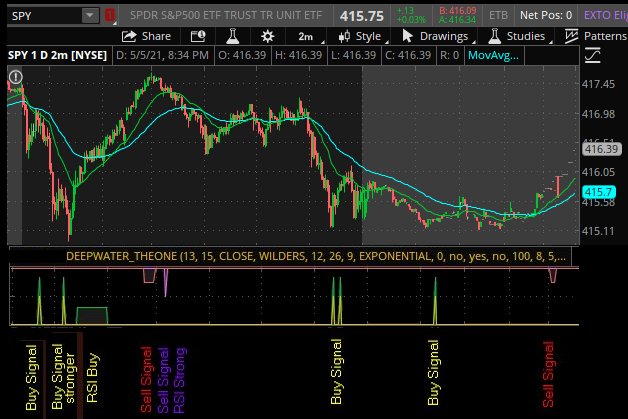

That’s the point I was getting at earlier. Your buy signals are great, but your sell signals aren’t triggered in downtrends. This makes scalping a mean reversion during a downtrend, with this indicator, extremely risky if relying on the exit signal. This will happen on a 1 minute chart just as it will a day chart. It’s difficult to find the balance.The code gives plenty of great buy signals. It's figuring out when to sell and not sell too early. So I trade with a yellow + green spikes as buys and wait for an RSI cumulative Purple sell

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DEEPWATER_THE ONE For ThinkOrSwim

- Thread starter Deepwater

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Should sell signals be triggered in down trends? That would be the job of stop loss orders. What your asking for is Clairvoyance. When a buy signal is generated it is because you met whatever conditions you set to trigger that buy signal. Now what you might be on to is that every buy signal needs to be paired to a sell signal. and if the price moves so many percent against the buy signal you trigger a sell to stop out your position. What we would have to figure out is how much slippage you or I want to tolerate. See the slippery slope we are on Chris?That’s the point I was getting at earlier. Your buy signals are great, but your sell signals aren’t triggered in downtrends. This makes scalping a mean reversion during a downtrend, with this indicator, extremely risky if relying on the exit signal. This will happen on a 1 minute chart just as it will a day chart. It’s difficult to find the balance.

“That would be the job of stop loss orders”Then why have sell signals at all?.“Should sell signals be triggered in down trends?” Yes, especially since that’s where your buy signals are triggered. It would serve to keep traders out of failed breakouts. Seems reasonable and doable. You just haven’t defined that condition yet. Your other signals are great though, and please don’t feel like I’m putting your indicator down. It really catches some nice signals.Should sell signals be triggered in down trends? That would be the job of stop loss orders. What your asking for is Clairvoyance. When a buy signal is generated it is because you met whatever conditions you set to trigger that buy signal. Now what you might be on to is that every buy signal needs to be paired to a sell signal. and if the price moves so many percent against the buy signal you trigger a sell to stop out your position. What we would have to figure out is how much slippage you or I want to tolerate. See the slippery slope we are on Chris?

Thank you.I updated the Page 1 code and placed a 5/6/2021 Revision date based on some feedback today. Should see a few more sells based off RSI overbought. TY

plot TrendReversal20 = 1 - (((RSIAvg3 >= 68 and RSI < RSIAvg3[-2]) and RSI3OverBoughtpivit)/ 2) ;

plot TrendReversal20a = 1 - ((((RSIAvg3 >= 60 and RSIAvg3 < 68 )and RSI < RSIAvg3[-2]) and RSI3OverBoughtpivit) / 4) ;

- RSIAvg3[-2] is still a bit worry some for me. Still looking ahead and plotting after 2 bars into the future.

Good point. Definitely getting more sells now with it changed to RSIAvg3[2]. That was a key error. I updated page 1 code. Ty so much Miklosh.Thank you.

plot TrendReversal20 = 1 - (((RSIAvg3 >= 68 and RSI < RSIAvg3[-2]) and RSI3OverBoughtpivit)/ 2) ;

plot TrendReversal20a = 1 - ((((RSIAvg3 >= 60 and RSIAvg3 < 68 )and RSI < RSIAvg3[-2]) and RSI3OverBoughtpivit) / 4) ;

- RSIAvg3[-2] is still a bit worry some for me. Still looking ahead and plotting after 2 bars into the future.

Last edited:

OK Update your code from page 1 DEEPWATER_THE ONE and tell me if it is any better. I am running it with your confirmation code to see if they complimentThat’s the point I was getting at earlier. Your buy signals are great, but your sell signals aren’t triggered in downtrends. This makes scalping a mean reversion during a downtrend, with this indicator, extremely risky if relying on the exit signal. This will happen on a 1 minute chart just as it will a day chart. It’s difficult to find the balance.

http://tos.mx/MS82qE1. Did I copy your script correctly? It doesn't appear on my chart.I call this study THE ONE. It is basically throw everything but the kitchen sink into one study that would help both a new trader and an experienced trader, Alert me to things gapping, stocks suddenly seeing large volume, stocks with RSIs in extreme ranges. There are so many widgets of script in here that I look forward to others trying to improve it for the group. It is my payback to all of you who taught me so much and were unselfish with your knowledge and code. This is the one study I can not live without. I have 3 monitors and 30 charts I watch and "THE ONE" is the only indicator under each chart. I recently added what I call cumulative RSI extreme to it. What it does is if RSI goes overbought or oversold it starts cumulating and incrementing a count that seems to give a pretty good sell or buy signal. I have never seen this done and it is some neat code. I also look at MACD as it rounds over the top or bottom to trigger buy or sell signals. I do this with Spikes. Spikes from the top down are sells. Spikes from the Bottom up are buys. This is my first post, I just registered after lurking for years.

Code:

Code:#DEEPWATER_THE ONE 5/7/2021 revision #https://usethinkscript.com/threads/deepwater_the-one.6518/ declare lower; input length = 13; input length2 = 15; input price = close; input averageType = AverageType.WILDERS; input fastLength = 12; input slowLength = 26; input MACDLength = 9; input averageTypeMACD = AverageType.EXPONENTIAL; def Diff = MACD(fastLength, slowLength, MACDLength, averageTypeMACD).Diff; def NetChgAvg = MovingAverage(averageType, price - price[1], length); def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def RSIAvg3 = MovingAverage(averageType, (RSI), 3); def RSIAvg5 = MovingAverage(averageType, (RSI), 5); def RSI3OverSoldpivit = RSIAvg3 > RSIAvg3[1] and RSIAvg3[1] > RSIAvg3[2] and RSIAvg3[2] < RSIAvg3[3] and RSIAvg3[3] < RSIAvg3 [4]; def RSI3OverBoughtpivit = RSIAvg3 < RSIAvg3[1] and RSIAvg3[1] < RSIAvg3[2] and RSIAvg3[2] > RSIAvg3[3] and RSIAvg3[3] > RSIAvg3 [4]; #--------------------5 day MA input displace = 0; input showBreakoutSignals = no; def MAvgExp14 = ExpAverage(price[-displace], 14); #--------------------oversold def twoBarPivotMACD = Diff > Diff[1] and Diff[1] > Diff[2] and Diff[2] < Diff[3] and Diff[3] < Diff [4]; def overSoldRSI = RSI <= 32; def overSoldRSIHeavy = RSI <= 30 and Diff < 0 and (close < close[7]); def TrendReversalalert = (twoBarPivotMACD and Highest(overSoldRSI, 6) > 0) / 3; plot TrendReversal = (twoBarPivotMACD and Highest(overSoldRSI, 6) > 0) / 3; Alert(TrendReversalalert, "Buy Alert"); plot TrendReversal1 = (twoBarPivotMACD and Highest(overSoldRSIHeavy, 6) > 0) / 1.2; TrendReversal.SetDefaultColor(GetColor(4));#yellow TrendReversal1.SetDefaultColor(GetColor(6));#green AddLabel(yes, if TrendReversal > 0 then "Buy" else ""); Alert( TrendReversalalert > 0, "Chart is now Oversold ", Alert.BAR, Sound.Ring); AddLabel(TrendReversalalert > 0 , "Chart is now Oversold ", Color.LIME); #-----------------------Overbought def twoBarPivotMACD1 = Diff < Diff[1] and Diff[1] < Diff[2] and Diff[2] > Diff[3] and Diff[3] > Diff [4]; def overboughtRSI = RSIAvg3 >= 65 and Diff > 0; def TrendReversalalert20 = (twoBarPivotMACD1 and Highest(overboughtRSI[1], 7) > 0); plot TrendReversal20 = 1 - (((RSIAvg3 >= 68 and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit)/ 1.5) ; plot TrendReversal20a = 1 - ((((RSIAvg3 >= 60 and RSIAvg3 < 68 )and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit) / 4) ; TrendReversal20.SetDefaultColor(GetColor(5)); #Red TrendReversal20a.SetDefaultColor(GetColor(2)); #lt Red plot TrendReversal50 = 1 - ((RSIAvg5 >= 70 and close < MAvgExp14) / 2) ; TrendReversal50.SetDefaultColor(GetColor(0)); #Red AddLabel(yes, if TrendReversal20 < 1 then "Sell" else ""); Alert( TrendReversal20 < 1 , "Chart is now Overbought ", Alert.BAR, Sound.Ring); AddLabel(TrendReversal20 < 1, "Chart is now Overbought ", Color.LIME); input show_label = yes; input show_bubble = no; #--------------------------- Large 5X and 10X Volume Alert input AverageLength = 100; input VolumeMultiplier = 8; input VolumeMultiplier2 = 5; input MinutesAfterOpen = 30; def AvgVol = Average(volume, AverageLength); def VolX = (volume > AvgVol * VolumeMultiplier) ; def Vol10X = (volume > AvgVol * 10) ; Alert(VolX, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes); AddLabel(VolX > 0, " Has 5X Volume Spike ", Color.LIGHT_GREEN); Alert(Vol10X, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes); AddLabel(Vol10X > 0, " Has 10X Volume Spike ", Color.LIGHT_GREEN); #-------------------------------------GAP UP Price def IsUp = close > open; def IsDown = close < open; def IsDoji = IsDoji(); def avgRange = 0.05 * Average(high - low, 20); def GapUp = IsUp[1] and IsUp[0] and high[1] < low[0] and high[1] < open[0] and (volume > AvgVol * 5) ; Alert(GapUp, Concat(GetSymbolPart(), " GAPUP" ), Alert.BAR, Sound.Ring); AddLabel(GapUp > 0, " GAP Up ", Color.LIGHT_GREEN); #---------------------------------Large Price change 3% def Priceup = IsUp[1] and IsUp[0] and high[1] < high[0] and high[2] * 1.02 < high[0] and high[3] * 1.03 < high[0] and (volume > AvgVol * 3) ; Alert(Priceup, Concat(GetSymbolPart(), " Price JUMP" ), Alert.BAR, Sound.Bell); AddLabel(Priceup > 0, " Price JUMP ", Color.CYAN); #---------------------------------HugePrice change 6% def Priceup2 = IsUp[1] and IsUp[0] and high[1] < high[0] and high[3] * 1.04 < high[0] and high[4] * 1.06 < high[0] and (volume > AvgVol * 3) ; Alert(Priceup2, Concat(GetSymbolPart(), " JUMP! JUMP! JUMP" ), Alert.BAR, Sound.Chimes); AddLabel(Priceup2 > 0, " JUMP! JUMP! JUMP ", Color.LIGHT_RED); #----------------------------------------------------------------------------------------- #--------------------------RSI cumulative running total def MAvgExp7 = ExpAverage(price[-displace], 7); def RSICalc = 50 * (ChgRatio + 1); def RSICalc1 = if RSI > 70 then 3 else if RSI < 30 then -3 else 0; def RSICalc2 = if RSI[1] > 70 then 2 else if RSI[1] < 30 then -2 else 0; def RSICalc3 = if RSI[2] > 70 then 1 else if RSI[2] < 30 then -1 else 0; def RSICalc4 = if RSI[3] > 70 then 1 else if RSI[3] < 30 then -1 else 0; def RSICalc5 = if RSI[4] > 70 then 1 else if RSI[4] < 30 then -1 else 0; def RSICalc6 = if RSI[5] > 70 then 1 else if RSI[5] < 30 then -1 else 0; def RSICalc7 = if RSI[6] > 70 then 1 else if RSI[6] < 30 then -1 else 0; def RSICalc8 = if RSI[7] > 70 then 1 else if RSI[7] < 30 then -1 else 0; def RSICalc9 = if RSI[8] > 70 then 1 else if RSI[8] < 30 then -1 else 0; def RSICalc10 = if RSI[9] > 70 then 1 else if RSI[9] < 30 then -1 else 0; def RSICalc11 = if RSI[10] > 70 then 1 else if RSI[10] < 30 then -1 else 0; def RSICalc12 = if RSI[11] > 70 then 1 else if RSI[11] < 30 then -1 else 0; def RSICalc13 = if RSI[12] > 70 then 1 else if RSI[12] < 30 then -1 else 0; def RSICalc14 = if RSI[13] > 70 then 1 else if RSI[13] < 30 then -1 else 0; def RSICalc15 = if RSI[14] > 70 then 1 else if RSI[14] < 30 then -1 else 0; def RSICalc16 = if RSI[15] > 70 then 1 else if RSI[15] < 30 then -1 else 0; def RSICalc17 = if RSI[16] > 70 then 1 else if RSI[16] < 30 then -1 else 0; def RSICalc18 = if RSI[17] > 70 then 1 else if RSI[17] < 30 then -1 else 0; def RSICalc19 = if RSI[18] > 70 then 1 else if RSI[18] < 30 then -1 else 0; def RSICalc20 = if RSI[19] > 70 then 1 else if RSI[19] < 30 then -1 else 0; def RSICalc21 = if RSI[20] > 70 then 1 else if RSI[20] < 30 then -1 else 0; def RSICalc22 = if RSI[21] > 70 then 1 else if RSI[21] < 30 then -1 else 0; def RSICalc23 = if RSI[22] > 70 then 1 else if RSI[22] < 30 then -1 else 0; def RSICalc24 = if RSI[23] > 70 then 1 else if RSI[23] < 30 then -1 else 0; def RSICalc25 = if RSI[24] > 70 then 1 else if RSI[24] < 30 then -1 else 0; def RSICalc26 = if RSI[25] > 70 then 1 else if RSI[25] < 30 then -1 else 0; def RSICalc27 = if RSI[26] > 70 then 1 else if RSI[26] < 30 then -1 else 0; def RSICalc28 = if RSI[27] > 70 then 1 else if RSI[27] < 30 then -1 else 0; def RSICalc29 = if RSI[28] > 70 then 1 else if RSI[28] < 30 then -1 else 0; def RSICalc30 = if RSI[29] > 70 then 1 else if RSI[29] < 30 then -1 else 0; def RSI30DayAvg = RSICalc1 + RSICalc2 + RSICalc3 + RSICalc4 + RSICalc5 + RSICalc6 + RSICalc7 + RSICalc8 + RSICalc9 + RSICalc10 + RSICalc11 + RSICalc12 + RSICalc13 + RSICalc14 + RSICalc15 + RSICalc16 + RSICalc17 + RSICalc18 + RSICalc19 + RSICalc20 + RSICalc21 + RSICalc22 + RSICalc23 + RSICalc24 + RSICalc25 + RSICalc26 + RSICalc27 + RSICalc28 + RSICalc29 + RSICalc30; AddLabel(RSI30DayAvg >= 10 and RSI30DayAvg < 20, " RSI SELL: " + RSI30DayAvg + " ", Color.ORANGE); AddLabel(RSI30DayAvg >= 20, " RSI SELL: " + RSI30DayAvg + " ", Color.RED); AddLabel(RSI30DayAvg <= -10 and RSI30DayAvg > -20, " RSI BUY: " + RSI30DayAvg + " ", Color.LIME); AddLabel(RSI30DayAvg <= -20, " RSI BUY: " + RSI30DayAvg + " ", Color.DARK_GREEN); plot TrendReversal5 = 1 - (((RSI30DayAvg >= 10 and RSI30DayAvg < 15) and close < MAvgExp7) / 2) ; TrendReversal5.SetDefaultColor(GetColor(0)); #magenta plot TrendReversal5a = 1 - (((RSI30DayAvg >= 16 and RSI30DayAvg < 25) and close < MAvgExp7) / 1.3) ; TrendReversal5a.SetDefaultColor(GetColor(0)); #magenta plot TrendReversal5b = 1 - ((RSI30DayAvg >= 25 and close < MAvgExp7) / 1.05) ; TrendReversal5b.SetDefaultColor(GetColor(0)); #magenta plot TrendReversal6 = ((RSI30DayAvg <= -15 and close > MAvgExp7 ) * .3) ; TrendReversal6.SetDefaultColor(GetColor(6)); #green plot TrendReversal6a = (((RSI30DayAvg <= -20 and RSI30DayAvg > -30) and close > MAvgExp7) * .85) ; TrendReversal6a.SetDefaultColor(GetColor(6)); #green #End Code

When you copy this code to the clipboard (CTRL - c), hit Studies, Edit Studies, on the left side Create, delete the plot Data = close; and paste the code on page 1 you copied into the space (CTRL - v). Up at the top left it will default name Newstudy blah blah bla. Name it DEEPWATER_THE ONE or whatever you want to name it. Hit OK and it should be added to the bottom of your chart. If you have a bunch of studies already loaded they may not all fit below your chart where you can SEE THEM. You may have to move it up or delete Studies your not using. Hope this helpshttp://tos.mx/MS82qE1. Did I copy your script correctly? It doesn't appear on my chart.

Last edited:

dechanchanman

New member

@Deepwater hey thanks for sharing your script i see theres been a few changes is the one on the first page updated? thank you again also may I PM you with some questions? cheers

DE apparently there is no PM feature here. I'll answer what I can.@Deepwater hey thanks for sharing your script i see theres been a few changes is the one on the first page updated? thank you again also may I PM you with some questions? cheers

Noca Jones

New member

dechanchanman

New member

oh ur right lol was gonna ask about your basket stocks i know u said u look at 6-7 at the same time, is it equities? sp stocks? thanksDE apparently there is no PM feature here. I'll answer what I can.

This is awesome! Greatness @Deepwater !

How do you set it up to give you text alerts, for when to buy or sell? Thanks

How do you set it up to give you text alerts, for when to buy or sell? Thanks

Last edited:

Hi @Deepwater - Thanks for sharing this study. This doesn't work for SPX, is there something I can comment out in the code for it to work on SPX?The code gives plenty of great buy signals. It's figuring out when to sell and not sell too early. So I trade with a yellow + green spikes as buys and wait for an RSI cumulative Purple sell

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 23 | |

|

|

Loken (v4) Bullish Smart Money for ThinkOrSwim | Indicators | 31 | |

|

|

Quarterly Theory For ThinkOrSwim | Indicators | 21 | |

| R | Megalodon Momentum For ThinkOrSwim | Indicators | 34 | |

| T | Mega Moving Average For ThinkOrSwim | Indicators | 26 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

320

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.