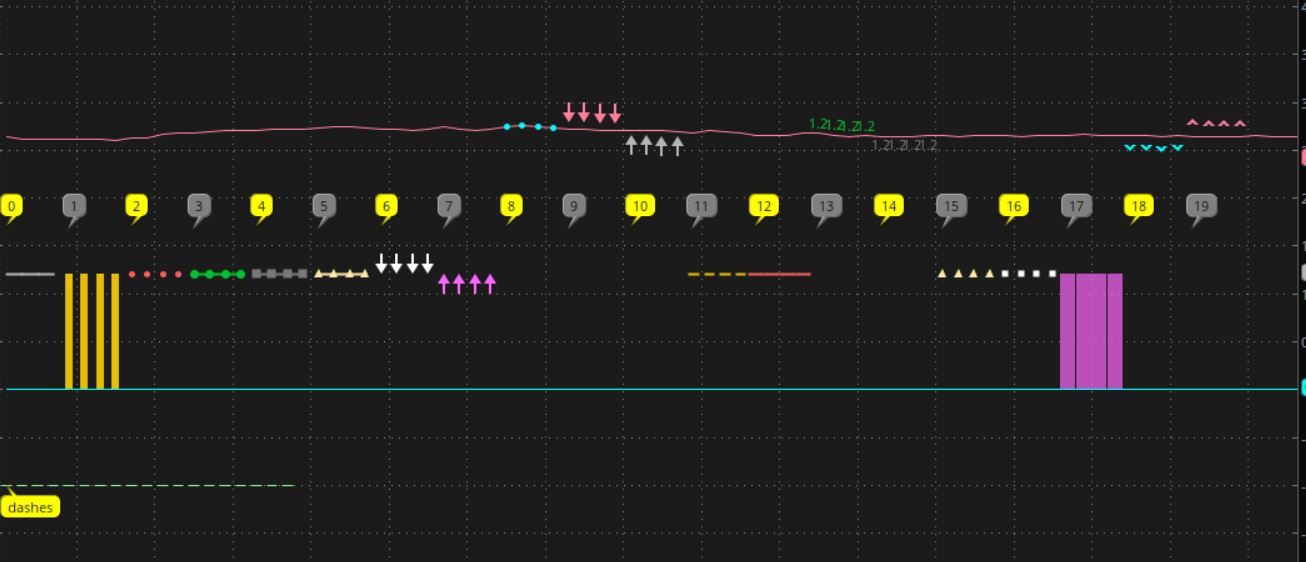

this study plots out all 20 strategies, on the first 80 bars on the chart. ( 0 - 19 )

boolean strategy plots are plotted at the chart symbol price levels, even if the candles are turned off, and even if a different symbol is specified in a close().

so pick a stock with a price around $2, to better see the boolean plots.

like SNDL

this turns off the main chart candles with this,

input HidePrice = yes;

HidePricePlot(HidePrice);

------------------

it is also possible to choose a strategy based on an input and an if then.

look below, after the image for an example.

SNDL

---------------------------

you can use an if then to choose a strategy.

the output of this, is at the bottom of the image, the 20 shapes at -1.

ref,

https://usethinkscript.com/threads/...remove-it-once-price-hits-it.5257/#post-75706

notes at the end of the study

https://tlc.thinkorswim.com/center/reference/thinkScript/Constants/PaintingStrategy

can use this

. z2.SetPaintingStrategy(2);

instead of this

. z2.SetPaintingStrategy(PaintingStrategy.POINTS);

but i think the number has to be a constant. the number can't come from a formula.

this study plots out all 20 strategies, on the first 80 bars on the chart. ( 0 - 19 )

boolean strategy plots are plotted at the chart symbol price levels, even if the candles are turned off, and even if a different symbol is specified in a close().

so pick a stock with a price around $2, to better see the boolean plots.

like SNDL

this turns off the main chart candles with this,

input HidePrice = yes;

HidePricePlot(HidePrice);

------------------

it is also possible to choose a strategy based on an input and an if then.

look below, after the image for an example.

Code:

# template_plot_strategy_numbers_00

def na = double.nan;

def bn = barnumber();

# turn off price bars

input HidePrice = yes;

HidePricePlot(HidePrice);

# cnt by x group of numbers

input seq_qty = 4;

def seq_num = floor((bn-1) / seq_qty)+0;

def iseven = (seq_num % 2 == 0);

input p = 1.2;

plot zz = 0;

# can't spec a price level for booleans

#input sym1 = "SNDL";

#plot x = close(sym1);

plot x = close;

input size = 2;

def maxn = 19;

def groupfirst = if bn == 1 then 1

else if seq_num > maxn then 0

else if seq_num != seq_num[1] then seq_num

else 0;

addchartbubble(groupfirst, p+0.5,

seq_num

, (if iseven then color.yellow else color.gray), yes);

#-----------------------------

# 0 LINE

plot z0 = if seq_num == 0 then p else na;

z0.SetPaintingStrategy(0);

z0.setlineweight(size);

#z0.SetPaintingStrategy(PaintingStrategy.LINE);

# 1 HISTOGRAM

plot z1 = if seq_num == 1 then p else na;

z1.SetPaintingStrategy(1);

z1.setlineweight(size);

#z1.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

# 2 POINTS

plot z2 = if seq_num == 2 then p else na;

z2.SetPaintingStrategy(2);

z2.setlineweight(size);

#z2.SetPaintingStrategy(PaintingStrategy.POINTS);

# 3 LINE_VS_POINTS

plot z3 = if seq_num == 3 then p else na;

z3.SetPaintingStrategy(3);

# error, only constants

#z3.SetPaintingStrategy(seq_num);

z3.setlineweight(size);

#z3.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

# 4 LINE_VS_SQUARES

plot z4 = if seq_num == 4 then p else na;

z4.SetPaintingStrategy(4);

z4.setlineweight(size);

#z4.SetPaintingStrategy(PaintingStrategy.LINE_VS_SQUARES);

# 5 LINE_VS_TRIANGLES

plot z5 = if seq_num == 5 then p else na;

z5.SetPaintingStrategy(5);

z5.setlineweight(size);

#z5.SetPaintingStrategy(PaintingStrategy.LINE_VS_TRIANGLES);

# 6 ARROW_DOWN

plot z6 = if seq_num == 6 then p else na;

z6.SetPaintingStrategy(6);

z6.setlineweight(size);

#z6.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

# 7 ARROW_UP

plot z7 = if seq_num == 7 then p else na;

z7.SetPaintingStrategy(7);

z7.setlineweight(size);

#z7.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

# 8 BOOLEAN_POINTS

plot z8 = if seq_num == 8 then p else na;

z8.SetPaintingStrategy(8);

z8.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

# 9 BOOLEAN_ARROW_DOWN

plot z9 = if seq_num == 9 then p else na;

z9.SetPaintingStrategy(9);

z9.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

# 10 BOOLEAN_ARROW_UP

plot z10 = if seq_num == 10 then p else na;

z10.SetPaintingStrategy(10);

z10.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

# 11 DASHES

plot z11 = if seq_num == 11 then p else na;

z11.SetPaintingStrategy(11);

z11.setlineweight(size);

#z11.SetPaintingStrategy(PaintingStrategy.DASHES);

# 12 HORIZONTAL

plot z12 = if seq_num == 12 then p else na;

z12.SetPaintingStrategy(12);

z12.setlineweight(size);

#z12.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

# 13 VALUES_ABOVE

plot z13 = if seq_num == 13 then p else na;

z13.SetPaintingStrategy(13);

z13.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

# 14 VALUES_below

plot z14 = if seq_num == 14 then p else na;

z14.SetPaintingStrategy(14);

z14.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.VALUES_below);

# TRIANGLES

plot z15 = if seq_num == 15 then p else na;

z15.SetPaintingStrategy(15);

z15.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

# SQUARES

plot z16 = if seq_num == 16 then p else na;

z16.SetPaintingStrategy(16);

z16.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.SQUARES);

# 17 SQUARED_HISTOGRAM

plot z17 = if seq_num == 17 then p else na;

z17.SetPaintingStrategy(17);

z17.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

# 18 BOOLEAN_WEDGE_DOWN

plot z18 = if seq_num == 18 then p else na;

z18.SetPaintingStrategy(18);

z18.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

# 19 BOOLEAN_WEDGE_up

plot z19 = if seq_num == 19 then p else na;

z19.SetPaintingStrategy(19);

z19.setlineweight(size);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_up);

#------------------------------

#x.SetDefaultColor(Color.red);

#x.hidebubble();

#-----------------------------

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_up);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

#x.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

#setlineweight() has no effect on values_above/ below

#x.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

#x.SetPaintingStrategy(PaintingStrategy.VALUES_below);

#x.SetPaintingStrategy(PaintingStrategy.LINE);

#x.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

#x.SetPaintingStrategy(PaintingStrategy.LINE_VS_SQUARES);

#x.SetPaintingStrategy(PaintingStrategy.LINE_VS_TRIANGLES);

#x.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

#x.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

# Strategy.DASHES: 1 dash per candle, no matter the zoom level

#x.SetPaintingStrategy(PaintingStrategy.DASHES);

#x.SetPaintingStrategy(PaintingStrategy.POINTS);

#x.SetPaintingStrategy(PaintingStrategy.SQUARES);

#x.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

#x.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

#x.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

#x.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#x.SetStyle(Curve.MEDIUM_DASH);

#x.SetDefaultColor(Color.red);

#x.setlineweight(1);

#x.hidebubble();

#SNDL

---------------------------

you can use an if then to choose a strategy.

the output of this, is at the bottom of the image, the 20 shapes at -1.

Code:

def v = -1;

input line_type = {"invisible", "dots", default "dashes", "solid"};

# this works , but the PaintingStrategy.dashes line looks like a solid line when zoomed out

# --------------------

input test_price_line1 = yes;

#plot line1x = if ( test_price_line1 and (crslin == 2 or crslin == 3 or crslin == 4)) then line1 else na;

plot line1x = if (test_price_line1 and bn < 20) then v else na;

line1x.SetDefaultColor(Color.LIGHT_GREEN);

line1x.HideBubble();

line1x.SetPaintingStrategy(if line_type == line_type."dots" then PaintingStrategy.points

else if line_type == line_type."dashes" then PaintingStrategy.dashes

else if line_type == line_type."solid" then PaintingStrategy.line

else PaintingStrategy.squares);

# -------------------

addchartbubble(bn == 1, v,

line_type

, color.yellow, no);ref,

https://usethinkscript.com/threads/...remove-it-once-price-hits-it.5257/#post-75706

notes at the end of the study