Here is an adaption of the Tradingview code.

Rather than separate codes for each timeframe, this uses input agg and you select the aggregation period.

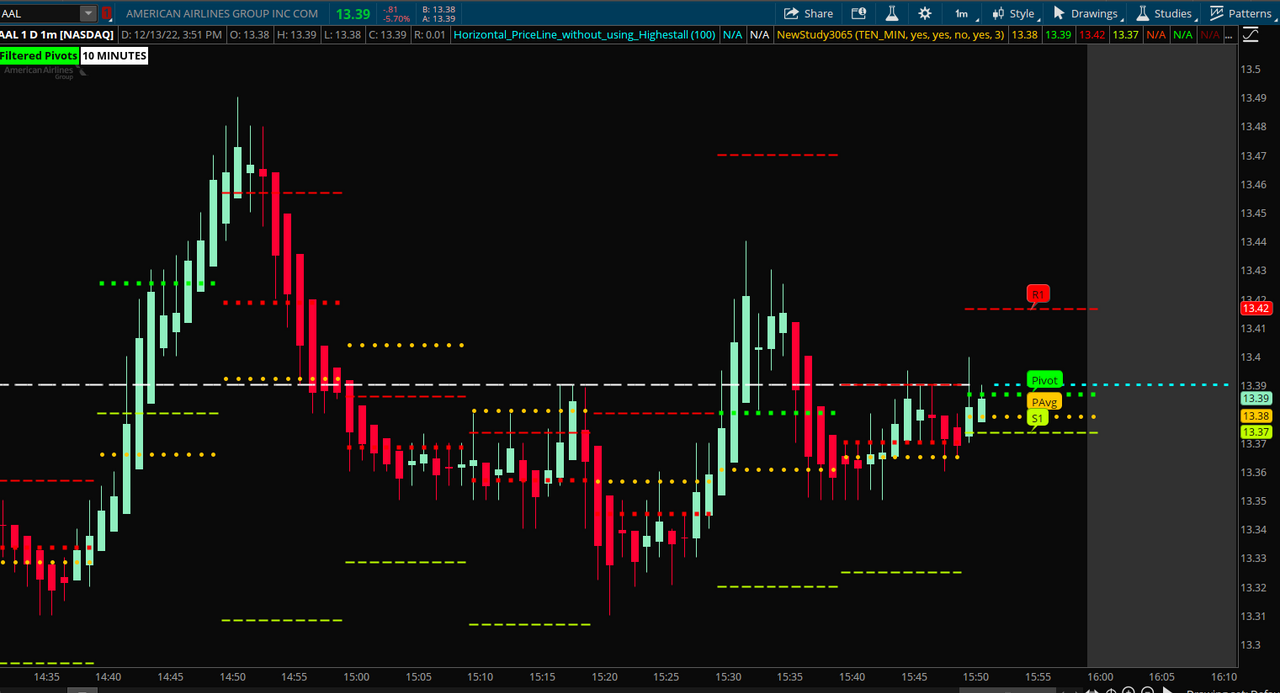

A label will show the choice of Filtered Pivots or Classic Pivots as well as the agg period selected.

The Filtered Pivots are colored green/red as bull/bear or white for Classic Pivots.

The R1-3 colors above the pivot are shades of Red and the S1-3 are shades of green.

Bubbles will display the last agg periods lines type.

Rather than separate codes for each timeframe, this uses input agg and you select the aggregation period.

A label will show the choice of Filtered Pivots or Classic Pivots as well as the agg period selected.

The Filtered Pivots are colored green/red as bull/bear or white for Classic Pivots.

The R1-3 colors above the pivot are shades of Red and the S1-3 are shades of green.

Bubbles will display the last agg periods lines type.

Ruby:

#//Created by ChrisMoody 11-23-14 with Special Thanks to TheLark...AKA...The Coding Genius

#study(title="CM_Pivot Points_M-W-D_4H_1H_Filtered", shorttitle="CM_Pivots_Filtered", overlay=true)

#Modified by Sleepyz

input agg = AggregationPeriod.HOUR;

input use_filtered = yes;#input(true,title="Show Filtered Pivots")

input show_avg = yes;#input(true,title="Show Pivot Average")

#sh = input(false, title="Show 1 Hour Pivots?")

#sf = input(false, title="Show 4 Hour Pivots?")

#sd = input(false, title="Show Daily Pivots?")

#sw = input(false, title="Show Weekly Pivots?")

#sm = input(true, title="Show Monthly Pivots?")

#sy = input(false, title="Show Yearly Pivots?")

input show_r3_s3 = no;#input(false, title="Show R3 & S3 Only On 1 Hour & 4 Hour?")

def na = Double.NaN;

def l = low(period = agg);

def h = high(period = agg);

def c = close(period = agg);

#// Classic Pivot

def pivot = (h + l + c ) / 3.0;

#// Filter Cr

def bull = pivot > (pivot + pivot[1]) / 2 + .0025;

def bear = pivot < (pivot + pivot[1]) / 2 - .0025;

AddLabel(1, if use_filtered then "Filtered Pivots" else "Classic Pivots", if use_filtered and bull then Color.GREEN else if use_filtered and bear then Color.RED else Color.WHITE);

AddLabel(1, if agg < AggregationPeriod.HOUR

then (agg / 60000) + " MINUTES"

else if agg < AggregationPeriod.DAY

then (agg / 60000 / 60) + " HOURS"

else if agg < AggregationPeriod.WEEK

then (agg / 60000 /1440 ) + " DAYS"

else if agg == AggregationPeriod.WEEK

then "WEEK"

else if agg == AggregationPeriod.MONTH

then "MONTH"

else if agg == AggregationPeriod.QUARTER

then "QUARTER"

else "YEAR", Color.WHITE);

#// Classic Pivots

def r1 = if use_filtered and bear

then pivot + (pivot - l)

else if use_filtered and bull

then pivot + (h - l)

else pivot + (pivot - l);

def s1 = if use_filtered and bull

then pivot - (h - pivot)

else if use_filtered and bear

then pivot - (h - l)

else pivot - (h - pivot);

def r2 = if use_filtered

then na

else pivot + (h - l);

def s2 = if use_filtered

then na

else pivot - (h - l);

def r3 = if show_r3_s3 and r1 + (h - l)

then r1 + (h - l)

else na;

def s3 = if show_r3_s3 and s1 - (h - l)

then s1 - (h - l)

else na;

#//Pivot Average Calculation

def smaP = SimpleMovingAvg(pivot, 3);

#//1 Hour Pivots

#def htime_pivot = security(tickerid, '60', pivot[1])

#def htime_pivotAvg = security(tickerid, '60', smaP[1])

#def htime_R1 = security(tickerid, '60', r1[1])

#def htime_S1 = security(tickerid, '60', s1[1])

#def htime_R2 = security(tickerid, '60', r2[1])

#def htime_S2 = security(tickerid, '60', s2[1])

#def htime_R3 = security(tickerid, '60', r3[1])

#def htime_S3 = security(tickerid, '60', s3[1])

plot agg_pivot_avg = if show_avg

then smaP

else na;# title="Hourly Pivot Average",style=cross, color=orange,linewidth=2)

plot agg_pivot = pivot;#(sh and htime_pivot ? htime_pivot : na, title="Hourly Pivot",style=circles, color=fuchsia,linewidth=2)

plot agg_r1 = r1;#(sh and htime_R1 ? htime_R1 : na, title="Hourly R1",style=circles, color=#DC143C,linewidth=2)

plot agg_s1 = s1;#(sh and htime_S1 ? htime_S1 : na, title="Hourly S1",style=circles, color=lime,linewidth=2)

plot agg_r2 = r2;#(sh and htime_R2 ? htime_R2 : na, title="Hourly R2",style=circles, color=maroon,linewidth=2)

plot agg_s2 = s2;#(sh and htime_S2 ? htime_S2 : na, title="Hourly S2",style=circles, color=#228B22,linewidth=2)

plot agg_r3 = r3;#(sh and htime_R3 ? htime_R3 : na, title="Hourly R3",style=circles, color=#FA8072,linewidth=2)

plot agg_s3 = s3;#(sh and htime_S3 ? htime_S3 : na, title="Hourly S3",style=circles, color=#CD5C5C,linewidth=2)

agg_pivot_avg.SetDefaultColor(Color.ORANGE);

agg_pivot_avg.SetPaintingStrategy(PaintingStrategy.POINTS);

agg_pivot_avg.SetLineWeight(2);

agg_pivot.AssignValueColor(if use_filtered and bull then Color.GREEN else if use_filtered and bear then Color.RED else Color.WHITE);

agg_pivot.SetPaintingStrategy(PaintingStrategy.SQUARES);

agg_pivot.SetLineWeight(2);

#R1-3 Reds

agg_r1.SetDefaultColor(Color.RED);

agg_r1.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_r1.SetLineWeight(2);

agg_r2.SetDefaultColor(Color.LIGHT_RED);

agg_r2.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_r2.SetLineWeight(2);

agg_r3.SetDefaultColor(Color.DARK_RED);

agg_r3.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_r3.SetLineWeight(2);

#S1-3 - Limes and Greens

agg_s1.SetDefaultColor(Color.LIME);

agg_s1.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_s1.SetLineWeight(2);

agg_s2.SetDefaultColor(Color.GREEN);

agg_s2.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_s2.SetLineWeight(2);

agg_s3.SetDefaultColor(Color.DARK_GREEN);

agg_s3.SetPaintingStrategy(PaintingStrategy.DASHES);

agg_s3.SetLineWeight(2);

input show_bubbles = yes;

input bubblemover = 3;

def b = bubblemover;

def b1 = b + 1;

def bubbles = show_bubbles and IsNaN(close[b]) and !IsNaN(close[b1]);

AddChartBubble(bubbles and agg_pivot_avg[b], agg_pivot_avg[b], "PAvg", agg_pivot_avg.TakeValueColor());

AddChartBubble(bubbles and agg_pivot[b], agg_pivot[b], "Pivot", agg_pivot.TakeValueColor());

AddChartBubble(bubbles and agg_r1[b], agg_r1[b], "R1", agg_r1.TakeValueColor());

AddChartBubble(bubbles and agg_r2[b], agg_r2[b], "R2", agg_r2.TakeValueColor());

AddChartBubble(bubbles and agg_r3[b], agg_r3[b], "R3", agg_r3.TakeValueColor());

AddChartBubble(bubbles and agg_s1[b], agg_s1[b], "S1", agg_s1.TakeValueColor());

AddChartBubble(bubbles and agg_s2[b], agg_s2[b], "S2", agg_s2.TakeValueColor());

AddChartBubble(bubbles and agg_s3[b], agg_s3[b], "S3", agg_s3.TakeValueColor());

Last edited by a moderator: