How do I know which stocks are pulling back? Is there a scanner to help me do that in TOS? I've been using this lately to try to enter at the bottom of huge moves that last for a few weeks to a few months. It only gives a few stocks a day each scan. But after I scan I don't want to buy it instantly I want it to make a new low first or bounce off the 200 SMA. I have to just add it to my watch list and wait like a week max to see if its a good setup and then buy. What I want to know is if there's a way to scan for something that's already in this position where within the last 10 days these exact things in the scan happened but now a new low was made so then I can just buy the stock the same day I scan. Any ideas?

For example, usually on the day I'd want to buy the volume will actually be lower than the unusual volume that happened within the last week or so on the breakout candle. But I don't know how to combine all these things. Thanks. Basically my current scan is more of an alert to watch it rather than the exact day I should buy. So I want to make it more efficient.

For example, usually on the day I'd want to buy the volume will actually be lower than the unusual volume that happened within the last week or so on the breakout candle. But I don't know how to combine all these things. Thanks. Basically my current scan is more of an alert to watch it rather than the exact day I should buy. So I want to make it more efficient.

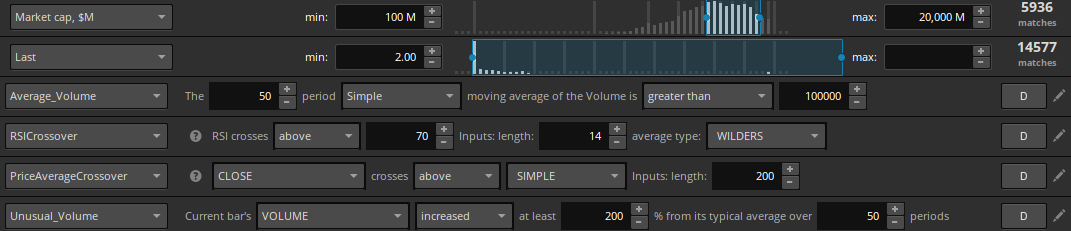

- Rsi cross above 70 within last 10 bars

- Price close above 200 sma within last 10 bars

- Unusual volume increase 200% of 50 periods within last 10 bars

Last edited: