Thanks so much for the Accumulation Swing indicator

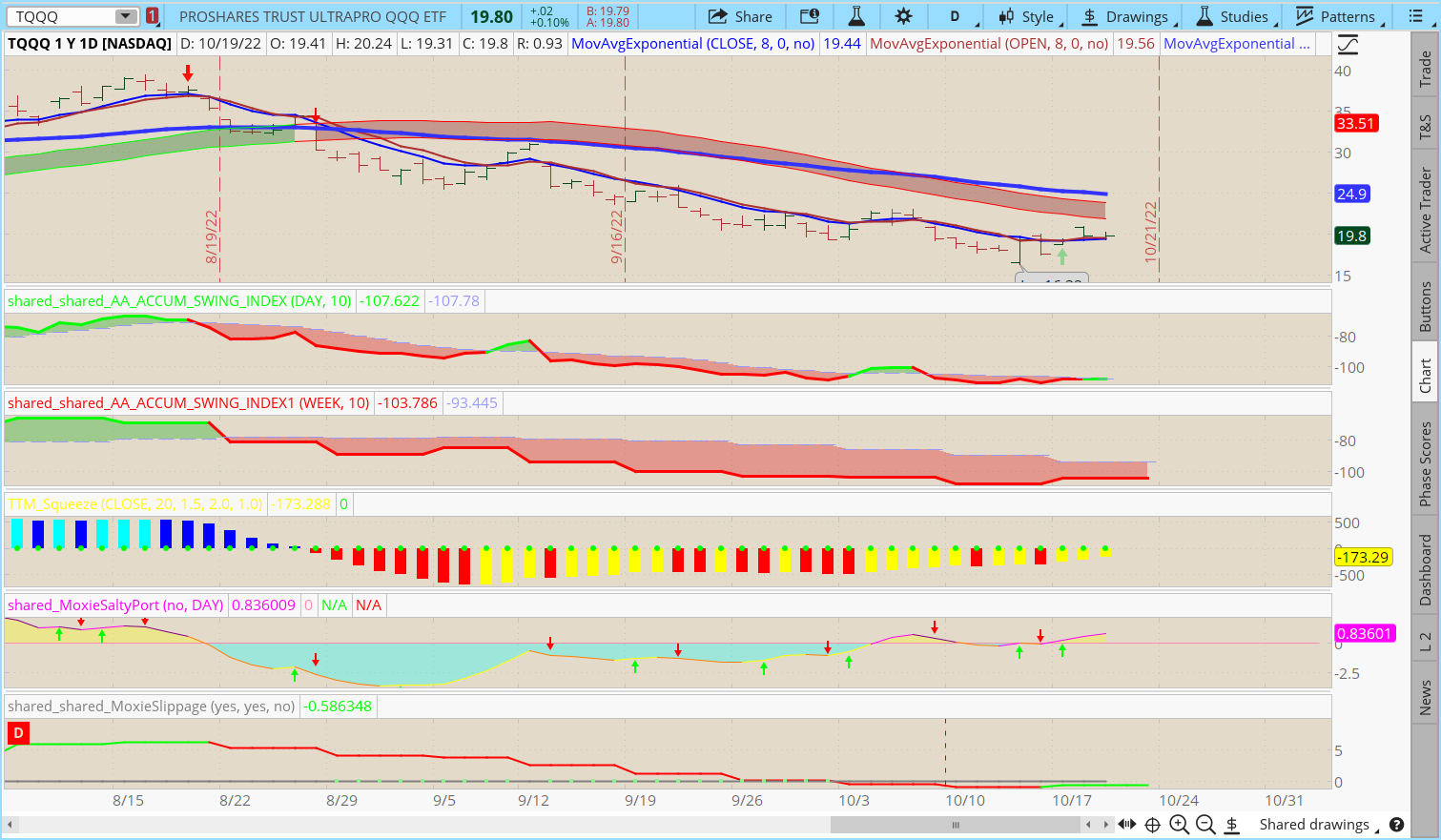

I put two Accum Swing Index's on my chart.

Fast and slow so for example on the two hour chart I will use one set at 4 hour and another set at day.

What this does is let me know if the market is having a short term reversal in a longer term trend.

On the daily chart I am using day and week and looking back over the past year trading TQQQ

on the daily time frame compounding it was up over 500 % for the year.

With 8 trades: one very small loss and 7 wins....being in the market all the time.

Rules are very simple:

when both are red sell longs and go short

when both are green cover and go long.

I added the Salty Moxie and it seems to give early warning of a trend change.

here is a link to my daily chart

https://tos.mx/1BCavDd

So thank you for sharing!!!!!

This is a great community!!!!

Bob

I put two Accum Swing Index's on my chart.

Fast and slow so for example on the two hour chart I will use one set at 4 hour and another set at day.

What this does is let me know if the market is having a short term reversal in a longer term trend.

On the daily chart I am using day and week and looking back over the past year trading TQQQ

on the daily time frame compounding it was up over 500 % for the year.

With 8 trades: one very small loss and 7 wins....being in the market all the time.

Rules are very simple:

when both are red sell longs and go short

when both are green cover and go long.

I added the Salty Moxie and it seems to give early warning of a trend change.

here is a link to my daily chart

https://tos.mx/1BCavDd

So thank you for sharing!!!!!

This is a great community!!!!

Bob

Last edited by a moderator: