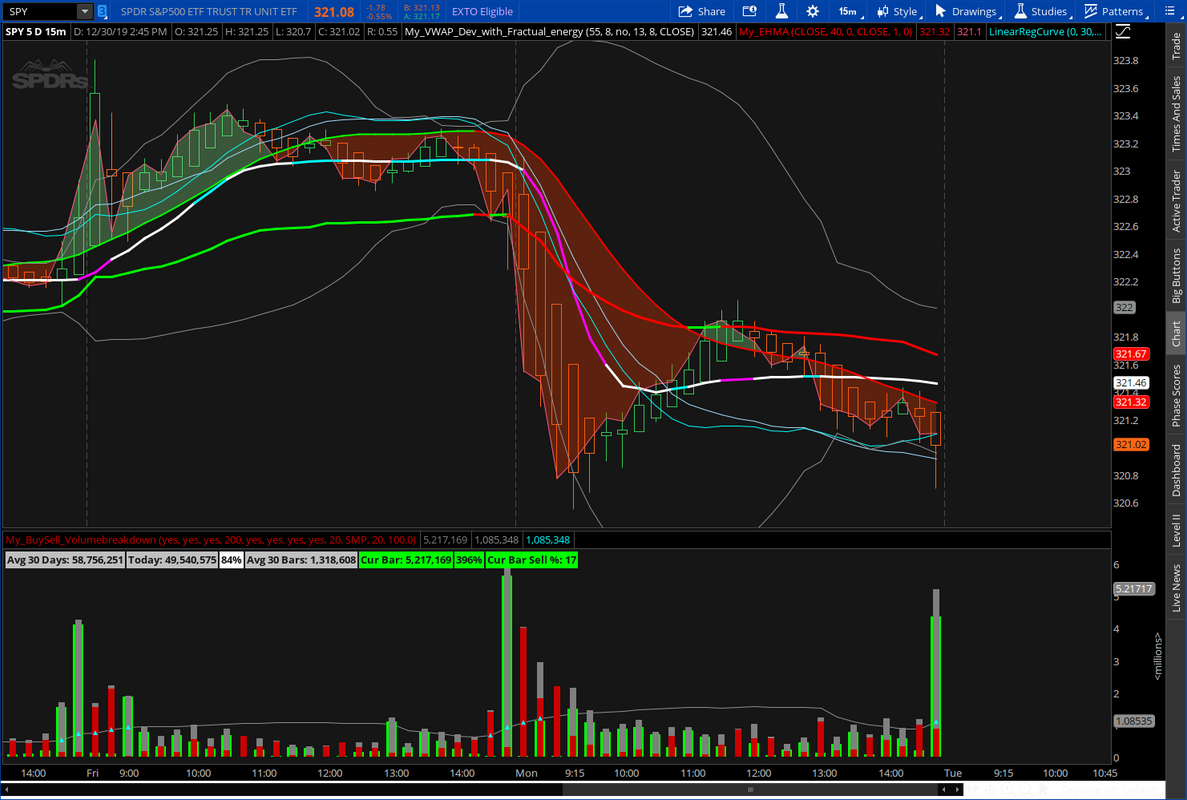

Volume indicator showing total, buy, and sell volumes as a histogram. Also average volume as a line plot. Bars with a specified percent over the average volume are marked on the bar. Additional Volume information provided by labels.

Rework of the previous study to show better representation of what volume is doing. Please consider replacing the old study if you are using it.

Rework of the previous study to show better representation of what volume is doing. Please consider replacing the old study if you are using it.

Code:

#Volume Buy Sell Pressure with Hot Percent for ThinkorSwim

# Show total volume in gray. Buying volume in green. Sell Volume in red.

# Volume average is gray line.

# Specified percent over average volume is cyan triangles.

# Horserider 12/30/2019 derived from some already existing studies.

declare lower;

#Inputs

input Show30DayAvg = yes;

input ShowTodayVolume = yes;

input ShowPercentOf30DayAvg = yes;

input UnusualVolumePercent = 200;

input Show30BarAvg = yes;

input ShowCurrentBar = yes;

input ShowPercentOf30BarAvg = yes;

input ShowSellVolumePercent = yes;

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

def buying = V*(C-L)/(H-L);

def selling = V*(H-C)/(H-L);

# Selling Volume

Plot SellVol = selling;

SellVol.setPaintingStrategy(PaintingStrategy.Histogram);

SellVol.SetDefaultColor(Color.Red);

SellVol.HideTitle();

SellVol.HideBubble();

SellVol.SetLineWeight(1);

# Total Volume

# Note that Selling + Buying Volume = Volume.

plot TV = volume;

TV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

TV.SetDefaultColor(Color.GRAY);

#TV.HideTitle();

#TV.HideBubble();

TV.SetLineWeight(1);

Plot BuyVol = buying;

BuyVol.setPaintingStrategy(PaintingStrategy.Histogram);

BuyVol.SetDefaultColor(Color.Green);

BuyVol.HideTitle();

BuyVol.HideBubble();

BuyVol.SetLineWeight(5);

#Volume Data

def volLast30DayAvg = (volume(period = "DAY")[1] + volume(period = "DAY")[2] + volume(period = "DAY")[3] + volume(period = "DAY")[4] + volume(period = "DAY")[5] + volume(period = "DAY")[6] + volume(period = "DAY")[7] + volume(period = "DAY")[8] + volume(period = "DAY")[9] + volume(period = "DAY")[10] + volume(period = "DAY")[11] + volume(period = "DAY")[12] + volume(period = "DAY")[13] + volume(period = "DAY")[14] + volume(period = "DAY")[15] + volume(period = "DAY")[16] + volume(period = "DAY")[17] + volume(period = "DAY")[18] + volume(period = "DAY")[19] + volume(period = "DAY")[20] + volume(period = "DAY")[21] + volume(period = "DAY")[22] + volume(period = "DAY")[23] + volume(period = "DAY")[24] + volume(period = "DAY")[25] + volume(period = "DAY")[26] + volume(period = "DAY")[27] + volume(period = "DAY")[28] + volume(period = "DAY")[29] + volume(period = "DAY")[30]) / 30;

def today = volume(period = "DAY");

def percentOf30Day = Round((today / volLast30DayAvg) * 100, 0);

def avg30Bars = (volume[1] + volume[2] + volume[3] + volume[4] + volume[5] + volume[6] + volume[7] + volume[8] + volume[9] + volume[10] + volume[11] + volume[12] + volume[13] + volume[14] + volume[15] + volume[16] + volume[17] + volume[18] + volume[19] + volume[20] + volume[21] + volume[22] + volume[23] + volume[24] + volume[25] + volume[26] + volume[27] + volume[28] + volume[29] + volume[30]) / 30;

def curVolume = volume;

def percentOf30Bar = Round((curVolume / avg30Bars) * 100, 0);

def SellVolPercent = Round((Selling / Volume) * 100, 0);

# Labels

AddLabel(Show30DayAvg, "Avg 30 Days: " + Round(volLast30DayAvg, 0), Color.LIGHT_GRAY);

AddLabel(ShowTodayVolume, "Today: " + today, (if percentOf30Day >= UnusualVolumePercent then Color.GREEN else if percentOf30Day >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowPercentOf30DayAvg, percentOf30Day + "%", (if percentOf30Day >= UnusualVolumePercent then Color.GREEN else if percentOf30Day >= 100 then Color.ORANGE else Color.WHITE) );

AddLabel(Show30BarAvg, "Avg 30 Bars: " + Round(avg30Bars, 0), Color.LIGHT_GRAY);

AddLabel(ShowCurrentBar, "Cur Bar: " + curVolume, (if percentOf30Bar >= UnusualVolumePercent then Color.GREEN else if PercentOf30Bar >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowPercentOf30BarAvg, PercentOf30Bar + "%", (if PercentOf30Bar >= UnusualVolumePercent then Color.GREEN else if PercentOf30Bar >= 100 then Color.ORANGE else Color.WHITE) );

AddLabel(ShowSellVolumePercent, "Cur Bar Sell %: " + SellVolPercent, (if SellVolPercent > 51 then Color.RED else if SellVolPercent < 49 then Color.GREEN else Color.ORANGE));

input length = 20;

plot VolAvg = Average(volume, length);

VolAvg.SetDefaultColor(GetColor(7));

# hiVolume indicator

# source: http://tinboot.blogspot.com

# author: allen everhart

input type = { default SMP, EXP } ;

input length1 = 20 ;

input hotPct = 100.0 ;

def ma =

if type == type.SMP then

SimpleMovingAvg(volume, length)

else

MovAvgExponential(volume, length);

plot hv =

if 100 * ((volume / ma) - 1) >= hotPct then

ma

else

Double.NaN;

hv.SetDefaultColor( Color.CYAN);

hv.SetLineWeight(1) ;

hv.SetPaintingStrategy( PaintingStrategy.TRIANGLES);

Last edited by a moderator: