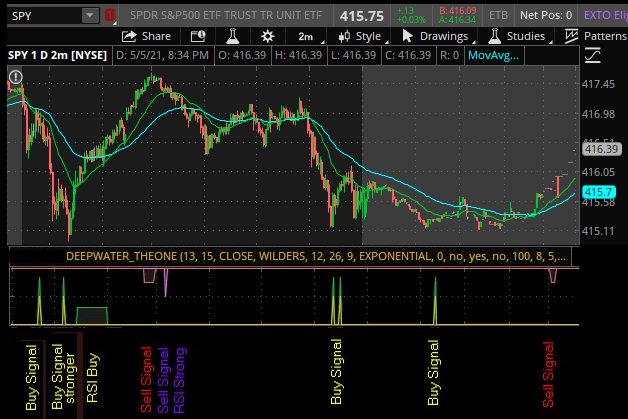

I call this study THE ONE. It is basically throw everything but the kitchen sink into one study that would help both a new trader and an experienced trader, Alerts me to things gapping, stocks suddenly seeing large volume, stocks with RSIs in extreme ranges. There are so many widgets of script in here that I look forward to others trying to improve it for the group. It is my payback to all of you who taught me so much and were unselfish with your knowledge and code. This is the one study I can not live without. I have 3 monitors and 30 charts I watch and "THE ONE" is the only indicator under each chart. I recently added what I call cumulative RSI extreme to it. What it does is if RSI goes overbought or oversold it starts cumulating and incrementing a count that seems to give a pretty good sell or buy signal. I have never seen this done and it is some neat code. I also look at MACD as it rounds over the top or bottom to trigger buy or sell signals. I do this with Spikes. Spikes from the top down are sells. Spikes from the Bottom up are buys. IT MAY BE THE EASIEST STUDY AS FAR AS SIGNALING. IF SOMETHING IS IN ALERT AND NEEDS A LOOK YOU GET AN ALERT. EASY FOR NOVICE and NEWBIES. Just load it and watch it for a week. This is not financial advice. it is a tool to help you make your own decisions.

FOREX or SPX type Indexes use code on page 10

P.S. The code will give signals a bit differently on different time scales so always look at charts that are say 1D 1Min, 2D 5Min and 10D 30Min (these are only examples) and compare the buy and sell signals it's giving you. I am Also running BillWilliams Indicator and Christpher84 ConfirmationCandles (without the arrows) upper and CC Candles Lower Indicators plus I also am running RSI with a RSI Avg only on my main screen chart.

5/17/2021 Added a stronger Buy indicator discriminator for Yellow/Green Buy Spikes.

5/20/2021 Added a stronger buy signal (taller) if a second buy comes within 14 candles of a previous strong buy. Changed Line Width to 2 or 3 to sharpen signal visibility. Reordered plot of yellow line to be after plot of stronger Green buys therefore you should only see Yellow Spike for over sold and only a larger Green Spike for the Strong Buy. No more yellow/Green Spikes.

5/27/2021 Rev 4 Changed RSI threashholds to 65 from 68 and 70 so a Strong Sell Signal should be generated more often at the Tops. changed the 10X volume jump to a 30X volume Jump and set the 5X Volume jump from 8x (mistake) back to 5X.

2/4/2022 revision 5 Changed this line from 100 to 2000; input AverageLength = 2000;

Note: The Words BUY SIGNAL SELL SIGNAL RSI BUY are added to the graphic for clarification and DO NOT Appear in the study

FOREX or SPX type Indexes use code on page 10

P.S. The code will give signals a bit differently on different time scales so always look at charts that are say 1D 1Min, 2D 5Min and 10D 30Min (these are only examples) and compare the buy and sell signals it's giving you. I am Also running BillWilliams Indicator and Christpher84 ConfirmationCandles (without the arrows) upper and CC Candles Lower Indicators plus I also am running RSI with a RSI Avg only on my main screen chart.

5/17/2021 Added a stronger Buy indicator discriminator for Yellow/Green Buy Spikes.

5/20/2021 Added a stronger buy signal (taller) if a second buy comes within 14 candles of a previous strong buy. Changed Line Width to 2 or 3 to sharpen signal visibility. Reordered plot of yellow line to be after plot of stronger Green buys therefore you should only see Yellow Spike for over sold and only a larger Green Spike for the Strong Buy. No more yellow/Green Spikes.

5/27/2021 Rev 4 Changed RSI threashholds to 65 from 68 and 70 so a Strong Sell Signal should be generated more often at the Tops. changed the 10X volume jump to a 30X volume Jump and set the 5X Volume jump from 8x (mistake) back to 5X.

2/4/2022 revision 5 Changed this line from 100 to 2000; input AverageLength = 2000;

Note: The Words BUY SIGNAL SELL SIGNAL RSI BUY are added to the graphic for clarification and DO NOT Appear in the study

Code:

#DEEPWATER_THE ONE 2/4/2022 revision 5

#https://usethinkscript.com/threads/deepwater_the-one.6518/

declare lower;

input length = 20;

input length2 = 15;

input price = close;

input averageType = AverageType.WILDERS;

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input averageTypeMACD = AverageType.EXPONENTIAL;

def Diff = MACD(fastLength, slowLength, MACDLength, averageTypeMACD).Diff;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def RSIAvg3 = MovingAverage(averageType, (RSI), 3);

def RSIAvg5 = MovingAverage(averageType, (RSI), 5);

def RSI3OverSoldpivit = RSIAvg3 > RSIAvg3[1] and RSIAvg3[1] > RSIAvg3[2] and RSIAvg3[2] < RSIAvg3[3] and RSIAvg3[3] < RSIAvg3 [4];

def RSI3OverBoughtpivit = RSIAvg3 < RSIAvg3[1] and RSIAvg3[1] < RSIAvg3[2] and RSIAvg3[2] > RSIAvg3[3] and RSIAvg3[3] > RSIAvg3 [4];

#--------------------5 day MA

input displace = 0;

input showBreakoutSignals = no;

def MAvgExp14 = ExpAverage(price[-displace], 14);

#--------------------oversold

def twoBarPivotMACD = Diff > Diff[1] and Diff[1] > Diff[2] and Diff[2] < Diff[3] and Diff[3] < Diff [4];

def overSoldRSI = RSI <= 32;

def overSoldRSIHeavy = RSI <= 30 and Diff < 0 and (close < close[7]);

def TrendReversalalert = (twoBarPivotMACD and Highest(overSoldRSI, 6) > 0) / 3;

Alert(TrendReversalalert, "Buy Alert");

plot TrendReversal1 = (twoBarPivotMACD and RSIAvg3 < 45 and Highest(overSoldRSIHeavy, 6) > 0) / 1.4;

plot TrendReversalstrongbuy = ((TrendReversal1[1] > 0 or TrendReversal1[2] > 0 or TrendReversal1[3] > 0 or TrendReversal1[4] > 0 or TrendReversal1[5] > 0 or TrendReversal1[6] > 0 or TrendReversal1[7] > 0 or TrendReversal1[8] > 0 or TrendReversal1[9] > 0 or TrendReversal1[10] > 0 or TrendReversal1[11] > 0 or TrendReversal1[12] > 0 or TrendReversal1[13] > 0 or TrendReversal1[14] > 0) and twoBarPivotMACD and RSIAvg3 < 45 and Highest(overSoldRSIHeavy, 6) > 0) / 1.1;

plot TrendReversal = (twoBarPivotMACD and TrendReversalstrongbuy < 1 and Highest(overSoldRSI, 6) > 0) / 3;

TrendReversal.SetDefaultColor(GetColor(4));#yellow

TrendReversal1.SetDefaultColor(GetColor(6));#green

TrendReversalstrongbuy.SetDefaultColor(GetColor(6));#green

TrendReversalstrongbuy.SetLineWeight(3);

TrendReversal1.SetLineWeight(2);

AddLabel(yes, if TrendReversal > 0 then "Buy" else "");

Alert( TrendReversalalert > 0, "Chart is now Oversold ", Alert.BAR, Sound.Ring);

AddLabel(TrendReversalalert > 0

, "Chart is now Oversold ", Color.LIME);

#-----------------------Overbought

def twoBarPivotMACD1 = Diff < Diff[1] and Diff[1] < Diff[2] and Diff[2] > Diff[3] and Diff[3] > Diff [4];

def overboughtRSI = RSIAvg3 >= 65 and Diff > 0;

def TrendReversalalert20 = (twoBarPivotMACD1 and Highest(overboughtRSI[1], 7) > 0);

plot TrendReversal20 = 1 - (((RSIAvg3 >= 65 and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit)/ 1.5) ;

plot TrendReversal20a = 1 - ((((RSIAvg3 >= 60 and RSIAvg3 < 65 )and RSI < RSIAvg3[2]) and RSI3OverBoughtpivit) / 4) ;

TrendReversal20.SetDefaultColor(GetColor(5)); #Red

TrendReversal20a.SetDefaultColor(GetColor(2)); #lt Red

TrendReversal20a.SetLineWeight(2);

TrendReversal20.SetLineWeight(3);

plot TrendReversal50 = 1 - ((RSIAvg5 >= 65 and close < MAvgExp14) / 2) ;

TrendReversal50.SetDefaultColor(GetColor(0)); #Red

TrendReversal50.SetLineWeight(3);

AddLabel(yes, if TrendReversal20 < 1 then "Sell" else "");

Alert( TrendReversal20 < 1 , "Chart is now Overbought ", Alert.BAR, Sound.Ring);

AddLabel(TrendReversal20 < 1, "Chart is now Overbought ", Color.LIME);

input show_label = yes;

input show_bubble = no;

#--------------------------- Large 5X and 30X Volume Alert

input AverageLength = 2000;

input VolumeMultiplier = 10;

input VolumeMultiplier2 = 5;

input MinutesAfterOpen = 30;

def AvgVol = Average(volume, AverageLength);

def Vol5X = (volume > AvgVol * VolumeMultiplier2);

def Vol10X = (volume > AvgVol * VolumeMultiplier);

def Vol30X = (volume > AvgVol * 30) ;

Alert(Vol5X, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes);

AddLabel(Vol5X > 0, " Has 5X Volume Spike ", Color.LIGHT_GREEN);

Alert(Vol10X, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes);

AddLabel(Vol10X > 0, " Has 10X Volume Spike ", Color.LIGHT_GREEN);

Alert(Vol30X, Concat(GetSymbolPart(), " has a large volume spike." ), Alert.BAR, Sound.Chimes);

AddLabel(Vol30X > 0, " Has 30X Volume Spike ", Color.LIGHT_GREEN);

#-------------------------------------GAP UP Price

def IsUp = close > open;

def IsDown = close < open;

def IsDoji = IsDoji();

def avgRange = 0.05 * Average(high - low, 20);

def GapUp =

IsUp[1] and

IsUp[0] and

high[1] < low[0] and

high[1] < open[0] and

(volume > AvgVol * 5) ;

Alert(GapUp, Concat(GetSymbolPart(), " GAPUP" ), Alert.BAR, Sound.Ring);

AddLabel(GapUp > 0, " GAP Up ", Color.LIGHT_GREEN);

#---------------------------------Large Price change 3%

def Priceup =

IsUp[1] and

IsUp[0] and

high[1] < high[0] and

high[2] * 1.02 < high[0] and

high[3] * 1.03 < high[0] and

(volume > AvgVol * 3) ;

Alert(Priceup, Concat(GetSymbolPart(), " Price JUMP" ), Alert.BAR, Sound.Bell);

AddLabel(Priceup > 0, " Price JUMP ", Color.CYAN);

#---------------------------------HugePrice change 6%

def Priceup2 =

IsUp[1] and

IsUp[0] and

high[1] < high[0] and

high[3] * 1.04 < high[0] and

high[4] * 1.06 < high[0] and

(volume > AvgVol * 3) ;

Alert(Priceup2, Concat(GetSymbolPart(), " JUMP! JUMP! JUMP" ), Alert.BAR, Sound.Chimes);

AddLabel(Priceup2 > 0, " JUMP! JUMP! JUMP ", Color.LIGHT_RED);

#-----------------------------------------------------------------------------------------

#--------------------------RSI cumulative running total

def MAvgExp7 = ExpAverage(price[-displace], 7);

def RSICalc = 50 * (ChgRatio + 1);

def RSICalc1 = if RSI > 70 then 3 else if RSI < 30 then -3 else 0;

def RSICalc2 = if RSI[1] > 70 then 2 else if RSI[1] < 30 then -2 else 0;

def RSICalc3 = if RSI[2] > 70 then 1 else if RSI[2] < 30 then -1 else 0;

def RSICalc4 = if RSI[3] > 70 then 1 else if RSI[3] < 30 then -1 else 0;

def RSICalc5 = if RSI[4] > 70 then 1 else if RSI[4] < 30 then -1 else 0;

def RSICalc6 = if RSI[5] > 70 then 1 else if RSI[5] < 30 then -1 else 0;

def RSICalc7 = if RSI[6] > 70 then 1 else if RSI[6] < 30 then -1 else 0;

def RSICalc8 = if RSI[7] > 70 then 1 else if RSI[7] < 30 then -1 else 0;

def RSICalc9 = if RSI[8] > 70 then 1 else if RSI[8] < 30 then -1 else 0;

def RSICalc10 = if RSI[9] > 70 then 1 else if RSI[9] < 30 then -1 else 0;

def RSICalc11 = if RSI[10] > 70 then 1 else if RSI[10] < 30 then -1 else 0;

def RSICalc12 = if RSI[11] > 70 then 1 else if RSI[11] < 30 then -1 else 0;

def RSICalc13 = if RSI[12] > 70 then 1 else if RSI[12] < 30 then -1 else 0;

def RSICalc14 = if RSI[13] > 70 then 1 else if RSI[13] < 30 then -1 else 0;

def RSICalc15 = if RSI[14] > 70 then 1 else if RSI[14] < 30 then -1 else 0;

def RSICalc16 = if RSI[15] > 70 then 1 else if RSI[15] < 30 then -1 else 0;

def RSICalc17 = if RSI[16] > 70 then 1 else if RSI[16] < 30 then -1 else 0;

def RSICalc18 = if RSI[17] > 70 then 1 else if RSI[17] < 30 then -1 else 0;

def RSICalc19 = if RSI[18] > 70 then 1 else if RSI[18] < 30 then -1 else 0;

def RSICalc20 = if RSI[19] > 70 then 1 else if RSI[19] < 30 then -1 else 0;

def RSICalc21 = if RSI[20] > 70 then 1 else if RSI[20] < 30 then -1 else 0;

def RSICalc22 = if RSI[21] > 70 then 1 else if RSI[21] < 30 then -1 else 0;

def RSICalc23 = if RSI[22] > 70 then 1 else if RSI[22] < 30 then -1 else 0;

def RSICalc24 = if RSI[23] > 70 then 1 else if RSI[23] < 30 then -1 else 0;

def RSICalc25 = if RSI[24] > 70 then 1 else if RSI[24] < 30 then -1 else 0;

def RSICalc26 = if RSI[25] > 70 then 1 else if RSI[25] < 30 then -1 else 0;

def RSICalc27 = if RSI[26] > 70 then 1 else if RSI[26] < 30 then -1 else 0;

def RSICalc28 = if RSI[27] > 70 then 1 else if RSI[27] < 30 then -1 else 0;

def RSICalc29 = if RSI[28] > 70 then 1 else if RSI[28] < 30 then -1 else 0;

def RSICalc30 = if RSI[29] > 70 then 1 else if RSI[29] < 30 then -1 else 0;

def RSI30DayAvg = RSICalc1 + RSICalc2 + RSICalc3 + RSICalc4 + RSICalc5 + RSICalc6 + RSICalc7 + RSICalc8 + RSICalc9 + RSICalc10 + RSICalc11 + RSICalc12 + RSICalc13 + RSICalc14 + RSICalc15 + RSICalc16 + RSICalc17 + RSICalc18 + RSICalc19 + RSICalc20 + RSICalc21 + RSICalc22 + RSICalc23 + RSICalc24 + RSICalc25 + RSICalc26 + RSICalc27 + RSICalc28 + RSICalc29 + RSICalc30;

AddLabel(RSI30DayAvg >= 10 and RSI30DayAvg < 20, " RSI SELL: " + RSI30DayAvg + " ", Color.ORANGE);

AddLabel(RSI30DayAvg >= 20, " RSI SELL: " + RSI30DayAvg + " ", Color.RED);

AddLabel(RSI30DayAvg <= -10 and RSI30DayAvg > -20, " RSI BUY: " + RSI30DayAvg + " ", Color.LIME);

AddLabel(RSI30DayAvg <= -20, " RSI BUY: " + RSI30DayAvg + " ", Color.DARK_GREEN);

plot TrendReversal5 = 1 - (((RSI30DayAvg >= 10 and RSI30DayAvg < 15) and close < MAvgExp7) / 2) ;

TrendReversal5.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal5a = 1 - (((RSI30DayAvg >= 16 and RSI30DayAvg < 25) and close < MAvgExp7) / 1.3) ;

TrendReversal5a.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal5b = 1 - ((RSI30DayAvg >= 25 and close < MAvgExp7) / 1.05) ;

TrendReversal5b.SetDefaultColor(GetColor(0)); #magenta

plot TrendReversal6 = ((RSI30DayAvg <= -15 and close > MAvgExp7 ) * .3) ;

TrendReversal6.SetDefaultColor(GetColor(6)); #green

plot TrendReversal6a = (((RSI30DayAvg <= -20 and RSI30DayAvg > -30) and close > MAvgExp7) * .85) ;

TrendReversal6a.SetDefaultColor(GetColor(6)); #green

TrendReversal6a.SetLineWeight(3);

TrendReversal5b.SetLineWeight(3);

TrendReversal6.SetLineWeight(2);

TrendReversal5a.SetLineWeight(2);

#End Code

Last edited: