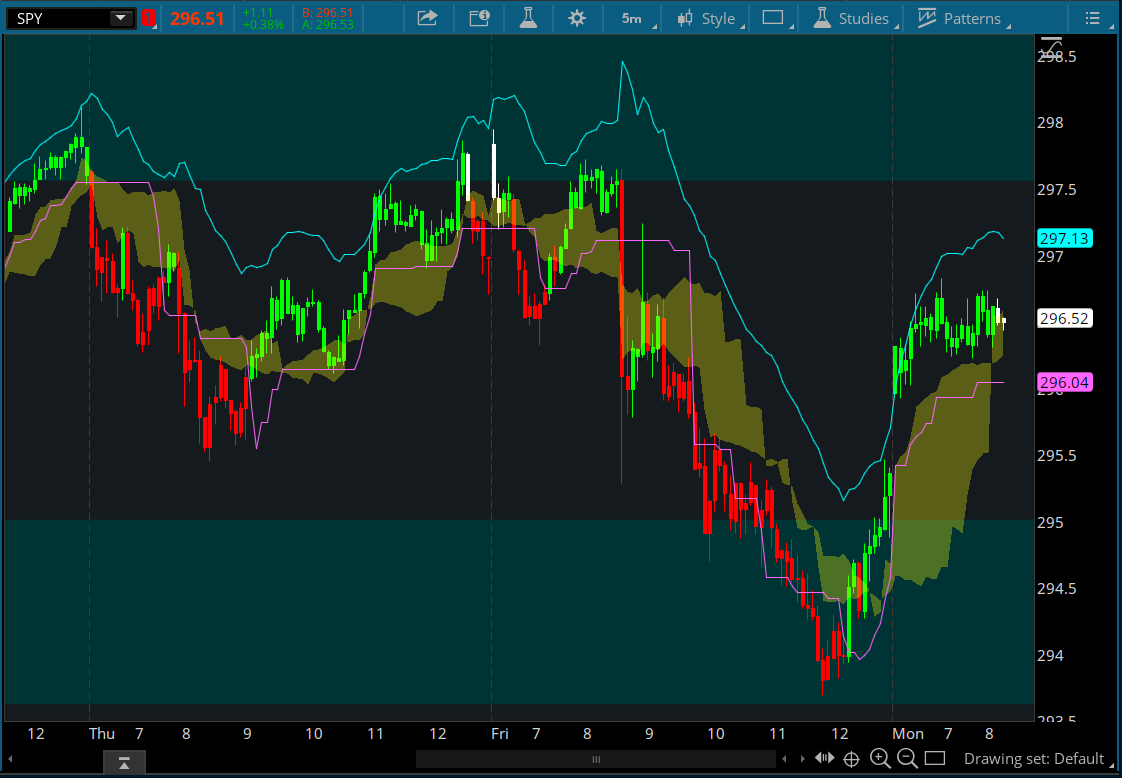

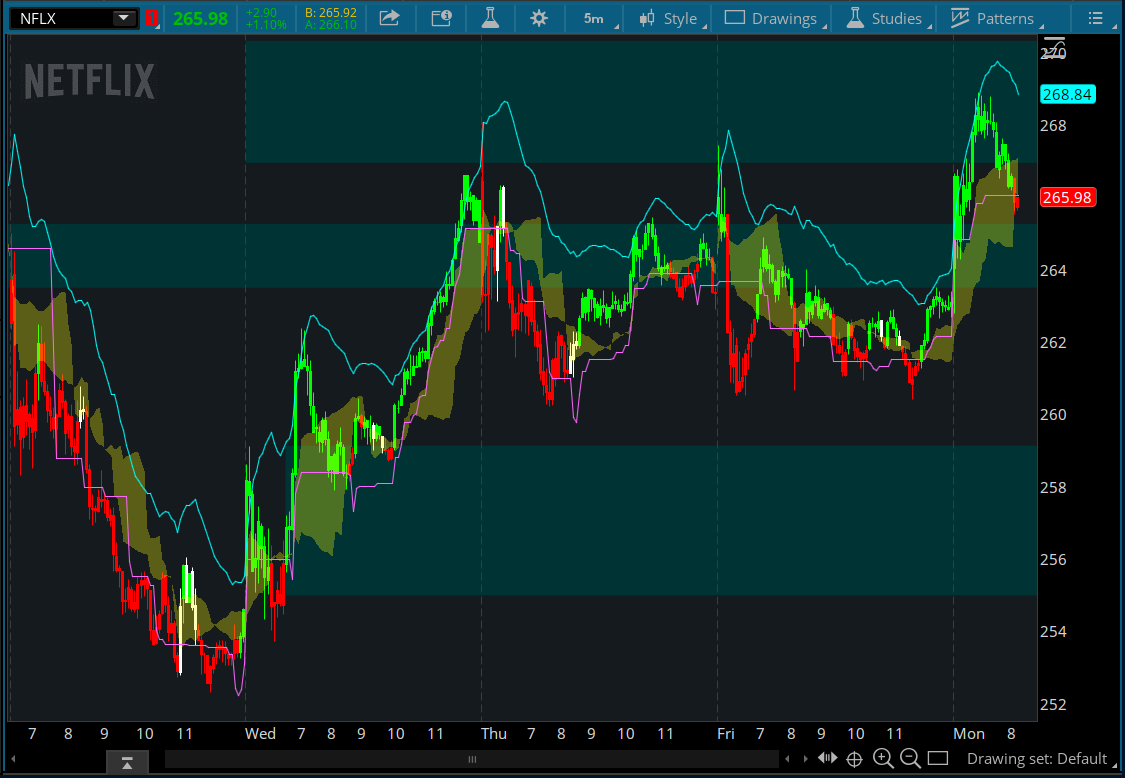

Found this interesting script on TradingView. I think it's based on Jim Berg's ATR Volatility Based System.

thinkScript Code

Code:

# ATR Volatility Based System Jim Berg

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/UxWO2H5P/

input length = 10;

def EntrySignal = close > (lowest(low, 20) + 2 * atr(Length));

def ExitSignal = close < (highest(high, 20) - 2 * atr(Length));

def TrailStop = highest(close - 2 * atr(Length), 15);

def ProfitTaker = expAverage(high, 13) + 2 * atr(Length);

assignPriceColor(if EntrySignal then Color.GREEN else if ExitSignal then Color.RED else Color.WHITE);

def entry = ((lowest(low, 20)) + 2 * atr(Length));

def exit = ((highest(high, 20)) - 2 * atr(Length));

plot trail = TrailStop;

plot profit_taker = ProfitTaker;

trail.SetDefaultColor(GetColor(0));

profit_taker.SetDefaultColor(GetColor(1));

AddCloud(entry, exit, color.yellow, color.yellow);Attachments

Last edited: